Best Forex Brokers in Canada for 2020

If you’re based in Canada and planning to trade forex online, there are hundreds of platforms to choose from. With that said, no-two brokers are the same, so you need to assess what it is you are looking for. For example, while some of you might be searching for a Canada forex broker that offers super-low fees, others will be after a specific currency pair. So, how should you go about comparing the best forex brokers in Canada?

In this article, we review the five best forex brokers in Canada to help you find your ideal platform. Not only we do discuss our top picks in detail, but we also give you some tips on how to research a broker and provide a step-by-step guide on how to get started.

Best Canada Forex Brokers of 2020

With hundreds of online trading platforms for Canadians to choose from, knowing which site to sign up with can be challenging. This is why we have decided to narrow our list of recommended brokers down to just five.

Each of the forex brokers listed below are heavily regulated, offer dozens of tradable currencies, support lots of everyday payment methods and, of course, accept Canadians.

1. AvaTrade - Trade Forex with up to 1:400 Leverage

AvaTrade is a good all-round option for those of you based in Canada. Firstly, the platform is actually operated by Friedberg Direct. As a result, you’ll benefit from the protections of the IIROC and the Canadian Investor Protection Fund (CIPF). AvaTrade also holds a number of trading licenses overseas, which includes Japan, South Africa, and Ireland.

AVATrade allows you to open an account with a minimum deposit of $100, which you can do via a debit/credit card, e-wallet or local bank transfer. In terms of the trading arena, AVATrade lists dozens of forex pairs. Although it could be stronger with its exotic currencies, it does host most majors and minors.

One of the most impressive things about AvaTrade’s forex offering is that it allows you to trade with up to 1:400 leverage. You can get your spreads down to 0.9 pips during standard market hours. This is especially competitive as the broker does not charge commissions when trading forex.

You’ll have the choice of both MT4 and MT5 at the platform, which means access to lots of advanced technical indicators, forex trading bots and forex trading signals. You can also access MT4 via the AvaTrade mobile app.

If you’re looking to trade other asset classes on top of forex, AvaTrade supports thousands of CFDs. Regardless of what you are trading, you can set up handy pricing alerts and notifications. With so many benefits, there’s no doubt AvaTrade is among the very best forex brokers in Canada.

- Spreads from just 0.9 pips

- Multiple licenses

- Both MT4 and MT5 supported

- Could be more educational resources

2. FXCM – Long Establish Broker with Tight Spreads

FXCM, short for Forex Capital Market, was established in 1999 and is one of the pioneers in the Forex CFD trading niche. It has a solid reputation for its transparent fees, fast order execution speeds, and competitive trading fees. This broker is highly regulated by several tier-one financial authorities like FCA in the UK, ASIC in Australis, America's CFTC, and CySEC in Cyprus.

Registering and verifying a forex trading account with the broker is easy, and forex trading is accessible via two of the most sophisticated platforms; FXCM's proprietary trading platform – TradeStation – and the all popular MT4. FXCM doesn't offer quite as many currency pairs as some other brokers, with just under 40 on offer. You can trade with up to 1:30 leverage.

These platforms feature hundreds of advanced trading and market analysis tools, give you real access to the forex market data, updated economic calendar, critical market news, and a demo account to practice and perfect your strategy. FXCM does not charge trade commissions or deposit or withdrawal processing fees, and the spreads are very competitive.

- Regulated by several leading bodies

- Excellent proprietary trading platform

- Analysis tools and market news

- Only up to 1:30 leverage

3. Forex.com - Trade Over 80 Currency Pairs

This broker, which is headquartered in the US, specializes primarily in currencies. This means that you will have access to more than 80 different pairs. This includes all majors and minors, and lots of exotics. Forex.com is also notable because the trading platform is suitable for both newbies and seasoned investors.

For example, you can get started with a deposit of just $50, and accounts take just minutes to set up. You can use a traditional debit or credit card to fund your account, so deposits are instant. For those of you with advanced trading requirements, Forex.com offers heaps of chart reading tools and technical indicators. As the broker utilizes the MT4 platform, you can also customize your trading screen however you wish.

