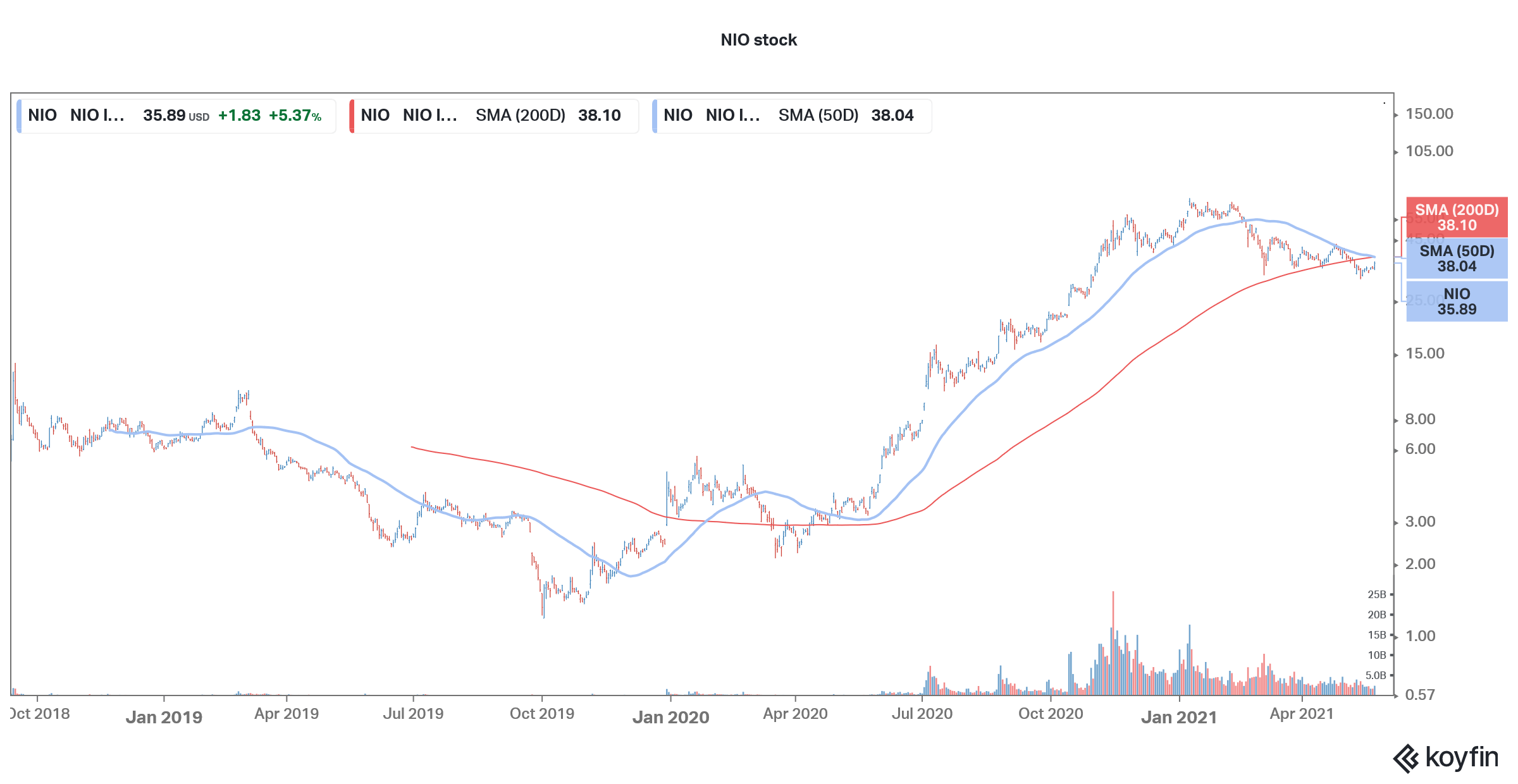

NIO stock gained over 5% yesterday and was trading over 1% higher in US premarket trading today. The company has announced plans to double the production capacity for its electric vehicles.

NIO does not produce its own cars but works with the state-owned Jianghuai Automobile Group popularly known as JAC. NIO has announced that “Pursuant to the joint manufacturing arrangement, from May 2021 to May 2024, JAC will continue to manufacture the ES8, ES6, EC6, ET7 and potentially other NIO models in the pipeline.”

