Intel stock was trading sharply lower in the US early price action today as markets gave a thumbs down to its quarterly earnings and guidance. Should you buy the dip in Intel stock?

Intel’s second-quarter earnings were ahead of analysts’ estimates for both the topline as well as the bottomline. Its non-GAAP revenues increased 2% year-over-year to $18.5 billion while analysts were expecting the metric at $17.8 billion. Its adjusted EPS of $1.26 was also ahead of the $1.06 that analysts were expecting.

Intel Q2 earnings beat estimates

The global semiconductor industry is currently in an upcycle. Chip demand has received an impetus from strong economic growth as well as the digital transformation. The increasing production of electric and autonomous cars is also leading to higher chip demand. Also, the supply hasn’t kept the pace which had led to a demand-supply mismatch. Intel expects the chip shortage situation to stretch into 2023.

Automotive industry

The automotive industry is among the worst affected by the chip shortage and automakers have lost several production days to the chip shortage. Ford is among the worst affected and had previously said that it expects to lose half of its second-quarter production due to the chip shortage.

“There are more whitewater moments ahead for us that we have to navigate,” said CEO Jim Farley during Ford’s first-quarter earnings call. He added, “The semiconductor shortage and the impact to production will get worse before it gets better.”

The company expects the chip shortage to wipe off billions from its pre-tax profits in 2021. According to consulting firm AlixPartners, the global automotive industry would lose $60.6 billion in revenues in 2021 due to the chip shortage. Apart from the automotive industry, while goods, gaming, and smartphone companies are also grappling with the chip shortage.

Pat Gelsinger on earnings

“There’s never been a more exciting time to be in the semiconductor industry. The digitization of everything continues to accelerate, creating a vast growth opportunity for us and our customers across core and emerging business areas. With our scale and renewed focus on both innovation and execution, we are uniquely positioned to capitalize on this opportunity, which I believe is merely the beginning of what will be a decade of sustained growth across the industry,” said Intel CEO Pat Gelsinger.

He added, “Our second-quarter results show that our momentum is building, our execution is improving, and customers continue to choose us for leadership products.”

Intel guidance

Intel also upwardly revised its 2021 revenue guidance to $73.5 billion which was $1 billion higher than its previous guidance. The company had increased the guidance by $500 million during the first-quarter earnings call also. Intel also increased its 2021 EPS guidance to $4.8 from $4.6. Meanwhile, the company said that it expects non-GAAP gross margins at 55% in the third quarter which is below the 59.2% that it posted in the second quarter.

The tepid gross margin guidance seems to be taking a toll on the stock today. Historically, the company’s margins have been in the ballpark of 60%. However, chipmakers are facing margin pressure as they ramp up investments. Margin pressure on chipmakers was also evident when TSMC reported its earnings last week.

Merger and acquisitions

Intel is rumored to buy GlobalFoundries which is a major chip. During Intel’s earnings release, Gelsinger said that “At this point, we would not say M&A is critical, but nor would we rule it out. He added, “Our view is that industry consolidation is very likely.”

Meanwhile, the PC market is looking strong which bodes well for companies like Intel. The company’s PC unit sales increased 33% in the second quarter as compared to the corresponding quarter in 2020. “Even as people go back to work, they’re largely going back to hybrid work,” said Gelsinger. He added, “We see that continuing, this need for PC density, for [more] PCs per household.”

