Swing Trading | How to Swing Trade for Beginners

Regardless of your level of experience in trading, the time frame on which you choose to trade can significantly impact your trading strategy and returns. The debate on what time frame is best for trading is never-ending.

One popular style of trading that you should consider is known as swing trading. What is swing trading and how does it work? How does it compare to other similar forms of trading?

Our guide to swing trading will help you understand its dynamics and assist you in figuring out whether it is the best trading strategy for you. Read on to find out everything you need to know about swing trading.

How to Swing Trade in 3 Quick Steps

In a rush? You should follow three easy steps in order to open an account and start swing trading today:

[three-steps id=”196090″]Step 1: Open a Swing Trading Account

If you don’t have a trading account yet and you want to master swing trading, make sure to check out one of the swing trading sites below. They have all the top swing trading tools you need to succeed in your trading journey.

1. eToro – Best Choice for Beginners

Founded in 2007, eToro boasts of being a leader in the global fintech revolution.

Users get two main account types, a demo account and live account. The demo account comes with $100,000 in virtual money, great for practice. This is particularly useful for beginners, who certainly need some hands-on experience before they try swing trading using real money.

eToro is renowned for its copy trading feature. This is one of the features that make it, hands down, the best choice for beginners. They can learn the ropes of trading firsthand from more seasoned traders. To get started, you can browse through other traders’ profiles to see their performance and risk score. Taking it to the next level, you can invest in a portfolio of the top eToro traders under CopyPortfolio.

When it comes to research, the site has great tools for technical analysis. Here you get access to great charting tools and analyst recommendations. You can get useful market highlights by signing up to a daily newsletter for market analysis.

Similarly, the education tools are not the most extensive but there are some basic videos. Contacting customer support is possible via live chat and web-based ticketing. However, they are not available 24/7 and they do not work on weekends.

Fees and commissions:

- eToro does not charge deposit or clearing fees. The firm, however, charges $5 on all withdrawals, the minimum withdrawal being $30.

- Fees for overnight and weekend CFD positions are charged.

- Because long (buy), non-leveraged stocks and ETFs are not executed as CFDs, they do not incur a commission.

- Depending on market conditions, fees, which always apply to open positions, are subject to change with no prior notice.

- Offers demo account with $100,000 virtual money

- Great charting tools

- Secure platform

- Relatively high fees

2. Plus500 – Offers access to a wide range of technical analysis tools

Plus500 is a popular CFD trading platform that is not only licensed by CySEC in Europe and Australia's ASIC but is also listed on the London Stock Exchange. In the UK. Plus500UK LTD is authorized and regulated by FCA.

The highly advanced Plus500 proprietary platform offers users access to 100+ technical indicators that they can use for swing trading as well as 2,000 financial instruments.

These instruments are CFDs for such asset classes as shares and stocks, Forex, commodities, cryptocurrencies, options, ETFs, and more.

Like eToro, Plus500 has a straightforward account creation process which will only take you a few minutes to complete. After signing up, you only need to deposit at least $100 to start swing trading. Most retail traders are capped at 30:1 for most trading instruments, advanced traders can also apply for up to 1:300.

Aside from its desktop trading platform, it also has an intuitive mobile app that has all the customizable technical analysis charts you need when identifying the best entry and exit points for your swing trades. You can access the app on iPad, iPhone and Android devices.

Fees and commissions:

Plus500 doesn’t charge commissions. Their spreads are variable and based on prevailing market conditions. Additionally, if you don’t log in for 3 months, it will charge you $10 per month for the inactivity fee.

- User-friendly mobile and desktop apps

- Offers 100+ technical indicators

- Free unlimited demo account

- Limited research tools

- charges overnight trading fees

Step 2: Learn How Swing Trading Works

Swing trading is a short-term technique used by traders to make small profits from market swings by holding a trading instrument for a short period. This could be anywhere from overnight to several weeks.

The essence of using this strategy is to optimize short-term price shifts, which are greater than what one would expect in intraday trading. Many traders use it because they want to focus on short-term gains and have small margins that can minimize their losses.

How does Swing Trading Work?

A majority of swing traders analyze trades based on the risk and reward ratio. They assess the charts of a trading instrument and determine where to place a stop loss. Next, they anticipate the best point to exit the trade with a profit.

Due to the short-term nature of this form of trading, most traders make use of technical analysis. However, they could also use fundamental analysis to enhance the results. Often they identify opportunities on daily charts and then watch 15-minute or 1-hour charts to get precise entry points, stop losses and take profit points.

Swing traders aim to maximize gains by accumulating the small wins they get from individual trades. For instance, while other types of traders may wait several months for a 25% profit, swing traders may earn a modest profit margin of between 5% and 10% in a shorter time.

Swing Trading Assets

Below are the common trading instruments that swing traders make use of.

What are the Benefits of Swing Trading?