In terms of the fundamentals, Forex.com offers a number of different account types. If you think you'll be trading large volumes, you can get the spread on EUR/USD down to just 0.2 pips + commissions. Other account types allow you to trade on a commission-free basis, but the spreads are higher. Finally, Forex.com is regulated by a number of US bodies, including the CFTC and NFA.

- Spreads from just 0.2 pips

- Supports MT4

- More than 80 pairs

- $40 wire withdrawal fee

- $15 monthly inactivity fee

4. Oanda – IIROC Licensed Forex Broker

Based in Canada, OANDA is a specialist online forex and CFD broker that accepts traders from Canada. The broker holds a wealth of regulatory licenses, including that of the IIROC. This also includes licensing bodies based in the UK, Singapore, Japan, and Singapore, so your funds are safe at all times.

OANDA supports just over 70 forex pairs across the majors, minors, and exotics, so there are plenty of trading options to choose from. When it comes to fees, OANDA does not charge any trading commissions. On the flip side, its spreads are higher than the industry average. For example, GBP/USD can be traded at 1.6 pips, while EUR/USD is slightly lower at 1.2 pips. You can trade with a maximum of 1:50 leverage on Oanda.

There are no account minimums to contend with at OANDA, which is ideal if you want to start off with really small amounts. You’ll have lots of options when it comes to depositing and withdrawing funds at the broker. This includes a debit/credit card, bank account, or PayPal. We also like the MarketPulse link-up that OANDA has integrated on its platform. This gives you access to key market developments throughout the day.

- No commission on forex trading

- No account minimums

- IIROC regulated

- Spreads higher than some other platforms

How to Choose a Canada Forex Broker

Whether you want to perform some additional research of your own, or you’re simply considering using an alternative broker, it’s crucial that you know what you are looking for.

For example, while a broker might offer commission-free trading, have you explored what its forex spreads are like? As such, below you will find the many considerations that you need to make when comparing the best forex brokers in Canada.

- Licensing

Your first port of call will be to assess the broker’s regulatory standing. In an ideal world, the broker will hold a license with the Investment Industry Regulatory Organization of Canada (IIROC). With that said, as long as the platform holds a tier-one license of some sort then you can be sure its regulated and secure; it’s perfectly fine if the broker is regulated by the likes of the FCA, ASIC, or CySEC. In fact, the five brokers that we have discussed on this page each hold licenses with several regulators.

- Eligibility for Canada

You then need to verify whether or not the broker accepts traders from Canada, as some overseas brokers have country restrictions.

- Forex Pairs

You’ll likely find heaps of currencies offered against the Canadian Dollar, especially in the majors and minors. If you’re looking to trade a less liquid currency, or if you’re interesed in exotics, you should check whether or not the broker supports this prior to signing up.

- Payment Methods

You also need to explore what payment methods the forex broker in question supports. After all, you will be required to trade with real-world Canadian dollars. Most traders in Canada prefer to use a domestic Visa or MasterCard, as this permits instant and (usually) free deposits. Alternatively, an e-wallet like Paypal also offers fast and cheap deposits. Some of the brokers listed on this page support a Canadian bank transfer, although it can take a couple of days for the funds to be credited.

- Spreads and Commission

The spreads offered by Canada forex brokers can vary a lot, and the higher the spread, the more you will pay in trading fees. As such, be sure to check what the spreads are like on your preferred currency pairs. Don’t forget, minimum spreads are usually offered for major pairs during standard market hours.Some Canadian brokers also charge trading commissions. If they do, then this will be expressed as a percentage against the amount you trade. For example, if you place a $1,000 sell order on EUR/USD, and the platform charges 0.5%, then you will pay a trading commission of $5.

- Trading Tools and Research

Seasoned traders will tell you first-hand just how important research tools are in the forex space. As such, choose a Canada forex broker that offers lots of advanced chart reading tools and technical indicators. You should also check to see whether or not the platform publishes fundamental news updates in real-time and provides market insights.

