Credit Suisse announced this morning that it expects to take another hit during the second quarter of this year as a result of its exposure to Archegos Capital, the US-based hedge fund that went bust as a result of its overleveraged positions in a handful of media stocks.

The Swiss bank reported these additional losses in the notes that accompanied its quarterly earnings report, indicating that the firm expects to write down another CHF 600 million ($655 million) during the second quarter of 2021 as it finished unwinding the positions it held for Archegos.

In an interview with CNBC, Credit Suisse’s CEO addressed investors’ concerns about its Archegos dealings by stating: “The loss we had in Archegos was unacceptable and we had to take actions in terms of management changes. We are reducing our exposure in this business, we are reviewing our risk, controls, and systems in that area”.

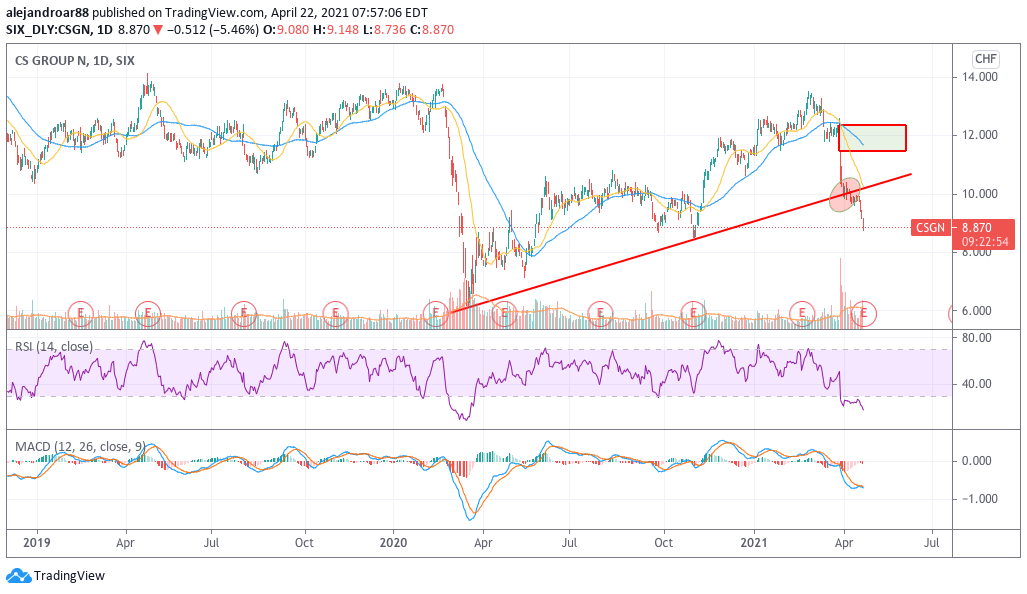

However, investors seem disappointed by the situation as reflected by the price action this morning, with Credit Suisse shares dropping nearly 6% in Switzerland at CHF 8.8 while the stock accumulates a 30% loss since the Archegos scandal came out.

Meanwhile, the financial institution is facing increased pressure to deal with the fallout of another unit – its supply chain finance program – which blew up after Greensill Capital, a company that facilitated supply chain debt, filed for bankruptcy in New York earlier this year.

As a result, Credit Suisse has been scrambling to gather the funds committed by investors through its asset management unit to get exposure to this innovative product, yet the firm announced this morning that has only been able to collect a total of $5.4 billion out of the $10 billion it reportedly held for investors by the end of February this year.

The bank informed investors that they will likely “suffer a loss” as a result of multiple invoices that were not paid and will not be paid by suppliers in the near future.

Among the changes Credit Suisse has made to its ranks to address growing concerns about its risk management systems, the bank replaced the head of its asset management unit while Brian Chin, the Chief Executive of the institution’s investment bank unit, stepped down from its position earlier this month.

Additionally, Lara Warner, Credit Suisse’s former Chief Risk and Compliance Officer stepped down from her role as well alongside Mr. Chin. The bank also informed that it will be reducing the leveraged exposure of its investment banking unit “by at least $35 billion” while it warned investors about upcoming regulatory scrutiny and potential legal and reputational issues that could materially affect the bank’s financial performance in the near future.

What’s next for Credit Suisse?

So far this year, Credit Suisse shares accumulate a 22% loss as a result of its exposure to Archegos and the fallout of the bank’s supply chain finance investment program.

Legal issues will likely emerge as a result of the strong losses that investors who were exposed to supply chain finance products will experience and those will likely have a material impact on the firm’s upcoming quarterly earnings report apart from the $600 million loss caused by Archegos alone.

The market’s reaction this morning seems to reflect these expectations, as the stock is trading at roughly half the bank’s tangible book value per share.

Meanwhile, Credit Suisse is trading at 8 times its last-twelve-months earnings, yet, since the bank will likely report strong losses in the next couple of quarters, the valuation seems to be more fixated on that.

The bank’s earnings have been quite volatile in the past quarters, which makes it difficult to establish where they might land in the near future. However, it seems likely that Credit Suisse will be reporting net losses in the next quarters based on the historical performance of its financial results while other quarters could also be affected by provisions made by the bank for legal settlements resulting from the fallout of the supply chain finance program.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account