The price of Bitcoin (BTC) is sliding to bear market territory again this morning, only 13 days after the cryptocurrency snapped its latest all-time of $42,000 per coin as the furious bull run seems to be taking a dramatic breather following a 40% advance since the year started.

As of today, Bitcoin’s price is dropping 8.5% at $32,400 per coin since the cryptocurrency trading session started, making this the tenth losing session for BTC out of the last thirteen.

Only yesterday, the chief investment officer of Guggenheim Partners, Scott Minerd, put out a bearish short-term call on the price of the cryptocurrency as he forecasted that BTC could drop to $20,000 during the year although he remains bullish on the coin in the long-term as reflected by a prior $400,000 forecast he made public in mid-December.

“I think, for the time being, we probably put in the top for bitcoin for the next year or so. And, we are likely to see a full retracement back toward the $20,000 level”, said the head of investments for Guggenheim, a US-based investment firm with roughly $270 billion under management.

Meanwhile, one of America’s largest asset management firms, BlackRock, could step into the Bitcoin arena on short notice, as a ‘Statement of Additional Information’ filed with the Securities and Exchange Commission (SEC) for the company’s Strategic Income Opportunity Fund (BSIIX) revealed that this, and possibly other funds, could engage in trading BTC futures offered by the Chicago Mercantile Exchange (CME).

BlackRock’s participation in the BTC futures market could further increase the demand for the crypto asset at a moment when liquidity seems to be drying up, which could result in a short-term boost for the price, although the company did not disclose how much of the fund would be invested in the cryptocurrency.

Blackrock’s Strategic Income Opportunity Fund currently manages $35 billion for investors.

What’s next for Bitcoin (BTC)?

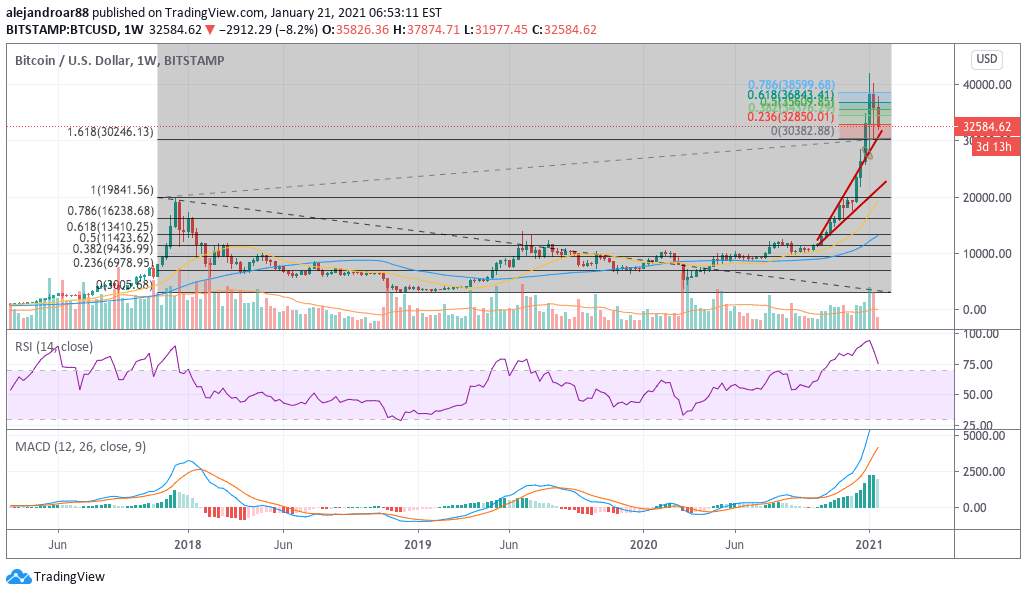

The chart above shows how Bitcoin (BTC) retraced from its heavily extended $42,000 all-time high at a point when the RSI was nearing the 90 level, only a few days after surpassing a short-term target we pointed in the early days of January.

As of today, the price is hovering above the 0.236 Fibonacci extension level highlighted in the chart, while the price action has also approached a zone of strong confluence that could serve as support in the following days.

At the $30,250 level, the price of BTC would step on the cryptocurrency’s upper trend line derived from its post-October parabolic move, while that level also coincides with the 1.618 extension emerging from the 2017’s Fibonacci retracement highlighted in the chart as well.

A bounce off this level could mean that Bitcoin might be heading for a U-turn in the short-term, as the coin’s favorable backdrop remains unchanged – i.e. excessive fiat liquidity, increasing support from institutional investors, lower liquidity amid a higher number of long-term holders.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account