Tesla stock was trading lower in US premarket trading today after the company missed its fourth quarter 2020 earnings. The stock has risen sharply over the last year and Tesla’s CEO Elon Musk tried to justify its valuation during the earnings call.

Tesla released its fourth quarter earnings yesterday after the markets closed. It reported revenues of $10.74 billion in the quarter, a year over year rise of 46%. The revenues were ahead of the $10.4 billion that analysts polled by Refinitiv were expecting.

Tesla’s fourth quarter earnings

Looking at the full-year numbers, Tesla reported revenues of $31.5 billion which were 28% higher than 2019. Automotive revenues accounted for over 86% of the company’s revenues in 2020. The higher revenues were led by the spike in deliveries.

Tesla delivered 180,570 cars in the fourth quarter of 2020, a year over year rise of 61%. It delivered 499,500 cars in the full year 2020 which was 36% higher than what it had delivered in 2019. In 2019 and 2018, the company’s car deliveries had respectively increased by 49% and 142%.

Tesla’s revenue growth

Meanwhile, Tesla’s revenue growth lagged the increase in deliveries in the quarter on lower average product selling prices. As the company’s sales mix has been transitioning from higher-priced Model S/X towards the lower-priced Model 3/Y. It has also started delivering China made Model Y in China. The model is priced competitively against comparable models from Chinese electric vehicle makers like NIO.

Earnings miss estimates

While Tesla’s topline growth surprised on the upside, the company missed its bottomline estimates. It posted adjusted earnings of $0.80 per share while analysts were expecting the Elon Musk-run company to post adjusted earnings of $1.03. This is the first time since the second quarter of 2019 when the company has missed earnings estimates.

It has been posting positive net income since the third quarter of 2019 and its earnings were better than expected all along. This includes the first and second quarter of 2020 when it posted surprise profits even as analysts expected it to post a loss in the quarter.

Tesla expects supercharged growth ahead

While Tesla’s revenue growth rates have come down gradually over the last three years, the company expects to return to high growth rates now. During the company’s fourth quarter 2020 earnings call, CFO Zach Kirkhorn said “We continue to expect a long-term volume CAGR of 50%, of which we may materially exceed this in 2021.” He added, “As we increase production rates, volumes will skew toward the second half of the year, and ramp inefficiencies will be a part of this year’s story and are necessary to achieve our long-term goals.”

It is worth noting that Tesla is building new factories in Berlin and Texas that would help it increase its production capacity. As a supply-constrained company, it can only sell as many cars that it can produce. Along with these factories, it is expected to announce new Gigafactories as it has a huge war chest.

Tesla’s cash position is very comfortable

Last year, Tesla generated free cash flows of $2.8 billion and raised almost $13 billion from share issuance. It had cash and cash equivalents of $19.4 billion at the end of 2020 which is higher than its total debt. While legacy automakers have a huge debt burden that’s further compounded by pension liabilities, Tesla now has negative net debt and the cash on its balance sheet exceeds its total debt.

Tesla stock’s valuation

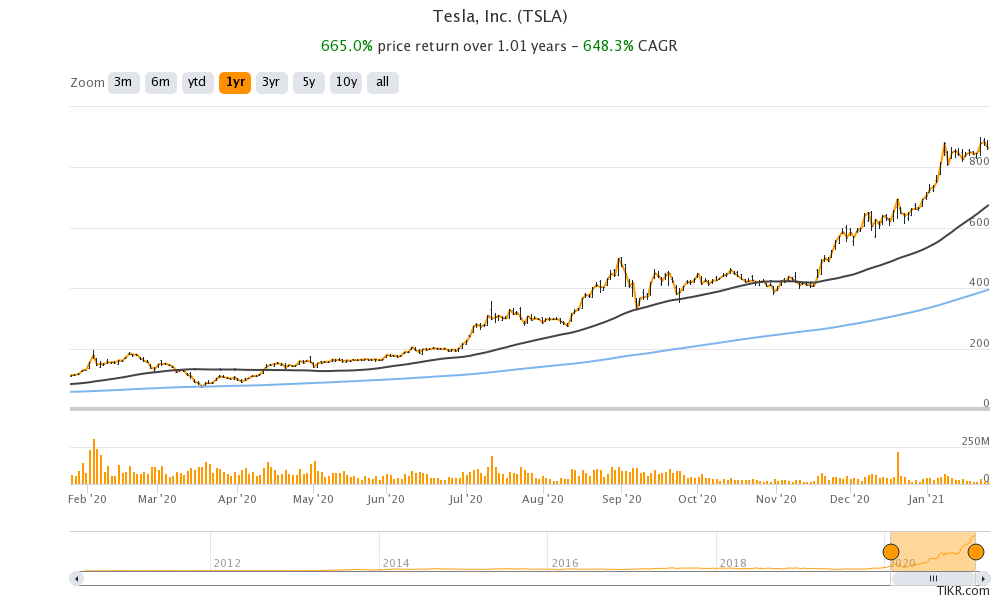

Tesla stock has risen 665% over the last year and has a market capitalization of $819 billion. It posted a GAAP net income of $721 million in 2020 which would mean a 2020 price to earnings multiple of 1135x. It is difficult to justify these valuation multiples based on the company’s current earnings. Incidentally, no automaker in history has commanded the kind of valuations that Tesla is now enjoying. Its market capitalization is now worth more than leading automakers like Toyota Motors, Volkswagen, General Motors, and Ford combined.

How Elon Musk justifies Tesla’s rally?

Musk, who has last year tweeted that he finds Tesla stock too high, tried to justify the company’s valuation during the earnings call. Using a hypothetical example Musk said that it can generate as many revenues from Robotaxis and FSD (full self-driving option) as it is making from selling cars. He also said that all these revenues would be almost gross profit and would add to its net income.

Taking the example of annual revenues of $60 billion, Musk said, “So — and the pace you get 20 PE on that, it’s like $1 trillion and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” He added, “And I suspect at least some number of investors are taking that approach.”

How’s Tesla making money

While Musk has put lofty projections, the current scenario is not as rosy as the stock price might reflect. Tesla’s profitability is almost entirely due to sales of carbon credits to rival automakers who might not need them once they ramp up their own electric vehicle production.

Carbon credits

Looking at 2020, Tesla made $1.58 billion from the sales of regulatory credits, a year over year rise of 166%. The credits directly flow to the company’s bottomline and were more than double of its 2020 GAAP income. Think of it this way, Tesla would have posted a net loss in 2020 on a GAAP basis had it not been for the carbon credits.

But then, markets are optimistic about Tesla and it is seen as the next trillion-dollar company. Gene Munster of Loup Ventures expects Tesla’s market capitalization to rise to $2 trillion by 2023. Munster had correctly predicted Apple’s market capitalization reaching $2 billion so there is every reason you should take his views seriously.

Apple’s electric vehicle plans

That said, Munster sees Apple’s entry into electric vehicles as the biggest risk for Tesla. Given its fan following and strong brand and history of coming up with premium products that buyers love, Apple could be the biggest challenge that Tesla investors should watch out for. Then there are Chinese electric vehicle makers like NIO who would also give Tesla a run for its money, at least in the Chinese electric vehicle market.

Tesla stock lost 2% in the regular trading session yesterday and was trading over 5% lower at $820.39 in US pre-market trading today.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account