It also said that “In addition, JAC will expand its annual production capacity to 240,000 units (calculated based on 4,000 work hours per year) in order to meet the growing demand for NIO vehicles.”

Electric vehicles

Here it is worth noting that electric vehicle companies have taken a divergent approach to production. On one hand, we have companies like Tesla and Lucid Motors which are setting up their own production plants. Tesla already produces cars at two of its Gigafactories in Freemont and Shanghai while another two of these are coming up in Berlin and Texas.

Tesla’s CEO Elon Musk recently said that the company is also exploring setting up a plant in Russia. However, US automakers have had a tough time in the country and both Ford and General Motors have exited the market.

NIO has partnered with JAC Motors

Companies like NIO and Fisker have taken a different approach and use third parties to manufacture their cars. While Fisker partnered with Magna to produce its first vehicle, it has partnered with Foxconn for its second car named Project PEAR.

To be sure, the demand for electric vehicles has been rising sharply. NIO is now aiming for a production capacity of 20,000 every month. In the fourth quarter of 2020, the company produced 5,000 electric cars in a month for the first time. In April, the company said that it has reached a monthly production capacity of 10,000 cars. However, like almost all other automakers, NIO is facing bottlenecks from the global chip shortage.

NIO lost production due to chip shortage

It lost five production days in the first quarter due to the chip shortage. It delivered 20,060 cars in the first quarter. Notably, NIO had to tone down its delivery guidance for the first quarter as it had to shut the plant for five days due to the chip shortage. The company expects to sell between 21,000-22,000 cars in the second quarter of 2021.

NIO, like Tesla, is a capacity-constrained company and can sell only as many cars as it can produce. Tesla sold almost half a million cars in 2020 and expects its deliveries to rise 50% annually for the next few years. The company would need new plants to supplement its capacity and here is where the new Gigafactories would come in handy.

Chip shortage is hurting the automotive industry

Meanwhile, in the short term NIO would continue to face bottlenecks due to the global chip shortage. According to consulting firm AlixPartners, the global automotive industry would lose $60.6 billion in revenues in 2021 due to the chip shortage. Apart from the automotive industry, while goods, gaming, and smartphone companies are also grappling with the chip shortage. Ford has been among the worst affected by the chip shortage and expects to lost half of its second-quarter production due to it.

However, the chip shortage has also been a boon for many chip companies. The Auto and power unit of STMicroelectronics NV reported a 280% increase in first-quarter profits.

The chip shortage is expected to persist at least for the new few quarters. “The second quarter is going to be worse for automakers than the first quarter,” said Song Sun-jae, an analyst at Hana Daetoo Securities Co. in Seoul. He added, “The chip-shortage problem could end up lasting longer, maybe into next year.”

NIO guidance

Ford expects its pre-tax profits to be almost $2.5 billion lower in 2021 due to the chip shortage. NIO meanwhile gave second-quarter revenue guidance between $1.24-$1.3 billion.

“The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortage,” said William Bin Li, NIO’s founder, and CEO. The company is also entering the Norway market and might soon enter other foreign markets as well including the US.

NIO has China’s backing

NIO has the tacit backing of the Chinese government. Last year, when the company was fighting for survival, the Hefei Municipal Corporation bailed it out with a cash infusion. China also has set up a special category of battery replacement that makes NIO cars eligible for the subsidy.

NIO offers a battery replacements service and car buyers can buy their cars without the battery that can help lower the initial buying price. Car buyers can then subsequently rent the battery which is a recurring revenue source for NIO.

Mizuho is bullish on NIO

Mizuho analyst Vijay Rakesh is bullish on NIO and has set a $60 target price. According to him, “Nio has a key differentiation from peers: a premium EV offering with a lower cost of ownership through its novel Battery-as-a-Service (‘BaaS’) battery swap module.”

He also added, “While Nio is focused on the premium EV segment, a China subsidy and an innovative BaaS program make Nio’s cars eminently affordable compared to competing brands, such as Tesla.”

Wall Street analysts are bullish on NIO and its target price implies an upside potential of 64% over the next-12 months. Of the 20 analysts polled by CNN Business, 13 rate it as a buy while six rate it as a hold. One analyst has a sell rating on the stock.

How to invest in NIO and EV stocks?

You can invest in EV stocks like NIO through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in clean energy companies like NIO.

Through a clean energy ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account