Oil futures are rising slightly above the $60 threshold in early commodity trading today, this being the tenth day of gains for crude prices in the last eleven sessions.

Brent futures are leading today’s uptick, surging nearly 3% at $63.4 per barrel, while futures of the West Texas Intermediate – the US benchmark for crude – are surging nearly 2% at $60.6 per barrel.

Tensions in the Middle East are contributing to this morning’s rally, as a Saudi-led coalition fighting in Yemen said on Sunday that a drone charged with explosives coming from the Iran-backed Houthi group had been intercepted. The device reportedly targeted Saudi Arabia.

Meanwhile, UK’s Prime Minister Boris Johnson announced today that he will be laying out his plan to progressively lift lockdowns in the European country on 22 February as vaccines keep being rolled out across the region.

The head of the British government indicated that the UK has already administered a first dose of the vaccine to more than 15 million people – around a quarter of the nation’s population – with Johnson qualifying this effort as an “extraordinary feat”.

The prospect of a swift economic recovery in the European region once vaccines are fully deployed is possibly the strongest catalyst for today’s uptick, while a report from Israel’s largest health care provider released on Sunday indicated that COVID infections dropped 94% among a total of 600,000 people who received the two shots of the Pfizer (PFE) vaccine.

Jim Ritterbusch, president of Ritterbusch and Associates, commented to CNBC last Friday that “expected U.S. stimulus and ongoing vaccine progress is likely to maintain appetite for risky assets in offering support to the oil market”.

On the other hand, other analysts have also been warning that this latest rally in oil prices could be reaching an unsustainable stage.

In this regard, Regina Mayor, global head of energy for KPMG, stated on Friday that the price of oil is “too frothy” at the moment as the speed at which the US is depleting its inventories is slower than the firm expected. In this context, Mayor emphasized that the $58 level for WTI oil seemed like a plausible target, which means that the US benchmark could be heading for a pullback shortly.

What’s next for oil futures?

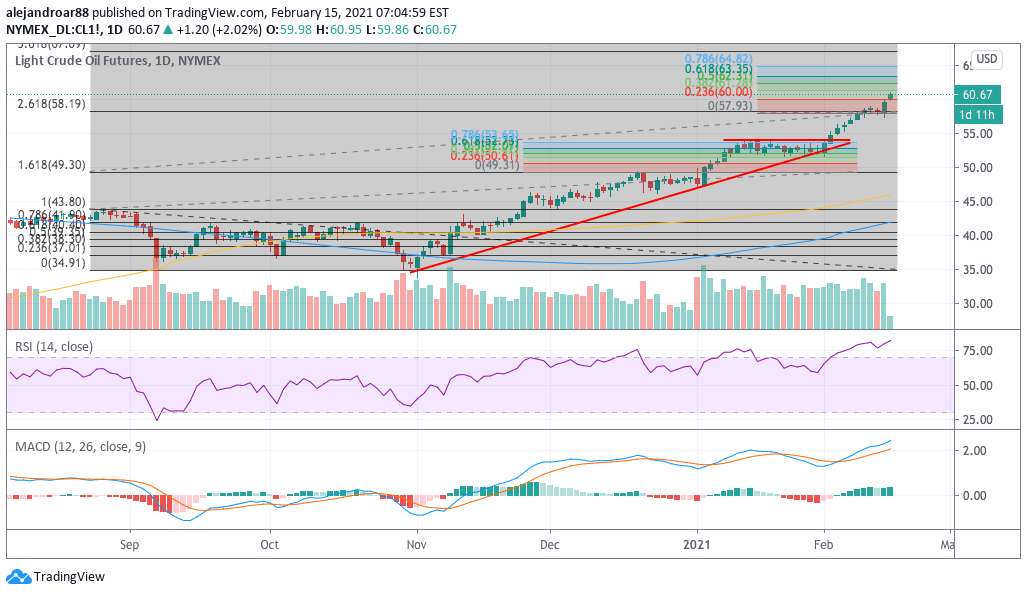

Based on this morning’s price action, the key levels to watch for oil over the coming days remain the same that we have already highlighted in previous articles, with a $65 short-term target for WTI futures if the bull run were to continue for a few more days while the $58 area should provide support in case of a pullback.

The market’s consensus for the WTI marker seems to be that a move beyond the $60 level is unsustainable, which means that traders should adopt a cautious approach to oil at this point by either taking some profits off the table or by tightening their stop prices to make sure their positions don’t get caught up in a strong pullback triggered by a seemingly imminent profit-taking move.

As of today, the RSI has stepped above the 80 level while the MACD keeps surging to new heights. That said, this is the third time that both the RSI and the MACD have posted higher highs in the past three to four months, which could lead to the potential exhaustion of the uptrend.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account