- Customer Support

Finally, check to see what hours the customer support is available, especially if you’re using a forex broker located overseas. If you are, it’s best to stick with brokers that offer live chat, as you’ll be able to speak with an agent without needing to call a non-toll-free number. [/su_list]

How to Join a Canada Forex Broker

So now that you know what to look out for when choosing a Canada forex broker, you might be wondering how the sign-up process actually works? If so, below you will find a handy step-by-step guide that shows you everything you need to know to start forex trading today.

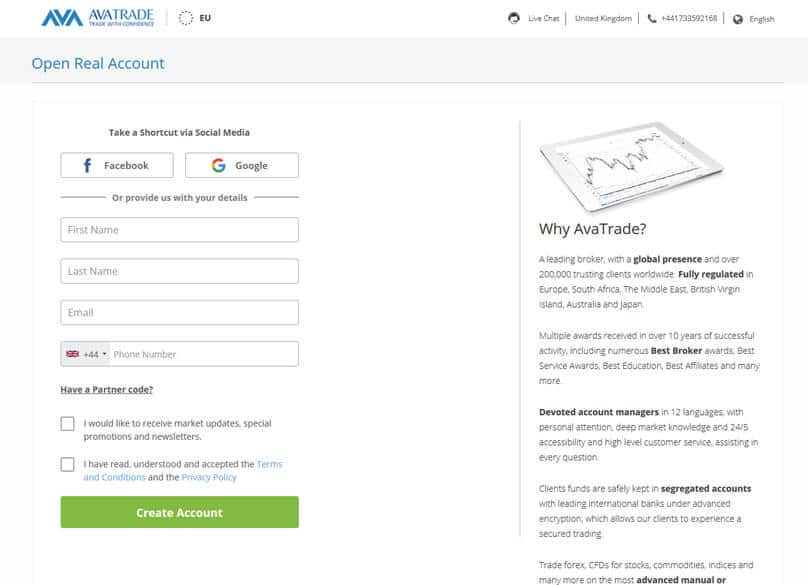

Step 1: Open a Forex Account

Head over to AvaTrade and elect to open an account. You’ll find the button located at the top of the screen.

- First and Last Name

- Nationality

- Date of Birth

- Home Address

- National Tax Number

- Contact Details

As AvaTrade is a heavily regulated broker, you will be asked to verify your identity before proceeding any further. All you need to do is upload a clear copy of your passport or driver’s license, and the platform will attempt to validate it on the spot.

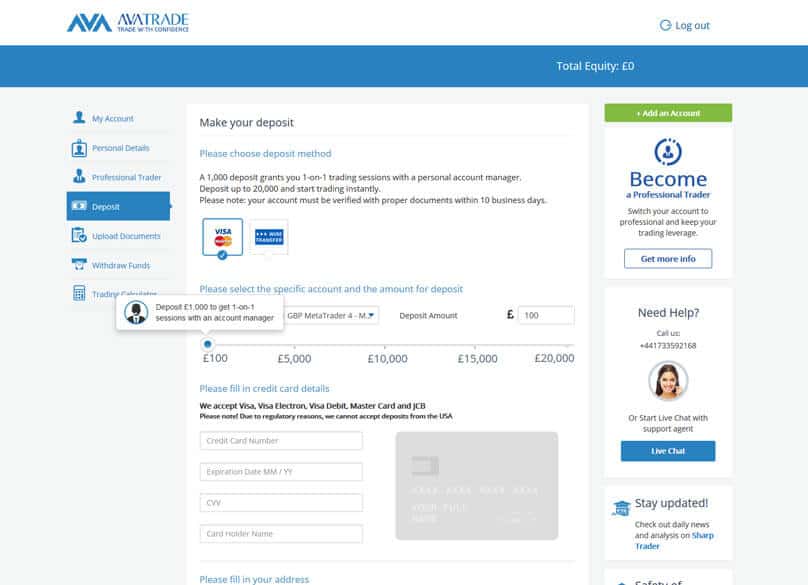

Step 2: Deposit Funds

You will now need to deposit some funds. Simply navigate to the deposit screen, select your preferred deposit method, enter in your chosen amount and hit confirm.

