The price of Bitcoin (BTC) is advancing the fourth day in a row aided by recent remarks from the Chief Executive of the digital payments giant PayPal who said that the company plans to launch a new business unit that will be entirely focused on cryptocurrencies and the blockchain.

These comments were made as part of the release of the firm’s financial results for the fourth quarter of 2020, with the head of PayPal, Dan Schulman” emphasizing that the volume of cryptocurrencies traded within the platform “greatly exceeded our [the company] expectations”.

Although PayPal’s boss did not lay out the details of what the business unit will do, he did mention that the firm plans to use cryptocurrencies “as a funding source to pay at PayPal’s approximately 29 million merchants around the globe”.

The news contributed to lifting the price of Bitcoin by 6% yesterday, while also advancing 0.3% today at $37,773 per coin in early cryptocurrency trading activity.

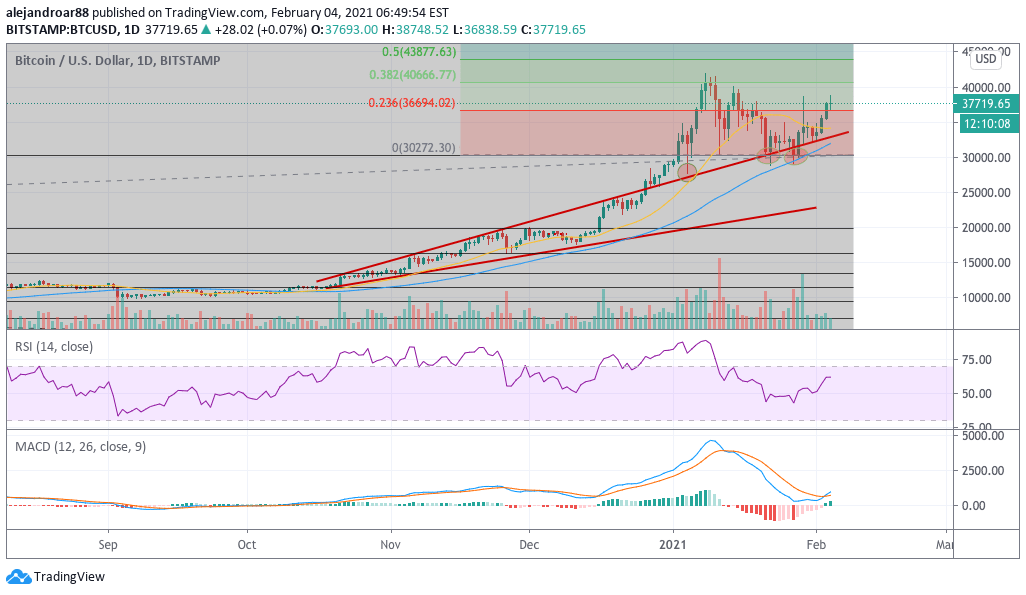

Bitcoin (BTC) has been recovering from a strong plunge in January, when the price retreated nearly 38% after peaking at $42,000 per coin, landing at $30,424 by 27 January while attempting to break the $30,000 at least two times.

For now, Bitcoin bulls seem to have held their ground at the $30,000 milestone, as the price has bounced strongly off that level.

Meanwhile, PayPal’s announcement could contribute to a fresh new bull run for Bitcoin (BTC), similarly to what happened in October 2020 when the firm first announced the launch of the feature that allows its clients to buy and sell cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Bitcoin Cash (BCH).

Goldman Sachs supports blockchain, not Bitcoin

Comments from the head of investment strategy at Goldman Sachs, Sharmin Mossavar-Rahmani, seem to indicate that the American investment bank does not support Bitcoin as a potential store of value, with the top executive indicating that high volatility continues to knee-cap the adoption of the cryptocurrency as an asset class.

“Something with a long-term volatility of 80% can’t be considered a medium of exchange”, said Rahmani during an interview with Bloomberg News.

That said, Rahmani acknowledged that Bitcoin is not going anywhere while emphasizing that the bank sees more promising opportunities in its underlying technology – the blockchain – rather than Bitcoin itself.

In this regard, certain reports have pointed to Goldman Sachs possibly working on the launch of its very own stablecoin – a cryptocurrency whose value is pegged to the price of a given fiat currency, often the US dollar.

What’s next for BTC?

The price of Bitcoin (BTC) has bounced strongly off its $30,000 psychological support and the price action also shows that the latest break below the upper trend line shown in the chart ended up being a false one.

Now, with a potential double-bottom formation at that $30,000 mark, the price appears to have been propelled to new heights, possibly aiming for the $40,000 threshold as a plausible short-term target.

This view is reinforced by a U-turn in the MACD, with the oscillator still hovering on positive territory while it just sent a buy signal.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account