The price of Bitcoin slid more than 6% yesterday after officials from the Federal Bureau of Investigation (FBI) announced that they had been able to recover a portion of the ransom paid by Colonial Pipeline to a group of hackers called DarkSide to regain control of what is a crucial piece of infrastructure of the United States oil industry.

According to a press release published yesterday, the Bureau recovered a total of $2.3 million corresponding to 63.7 BTC tokens out of the 75 that Colonial effectively paid hackers to regain control of the network.

The agency disclosed that they were able to retrieve the cryptocurrency by analyzing Bitcoin’s decentralized ledger to identify the virtual addresses to which the tokens were transferred to then proceed with the seizure by using the wallet’s private key – the equivalent of a password in the crypto world.

The price of Bitcoin (BTC) immediately went down after the press release came out, possibly as two of the features that have made BTC so popular such as the anonymity that holders can maintain along with the security of the blockchain in terms of preventing this kind of seizures came into question.

According to an affidavit provided by the FBI to seek the court’s approval for the seizure, the agents in charge indicated that one virtual address – also known as a wallet – was identified as the final destination where the criminals parked the money they collected from Colonial. Somehow, the agency had the private keys required to access the wallet and retrieve the stolen tokens.

When questioned about how the Bureau got the keys, a matter that continues to cause controversy, Deputy Director Paul Abbate said: “I don’t want to give up our tradecraft in case we want to use this again for future endeavors”.

The rescuing of Colonial’s ransom is another interesting turn of events in Bitcoin’s history as it appears to indicate that regulators and law enforcement agencies are not entirely unable to get to criminals – and their money – even if they attempt to conceal the funds obtained from a crime by using the cryptocurrency.

Meanwhile, according to an exclusive report from Reuters, the Justice Department has elevated ransomware attacks such as the one suffered by Colonial Pipeline to the same priority levels as terrorist attacks due to the potential damage that they can inflict to the country’s national security.

So far today, the price of Bitcoin continues to drop by 1.5% at $33,035 per coin in early cryptocurrency trading action as the negative momentum that started back in mid-April seems to continue.

What’s next for Bitcoin (BTC)?

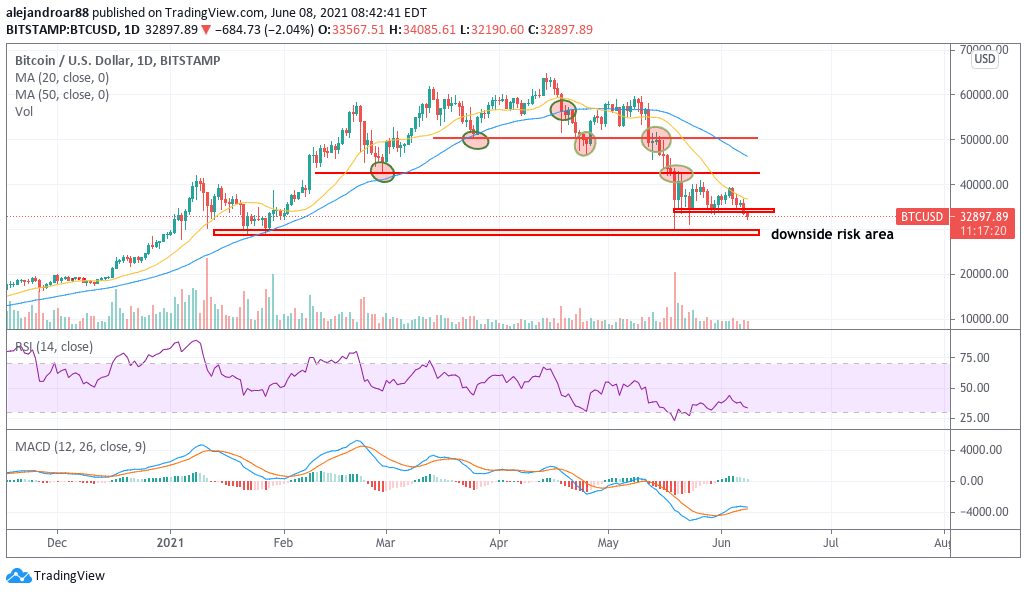

In the past few sessions, Bitcoin’s price action had found support at the $34,000 level but this latest development concerning the retrieval of the ransom by the FBI is pushing the cryptocurrency below that level – a situation that could end up triggering another wave of selling if leverage positions get smoked again.

Before the news, the daily RSI readings for Bitcoin were posting a bullish divergence, a technical signal that indicates the potential reversal of a downtrend as a result of a slow down in negative momentum. However, yesterday’s sell-off broke that divergence while sending the oscillator near oversold levels.

For now, the near-term outlook for Bitcoin (BTC) is bearish as the negative momentum seems poised to continue in the following days while the coin continues to trade below its long-term moving averages.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account