The price of Bitcoin (BTC) is hovering above the $40,000 psychological threshold today in early cryptocurrency trading action only two days after the token slid to its lowest levels in almost four months.

A ban imposed by top Chinese financial regulatory agencies on the offering of crypto-related products and services by payment processing companies and financial institutions was the main catalyst that wiped around $215 billion from the total market capitalization of BTC while statistics indicate that the sell-off may have been accelerated by the liquidation of levered positions held by thousands of traders.

According to data from the blockchain analytics company Bybt, a total of $8.93 billion in cryptocurrency positions were liquidated from Monday to Wednesday, with at least 42% of those being BTC positions.

Meanwhile, the firm revealed that no less than 800,000 traders may have received a margin call as a result of Bitcoin’s plunge, as the value of the coin plunged by as much as 30% in a single day to reach a session low of $30,006 before it started to bounce.

Moreover, cryptocurrency exchanges reported the biggest single-day net inflow of Bitcoin (BTC) since 12 May last year, with a total of 30,750 coins moving onto their wallets to be sold and out of cold storage amid the massive losses that the digital asset was experiencing.

Users reported several disruptions in the trading services provided by top exchanges including Coinbase (COIN) and Binance, while some brokers temporarily halted transactions as they struggled to deal with the massive spike in trading volumes.

Cathie Woods, the popular fund manager who runs Ark Invest and who is also a strong supporter of Bitcoin, reaffirmed her thesis that Bitcoin is moving to $500,000 per coin in the future despite this week’s massive sell-off as she believes the market is just experiencing a temporary “capitulation phase”.

According to Woods, this opens up the door for more institutional interest now that the price has taken a breather.

“I think we’re in a capitulation phase. That’s a really great time to buy no matter what the asset is”, Woods stated during an interview with Bloomberg Businessweek.

On the other hand, Woods emphasized that environmental concerns may be affecting the performance of the cryptocurrency as well, even though he went on to explain that Bitcoin miners will actually help renewable sources of energy to grow and evolve as they will become a key piece of the puzzle in the creation of a sustainable environment in which Bitcoin continues to thrive.

Other developments currently affecting the performance of cryptocurrencies this week include a new rule from the US Treasury Department that requires that any transaction of over $10,000 in crypto must be reported to the Internal Revenue Service (IRS).

This decision aims to curve tax evasion using cryptocurrencies – a situation that has been a long-dated concern among regulators and policymakers due to the decentralized nature of these digital assets.

Moreover, the Federal Reserve announced yesterday that it was taking another step forward in studying the possibility of introducing its very own digital currency. The institution will be releasing a “discussion paper” on the merits of central bank digital currencies this summer to further research the topic.

The decision from the Fed comes nearly a month after China released to the world what would be the first central bank-backed digital currency – the digital yuan – even though some details of the project are yet to be disclosed by the government.

The development and widespread adoption of central bank-backed digital assets could threaten the long-standing reign of Bitcoin (BTC) as the go-to cryptocurrency and these advancements, along with the rest of the developments mentioned earlier, appear to be troubling the market as the price has failed to climb above a key resistance that has now become support during the latest price action.

What’s next for Bitcoin (BTC)?

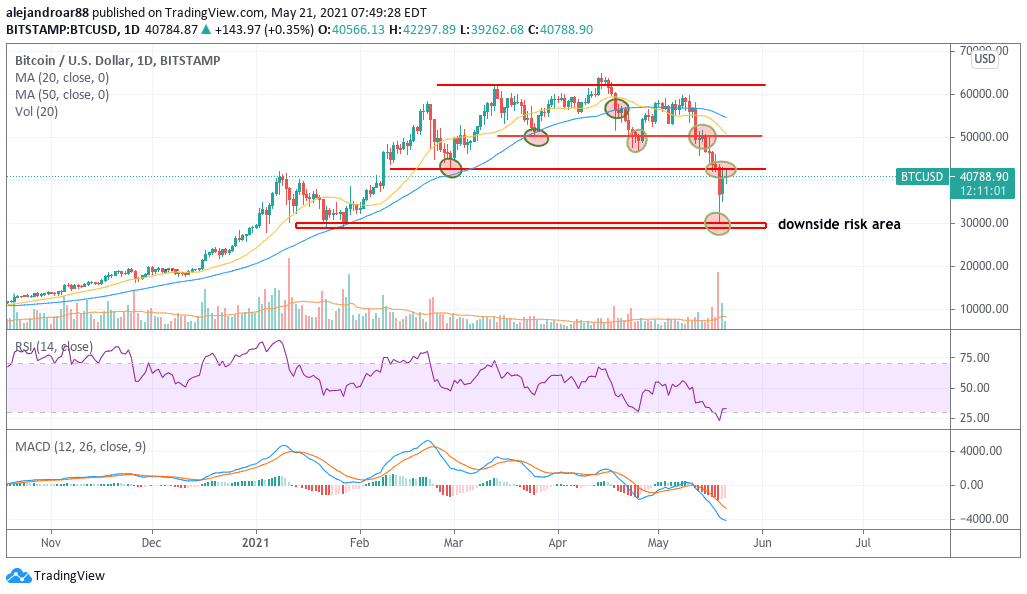

The chart above shows how the price of Bitcoin (BTC) has attempted (and failed) to climb above the $42,500 area two times already – a support level that we had previously categorized as the last line of defense for the cryptocurrency.

That particular area is now turning to resistance for BTC and that reinforces the thesis that bulls don’t have enough ammo just yet to keep pushing the price higher.

From the perspective of momentum, this week’s massive plunge has pushed the daily RSI and the MACD to their lowest levels in years while the weekly readings show that the MACD has sent a sell signal already.

It would be plausible to think that Bitcoin may continue to move higher in the next few sessions after most indicators are flashing oversold. However, when the price trend changes so radically and momentum readings touch such low levels it often indicates a mid-term reversal in the trend rather than a short-lived correction.

For now, the short-term outlook for BTC would turn bullish if the price reclaims the $42,500 area but traders should be cautious not to get too excited unless momentum readings turn to positive territory as the latest meltdown may be a signal that the price trend has changed its direction.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account