Sundial Growers stock was up sharply in US premarket trading today after it reported its first quarter earnings which showed that the cannabis company turned positive on the EBITDA level.

Sundial Growers reported gross revenues of $11.7 million in the quarter which were 29% lower than what it had posted in the corresponding quarter in 2020. While most other cannabis companies are reporting high double digit revenue growth, Sundial Growers’ revenues have been falling for the last few quarters.

Sundial Growers reports a fall in revenues

To some extent, the fall in revenues can be explained by the company’s gradual pivot from low margin wholesale sales to high margin value add cannabis product. That said, even the value add marijuana sales fell in the first quarter of 2021.

Sundial Growers reported a decline in net sales of branded cannabis products from $11.4 million in the first quarter of 2020 to $7.2 million in the first quarter of 2021. Commenting on the fall in revenues, the company said “Sales were impacted by provincial boards reducing inventory levels, retail market conditions and continued price compression across the industry and Sundial’s portfolio. These market dynamics impacted all of Sundial’s formats and brands in the first quarter.”

The company is also looking at rationalizing its footprint. “The sustained decline in Canadian cannabis flower pricing has prompted Sundial to liquidate certain inventory in the first quarter and we are now limiting the offering of discount products in markets where we view the economics as neither attractive nor sustainable,” Sundial Growers said in its release. It added, “We do not plan to pursue top line advancement without profitability nor the maintenance of market share at any and all cost.”

Sundial Growers post positive adjusted EBITDA

Sundial Growers reported a positive adjusted EBITDA of $3.3 million in the quarter. It was the first quarterly positive EBITDA in the company’s history. However, the company posted a net loss of $134.4 million in the quarter. Out of this, $130 million were “non-cash amounts reflecting the impact of share price volatility on accounting valuation of derivative warrants.”

Cannabis industry

The cannabis industry is marred by massive losses and cash burn even as the sector is a long-term growth play. The perennial losses are leading to a consolidation in the sector. Tilray and Aphria have already merged to create the world’s largest cannabis company. Curaleaf would also soon merge with EMMAC Life Sciences to regain its title as the world’s largest cannabis company.

Strong balance sheet

Meanwhile, Sundial Growers is also looking at inorganic growth opportunities and has formed a JV with SAF Opportunities. Among others, the JV would look at setting up n SPAC (special purpose acquisition company). While there were concerns over Sundial Growers’ balance sheet in 2020, it now has ample cash to its balance sheet.

Short squeeze

The company capitalized on the short squeeze driven rally and issues new shares in a frenzy. As of 7 May, it had 1.86 billion common shares outstanding and had a cash balance of a little over $752 million.

Sundial Growers is looking to deploy these funds into other cannabis companies and at the end of the first quarter it had invested $96 million in cannabis companies which generated $15.7 million gains in the first quarter which consists of realized as well as unrealized gains. The company’s net book value per share was $0.61 at the end of the first quarter which is not much higher than its current market price.

Sundial Growers is continuing with its investments in the second quarter also. In April, it invested $188 million in SunStream Opportunities. In May, it announced the acquisition of 10.1% stake in The Valens Company. It has also announced the acquisition of Inner Spirit Holdings and Spiritleaf retail cannabis network for $131 million but the deal is subject to regulatory approvals.

Capital allocation strategy

Commenting on its capital allocation strategy, Sundial Growers said that it “remains focused on building long-term shareholder value through the accretive deployment of cash resources and on sustainable profitability based on its streamlined and right-sized operating structure, and its enhanced offering of high-quality brands.”