Step 3: Choose a Forex Pair

With a wide range of cur currency pairs on offer at AvaTrade, your best bet is to search for the specific currencies that you wish to trade. For example, if you want to trade the Canadian dollar against the US dollar, enter ‘USD/CAD’ into the search box. Alternatively, you can manually browse through the many currencies offered at the platform.

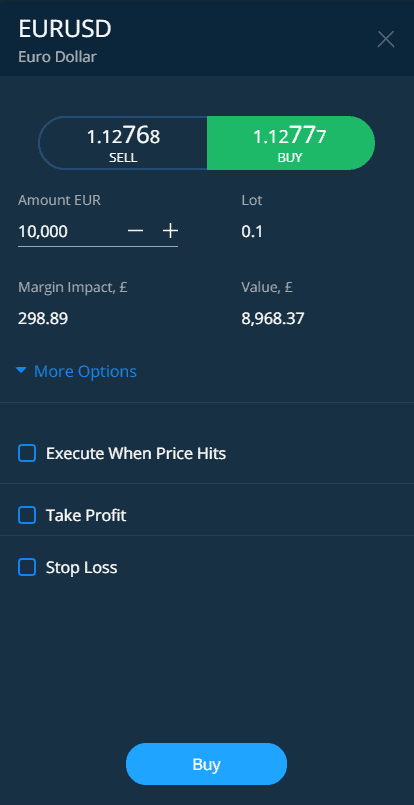

Step 4: Place Order

Now that you have decided which forex pair you wish to trade, you will need to set up an order.

If you’ve never placed a forex order before, we would suggest reading through the guidelines below.

- Buy/Sell: You first need to determine whether you want to place a ‘buy’ or ‘sell’ order. If it’s the former, this means that you think the exchange rate will increase in value. Alternatively, if you think the exchange rate will drop, opt for a sell order.

- Amount: This lets the broker know how much you wish to risk on the trade. Simply enter your stake in dollars and cents. Although brokers like Forex.com also allow you to specify your stake in currency units, we would opt against this as it’s easy to make a mistake.

- Leverage: If you plan to trade on leverage, select your preferred multiple (2x, 3x, etc.).

- Stop-Loss: It’s always wise to set up a stop-loss order, as this will ensure that your losses are minimized in the event the trade goes against you.

- Take-Profit: Much like a stop-loss order, this allows you to close out your trade automatically. Only this time, you’ll be locking in your profits.

Finally, click on either ‘buy’ or ‘sell’ to complete your trade.

Leverage at Canada Forex Brokers

Leverage allows you to make larger trades by effectively borrowing capital from your broker. For example, a $100 forex trade with leverage of 1:5 is worth $500.

The maximum leverage you can trade with in Canada depends on your chosen broker. If you go with an IIROC-licensed broker, then you’ll be restricted to a maximum of 1:50 leverage.

However, there are also many overseas brokers which are not restricted by the limits imposed by the IIROC and can therefore offer significantly higher leverage. For example, AvaTrade offers up to 1:400 leverage.

As trading forex with leverage comes with increased risk, we suggest you thoroughly do your research and only trade what you an afford to lose.

Conclusion

Canadian are spoilt for choice when it comes to choosing an online forex broker. Not only does this include a good number of domestic-based brokers, but heaps of overseas platforms that are regulated by tier-one licensing bodies. This means that knowing which broker to sign up with can be challenging, so we hope our guide has cleared the mist for you.

We’ve outlined our picks for the best forex brokers in Canada. All of our recommended brokers are heavily regulated, offer low spreads and commissions, and have a good range of currency pairs. Just make sure that you understand how forex trading works prior to opening and trading!

AvaTrade: Best Canada Forex Broker 2020

- Up to 1:400 leverage

- Supports MT4 and MT4

- Tight spreads

- Strictly regulated

FAQs

Are Canada forex brokers regulated?

Can Canada trade forex on leverage?

Will I need to provide ID at a Canada broker?

What is the minimum deposit amount at Canada forex brokers?

What payment options do Canada forex traders have to choose from?