The fourth quarter earnings season is in a full swing. Popular EV (electric vehicle) maker Tesla is also scheduled to release its earnings this week. What are analysts expecting from the company’s fourth quarter earnings?

Tesla has posted better than expected earnings for the last five consecutive quarters. The winning streak began in the third quarter of 2019 when it posted a surprise profit while analysts were expecting the Elon Musk run company to post a loss in the quarter.

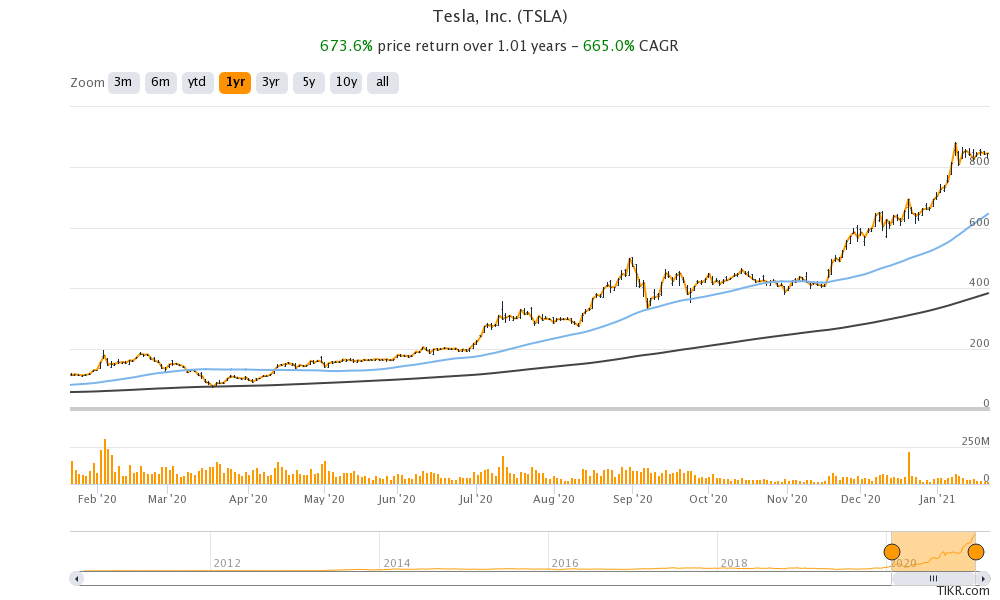

Tesla has posted profits for five quarters

Since then, Tesla has posted a profit in all quarters. These include the first quarter of 2020 where its sales are seasonally weak. Also, its China Gigafactory was shut for a few days during the quarter. It posted a profit in the second quarter of 2020 also despite its Freemont plant being shut for many days. Incidentally, the company managed to almost fulfill its initial guidance of 500,000 deliveries in 2020 despite the plant shutdowns.

The profitability streak helped Tesla find a place in the S&P 500—the world’s most popular and most indexed stock exchange. The S&P 500 Index Committee added the stock in one stretch that led to a further rise in Tesla stock.

Tesla’s fourth quarter earnings estimates

Analysts polled by TIKR expect Tesla to post revenues of $10.4 billion in the fourth quarter—a year over year increase of 41.2%. The company’s revenues had increased by 39.2% in the third quarter of 2020. However, analysts expect the company’s sales to grow 64.7% and 86.1% respectively in the first and the second quarter of 2021.

Deliveries have been rising

Tesla delivered 180,570 cars in the fourth quarter of 2020 which was 61% higher than what it had delivered in the fourth quarter of 2019. It delivered 499,500 cars in the full year 2020 which was a year over year increase of 36%. In 2019 and 2018, Tesla’s car deliveries had increased by 49% and 142% respectively. The sharp increase in 2018 deliveries, where Tesla’s car deliveries more than doubled was due to the launch of its mass-market Model 3. Model 3 gave Tesla the scale that the higher-priced Model S and Model X could not.

Tesla’s growth has been slowing

That said, Tesla’s delivery growth has tapered down over the last two years. Last year, during the third quarter earnings call, Tesla’s CEO Elon Musk said that the company could deliver up to a million cars in 2021. Analysts are expecting the company to deliver between 825,000-875,000 cars this year. We’ll get more clarity when the company releases its fourth quarter earnings report. It provides annual delivery guidance at the beginning of the year during its fourth quarter earnings release. The guidance on 2021 guidance could be among the most important things to watch during Tesla’s fourth quarter earnings call.

Can Tesla post another profitable quarter?

Analysts expect Tesla to post an adjusted EPS of $1.02 which is 147% higher than what it had posted in the corresponding quarter last year. That said, despite the continuous streak of profitability, Tesla’s stock looks somewhat overvalued. The company’s market capitalization is now over $800 billion and it trades at an NTM (next-12 months) enterprise value to sales multiple of 18.27x.

Is Tesla’s stock overvalued?

To be sure, it won’t be prudent to value a growth company like Tesla only on the NTM numbers. That said, even if we consider the growth, it is hard to justify the valuation. Even to have a 2025 price to earnings multiple of 25x, Tesla would need to post a net profit of $32 billion in 2025. In 2020, it is expected to post an adjusted profit of $2.6 billion. The over 12-fold increase in net profit over the next five years looks improbable.

Electric vehicle industry

This holds especially true looking at the slowing growth. Also, there looks a very high possibility of a price war in the EV industry as new models hit markets over the next two to four years. These include new models from established EV makers like Tesla and NIO as well as models from newly listed EV companies like Fisker, Nikola, and Canoo. To add to the glut, there would be several all-electric models from legacy automakers.

For instance, Ford’s electric F-150 would debut around the same time as Tesla’s Cybertruck. It would be a battle worth watching between America’s bestselling pick-up for decades and Tesla’s Cybertruck that has an unconventional design. There are also reports that Apple would launch its electric car somewhere by the middle of this decade. Gene Munster, who expects Tesla’s market capitalization to soar above $2 billion over the next three years, sees Apple’s entry into the EV industry as the biggest risk for the company.

Should you buy Tesla stock?

Shorting Tesla stock has been suicidal and even long-term bear Jim Chanos admitted last month that he has trimmed his short positions on the stock calling it “painful.” In April 2020, he had said that he is “maximum short” on the stock. Tesla’s short-sellers lost $40 billion last year as Tesla stock soared 740%. That’s the highest loss that short-sellers have made on any stock in one single year. Meanwhile, Michael Burry of “The Big Short” fame revealed last year that he is short on Tesla stock.

In the short to medium term, investor euphoria can keep Tesla stock going. However, over the long term, it would need to justify the valuations with commensurate earnings.

You can trade in Tesla stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account