It provides more opportunities to make a profit compared to day trading or trend trading. Smaller gains earned add up to significantly large annual returns. Most short-term trading strategies need constant monitoring. A major advantage of swing trading is that you do not have to monitor your positions daily. You can periodically check them and take action when it calls for it. This makes it suitable for traders who have full-time jobs. Unlike long-term traders who have to wait a few months to get results, you will get results in a significantly short time. This makes it possible to monitor and quickly adjust your strategy to optimize gains. The ability to minimize risks could arguably be the most significant advantage of swing trading. When the stop losses are smaller, you can order larger-sized positions. You can also set wider stop losses. This helps reduce the number of positions that close prematurely. Traders using this strategy can take advantage of longer trends, making their analyses more relevant. Oftentimes, analyses carried out on larger time units are stronger and less vulnerable to false signals than shorter ones. And since such trades follow longer price swings, they are more likely to generate higher profits.

Frequent opportunities to make gains

Easy portfolio management

Offers quick results

Mitigates risk

Lets you optimize longer trends

Swing Trading vs. Day Trading

In many respects, the two trading techniques are similar. The major difference is time. When you are a day trader, you do not hold your stocks overnight.

Day trading, as the name suggests, is whereby you trade your positions within a few minutes or hours. In fact, day traders often open and close multiple trading positions in a single day as they focus solely on opportunities to compound returns fast. On the downside, since day trading closes the same day, you make frequent trades resulting in high transaction costs. This can consume a large portion of your profit. Also, even though day trading has the potential to make quick gains within a short span of time, it can deplete your funds just as fast. If you think that day trading typically has more potential for profit, then you should know that this only applies to small accounts. The bigger an account, the harder it becomes to use all capital on day trades. Swing trading can last overnight or take a number of days, weeks or even months. Swing traders also get access to leverage or margin while day traders do not. Additionally, swing trading is a more cost-efficient approach since it minimizes the effect of spreads. Though spreads are usually small amounts, they are charged with every trade and eventually add up. But for trades taking place over a span of time, spreads will not significantly impact profits. On the downside, if there is a large price gap after several days or weeks, then the next session can open at a significantly different price from how it closed the previous day or week. This can result in a huge loss.

Day Trading

Swing Trading

Swing Trading Strategies

Below are some of the common swing trading strategies:

This trading strategy helps you decide the best time of entry or exit. For example, if the security closes above the T-line, it means that the price will climb, and if it closes below the T-line, it indicates that the price will go down. This strategy makes use of lines that can determine the level of support or resistance in an area. These levels are associated with a percentage showing how much the price of a prior move has retraced. The Fibonacci Retracement levels are 78.6%, 61.8%, 38.2% and 23.6%. The indicator is instrumental because it can create levels between any two given price points. Japanese Candlestick charts have been in use for centuries to read patterns and identify trading opportunities.

T-line Trading

Fibonacci Retracement

Japanese Candlesticks

Step 3: Choose a Swing Trading Strategy

As mentioned above, swing trading relies heavily on technical analysis. Familiarize yourself with the various tools available and identify the ones that work best for you. However, you should never trade based on a single technical tool. Having multiple indicators giving you the same message is usually a positive sign. Also, make sure you fully understand the indicators you’re using. Misinterpreting signals can quickly lead to losses. If you are a beginner, it is advisable to take your profits after the line has hit so you do not incur losses. An advanced swing trader may hold off for a while to make sure the market has not made a new high before he collects his profits. When you enter a swing trade, place your stop loss close to your entry point. This can help you get out of a position quickly in case things take an unexpected turn. You should raise your stop loss level consistently as the price increases, so you’re always locking in more profit in case the trend reverses. Once you measure the primary and intermediate trends of the market, make decisions in harmony with these. Do not focus only on short-term trends as the overall success is based on the long-term context. Larger trends often reassert themselves sooner or later and impact short-term decisions.

Use technical analysis tools

Know when to take your profits

Set up your stop loss point

Align your trades with the overall market trend

Step 4: Open a Swing Trade

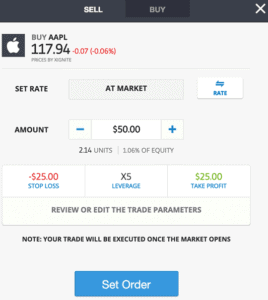

To illustrate how to open a swing trade, we’ll illustrate the process for our top-rated brokerage, eToro. To get started, you’ll first need to open and fund a trading account. After that, find the stock or other asset you’re planning to swing trade using the search box at the top of the dashboard.

You’ll then decide how much money you want to invest and whether or not you want to trade with leverage. To set up a stop loss, use the tab on the left-hand side of the trading window. With eToro, you can check the ‘Trailing Stop Loss’ box to have your stop-loss automatically move up as the price of the asset you’re trading increases. It’s a good idea to use trailing stop losses to lock in profits.

You can also set a profit-taking level. If your trade results in this set gain, eToro will automatically sell part or all of your position.

When your stop loss and profit-taking levels are set, hit ‘Open Trade’ to purchase the asset.

Conclusion

Swing trading differs significantly from day trading and other styles based on the time frame.

It is a good trading strategy that beginners, as well as advanced traders, can make use of. For the latter group, it provides an opportunity to diversify their approaches and optimize gains. And for the former, it keeps motivation levels high and does not have too many requirements.

No matter your level of experience, choosing the most suitable swing trading platform will go a long way in ensuring a hassle-free trading experience. Take time to choose well, learn the rules of the game and strive to perfect the art of swing trading.