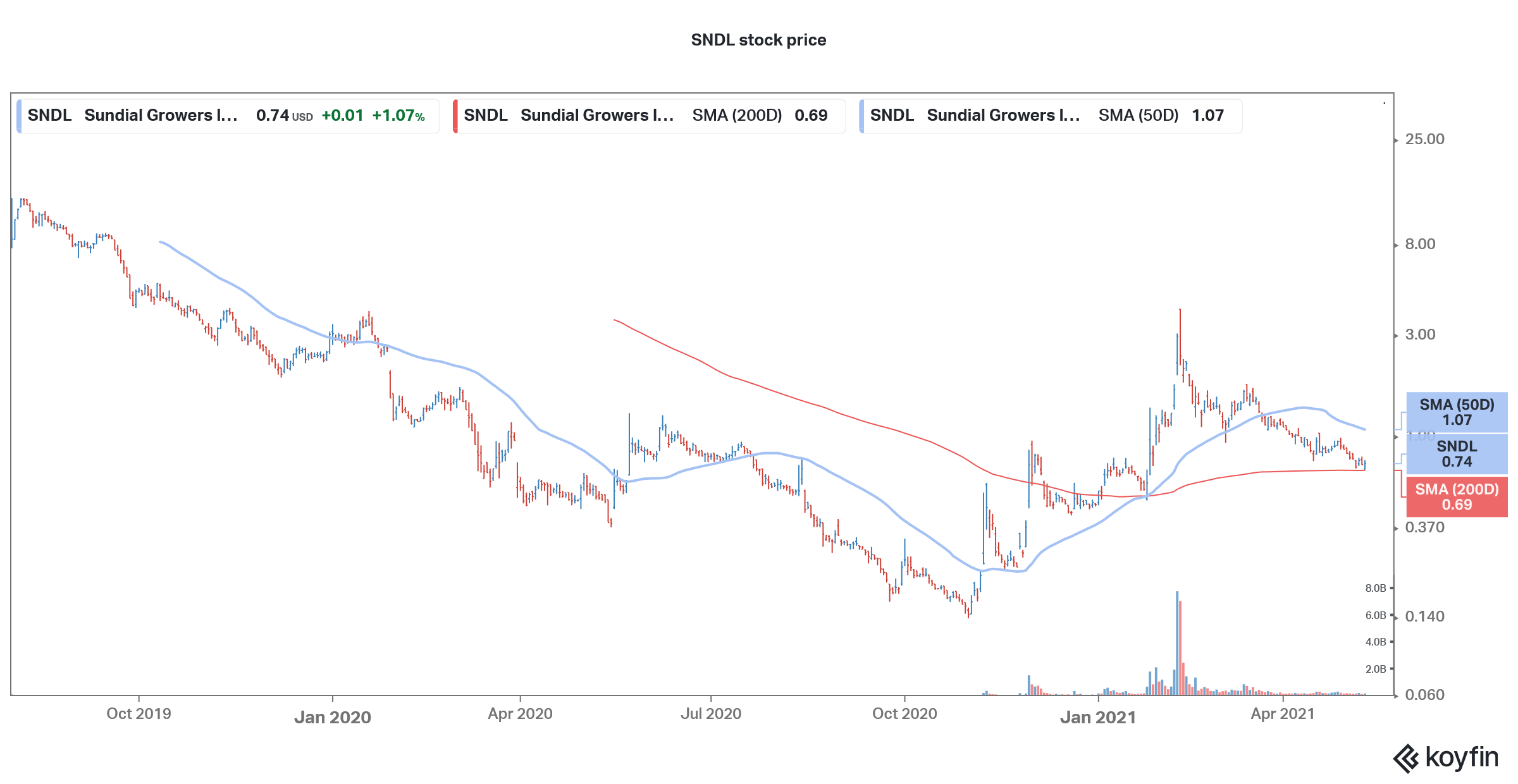

Sundial Growers was among the favourite WallStreetBets stocks. However, it has since crashed from its highs and is currently down 81% from its 52-week highs. All the stocks that were pumped by WallStreetBets have crashed from their highs as the short squeeze mania fizzled away.

How to trade in Sundial Growers stock

Sundial Growers stock was trading over 5% higher in US premarket trading today. You can trade in Sundial Growers stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the cannabis company could be to invest in ETFs that invest in marijuana companies

Through a marijuana ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio. The AdvisorShares Pure Cannabis ETF (YOLO) is one ETF that invests in marijuana companies.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account