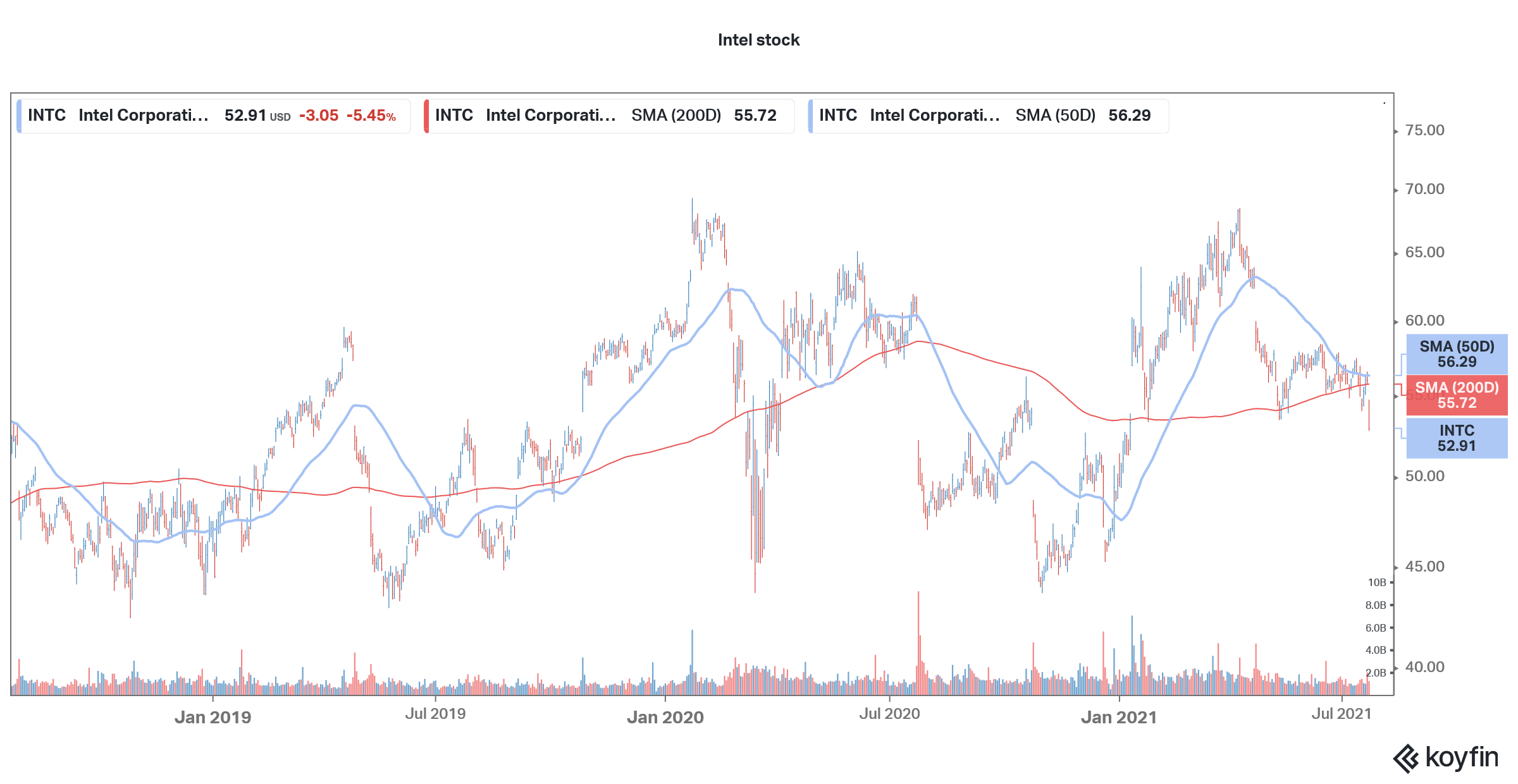

Intel stock target price

Intel has an average price target of $59.96 according to the data from TipRanks. The target price is a premium of 13% over current prices.

Of the 27 analysts covering Intel stock, nine have rated the shares as a buy while 10 analysts have a hold rating on the shares. Eight analysts have a sell rating. Several analysts have revised their target price on Intel after the second-quarter earnings release.

Analysts have mixed views

Analysts don’t seem bullish on Intel’s earnings. Bank of America, Jefferies, Evercore ISI, Truist, and Wells Fargo lowered Intel’s target price after its second-quarter earnings. Barclays’s analyst Blayne Curtis lowered Intel’s target price from $58 to $50 and said that he does not agree with the “sunny outlook from management” when the “PC market is already correcting, process struggles continue, and the Foundry strategy makes little sense to us.”

That said, Intel stock looks like a good buy after having fallen sharply from the peaks. The dip today could be an opportunity to buy and hold the stock for the long term.

You can buy Intel stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account