Oil futures are snapping an 8-day winning streak today in early commodity trading activity as crude prices keep booming on the back of prolonged supply cuts and inventory drops.

Brent crude futures are leading today’s uptick, advancing 1.5% at $61.5 per barrel, while futures of the West Texas Intermediate (WTI) – the US benchmark – are up 0.5% at $58.7 per barrel – reaching their highest level since January 2020 while getting close to pre-Wuhan levels.

A surprising drop in US crude stockpiles, as reported by the American Petroleum Institute (API), supported yesterday’s 7-day uptick for oil, with inventories falling by 3.5 million barrels while analysts were expecting a buildup of 985,000 barrels for the week ended on 5 February.

Meanwhile, oil’s bull run seems to have started back on 1 February, after sources indicated that Saudi Arabia and other OPEC countries exceeded their quota of cuts while Libya – another important oil producer – faced a blockade of some of its key ports by paramilitary forces.

Since then, the WTI marker accumulates a 12.5% gain while the price of Brent crude has advanced 10.6% as well.

Analysts have been supporting multiple bull market thesis on oil lately, with one notable comment from the head of global energy research firm Energy Aspects, Amrita Sen, who stated that his team sees “prices reaching $80 per barrel next year” while commenting that there is “an outside chance of [reaching] $100”.

The energy expert attributed this potential bull run to the Federal Reserve’s intervention in the financial markets through the injection of massive amounts of liquidity, which has resulted in inflated asset prices across the board.

Meanwhile, the market is expecting the release of data from the United States Energy Information Administration (EIA) at 15:30 GMT, with analysts still expecting a 985 million buildup in crude stockpiles.

What’s next for oil futures?

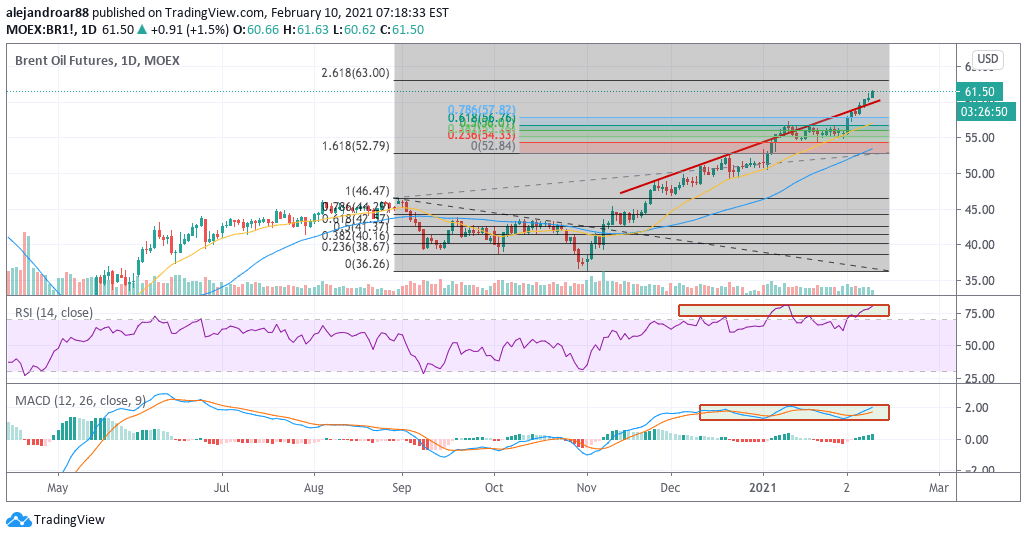

Although oil’s latest bull run could be due for a breather in the following days, most technicals are currently pointing to the continuation of this latest surge as the positive momentum keeps climbing.

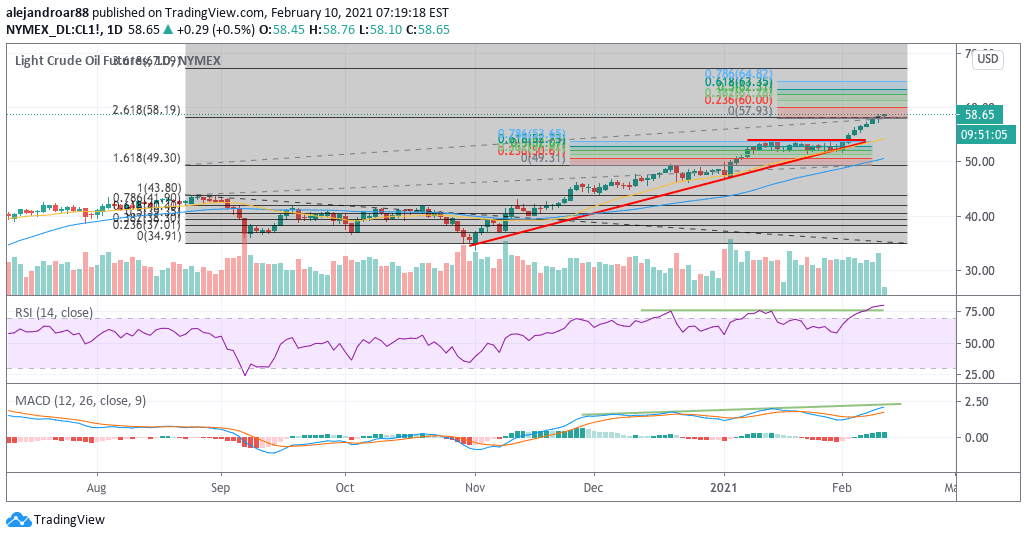

For the WTI marker, the price has already stepped on the 2.618 Fibonacci extension after moving above the $54 level – a threshold that served as resistance for almost two weeks for the US benchmark.

As a result, the RSI has posted its highest daily reading in roughly three years – indicating the strong positive momentum that oil is seeing amid prolonged cuts and a progressive recovery in the demand for crude as vaccines keep being rolled out across the world.

At this point, only a handful of variables could derail a move higher such as an unexpected surge in output or a strong uptick in US inventories.

Meanwhile, if none of those events materialize, a first target for WTI futures could be set at $65 – representing an 11% upside for traders if this milestone were to be hit.

Brent futures, on the other hand, seem headed to hit the 2.618 Fibonacci extension highlighted in the chart as well as the uptrend seems to have accelerated in the past three days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account