Oil futures are posting their fourth consecutive day of gains after a decision from Saudi Arabia to cut its daily output by one million barrels per day ended up propelling the price of crude above $50 for the first time since the pandemic started.

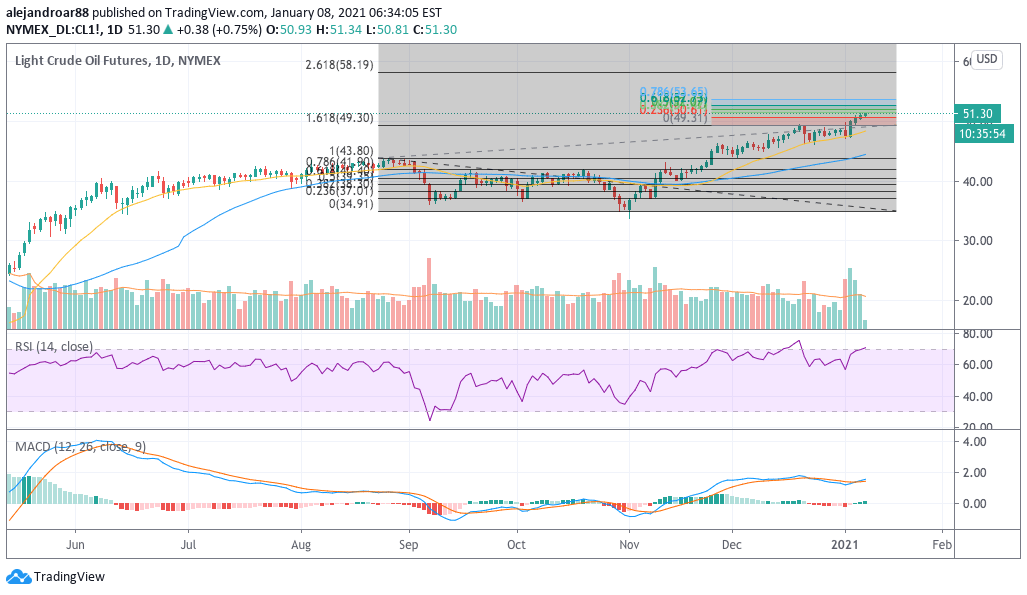

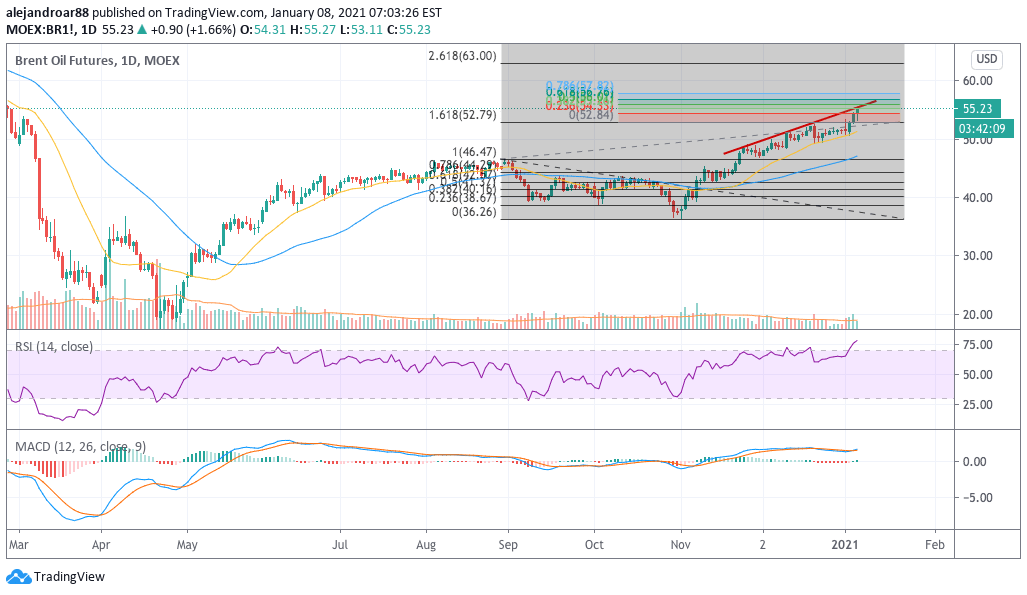

Futures of the West Texas Intermediate (WTI) are advancing 0.75% so far in early commodity trading activity at $51.30 while Brent futures are up 1.5% while hovering above the $55 level as traders remain optimistic about the impact of this measure.

Meanwhile, market participants will be awaiting the release of Baker Hughes’s widely-followed rig count report to analyze how oil producers have been responding to the latest demand concerns caused by the reintroduction of lockdowns in Europe amid a spike in the number of daily contagions.

Saudi Arabia’s decision to slash its output was fairly unexpected, as Russia secured permission to ramp up its production by 65,000 barrels per day while the Middle East country seems to have taken up the burden of making this much needed cut to ensure that oil prices don’t succumb amid a gloomy short-term demand outlook.

The biggest concern at the moment is associated with the new strain of COVID-19 that has been identified in multiple developed countries, as, although vaccines are being progressively rolled out, the demand for crude could be affected by the reintroduction of travel halts bans other quarantine measures that will decelerate fuel consumption around the world.

Goldman Sachs energy team wrote on Wednesday: “Despite this bullish supply agreement (from OPEC), we believe Saudi’s decision likely reflects signs of weakening demand as lockdowns return, with our updated 1Q21 balance actually weaker than previously”.

However, the American investment bank reiterated its bullish year-end outlook for Brent futures specifically, forecasting a price of $65 per barrel amid the prospect of a strong rebound in oil demand during the second quarter of this year.

What’s next for oil futures?

WTI futures have now passed a short-term target of $49.30 outlined by the 1.618 Fibonacci extension derived from the latest price action and could now be headed to $53.5 if this bull run is to continue.

Given the positive influence of this recent supply cut and the progressive improvement in the demand for crude as vaccination efforts keep moving forward around the world, it would be plausible to see oil prices hitting this higher threshold in the following weeks.

However, the virus situation remains a looming short-term threat for WTI futures, especially in the United States as the country has failed to contain the spread of the virus and it is now reportedly encountering the new strain that was first identified in Europe, a situation that could end up accelerating the number of daily contagions in the North American country.

That particular scenario remains a concern for oil traders, as it could lead to the introduction of strict lockdowns in key states of the country, with cases rising steadily to new highs after nearly 280,000 individuals reportedly tested positive yesterday.

Meanwhile, Brent futures seem to be about to encounter a strong trend line resistance – shown in the chart above – with the price now possibly facing a boom or bust moment before it can move higher to a short-term target of $58 per barrel indicated by the trend-based Fibonacci extension.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account