To get the Best of the Bond Market delivered to your email daily click here.

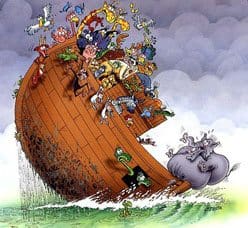

A full sized replica of Noah’s Ark could sink without a trace unless investors purchase roughly $29 million in unrated municipal bonds by Feb. 6. Writes Bloombergs Brian Chappatta. Giving bond buyers just 34 days and 33 nights to save the stricken project.

The project has so far raised $26.5 million, but needs to sell another $55 million in total to avoid triggering a redemption of all the bonds, Ken Ham, the nonprofit’s president, said in an e-mail to supporters yesterday. Without the proceeds, construction funding will fall short, he said.

The 510-foot “Ark” is intended to be the centerpiece of a planned biblical theme park called Ark Encounter. But the deal has come in for criticism, with some saying its religious theme may violate the Constitution.

Religious objections aside, the deal highlights the risk of Industrial-development bonds, which are considered the riskiest municipal debt because they account for the largest proportion of defaults in the $3.7 trillion municipal market.

The first phase of construction is due to start in March, but time is fast running out and the signs aren’t good. Ark Encounter has so far failed to entice any institutional investors, a sure sign of the validity of the project.

Unless the hole in funds can be filled by private bond buyers before the February 6th deadline, the whole project will have to be abandoned. It seems only a miracle can save them now. Still, stranger things have happened!

Todays Other Top Stories

Municipal Bonds

Bloomberg: – Morgan Stanley to Barclays see second yearly muni losses. – State and local bonds are set for their first back-to-back annual losses in more than three decades after the $3.7 trillion U.S. municipal market suffered its worst year since 2008.

Forbes: – How could a Puerto Rico default hammer the $3.7 trillion U.S. muni-bond market in 2014? – As we head into 2014, you may be asking why we are concerned about a small island located in the Caribbean Sea, about a thousand miles southeast of Miami. Geographically, it is a mere speck on the map… practically irrelevant. In fact, 70 islands the size of Puerto Rico could fit comfortably into the state of Texas. However, the debt burden currently burying this economy may eventually send nasty tremors into the United States’ municipal bond market.

Reuters: – Puerto Rico aims to sell bonds in near term. – Facing the prospect of losing its investment grade credit rating if it can’t tap capital markets, Puerto Rico plans to issue long-term debt in coming weeks, a spokeswoman for the commonwealth’s Government Development Bank said on Thursday.

Reuters: – BofA Merrill Lynch still top U.S. municipal underwriter. – Bank of America Merrill Lynch remained the top underwriter in a shrinking U.S. municipal bond market in 2013, while California sold the most debt in the year, Thomson Reuters data released on Thursday showed.

Bizjournals.com: – Bay Area investors nervously watch Puerto Rico’s finances. – While California continues to enjoy a gusher of cash flooding into the Golden State’s tax coffers, Bay Area municipal bond investors are growing increasingly alarmed by Puerto Rico’s sad state of affairs.

BusinessWeek: – Water bonds shrivel as California sees driest year. – The driest year on record for Los Angeles and San Francisco is threatening water supplies to the world’s most productive agricultural region and almost doubling borrowing costs on some bonds issued by California water agencies.

Morningstar: – Year in review: Municipal CEFs. – Normally regarded as a sleepy–and “safe”–asset class, municipal bonds were hammered in 2013. In fact, munis were hit twofold: first by rising interest rates, and then by credit concerns. After a spectacular run in 2012, many muni investors were likely disappointed.

FT: – BlackRock steps into Detroit bonds fight. – BlackRock, the world’s biggest fund manager by assets, is preparing to step in to the fight over the financial future of Detroit, where the treatment of bondholders could set a precedent for struggling towns and cities across the U.S.

ETF Trends: – A battered municipal bond market enters 2014. – Since the S&P Municipal Bond Index was launched in 2000 it never has had two years in a row of negative returns. However, a new year begins with all the uncertainty and expectations of any other year. Municipal bond funds are entering 2014 following a long string of monthly cash outflows indicating that retail investors remain skeptical of the short term prospects of the muni market.

MoneyNews: – Consider emerging market, muni bonds. – With U.S. stocks having soared last year while bonds declined, many investors will want to rebalance their portfolios to maintain their desired stock and bond allocations.

Education

LearnBonds: – Bonds and younger investors (Are bonds for kids?) – There is some debate within the investment community about whether bonds are a wise investment for children and young adults. Investment is an incredibly personal decision and is dependent on the unique situation of the investor. The choice of whether bonds are the correct type of investment for an individual needs to be based on the personal and financial situation of the investor, as well as the investor’s intended use for the money down the line.

Treasury Bonds

Bloomberg: – Treasury yields drop from 2-year high as investors weigh outlook. – Treasury 10-year yields fell from the highest level in more than two years as investors speculated whether the U.S. economy will improve enough for the Federal Reserve to end bond purchases in 2014.

Jay on the Markets: – Bonds are to fear early in the year. – The treasury bond market has showed a strong seasonal tendency to perform poorly during the early part of the year. People often ask me “why” this would be so. In fact I get that question often enough to make me wish I had a good answer. Alas, as a proud graduate of “The School of Whatever Works”, I can only repeat our school motto, which is “Whatever!”

Corporate Bonds

Bloomberg: – Credit swaps hold in U.S. as bond spreads reach lowest since ’07. – A gauge of U.S. corporate credit risk held at about the lowest level in six years as relative yields on investment-grade debt fell to the least since 2007.

Fundweb: – Corporate bonds move into 2014 with an uncertain future. – Quantitative easing has made corporate bonds a boon for investors but its slowdown in 2014 will bring increased volatility and greater chance of defaults.

High Yield

Forbes: – High yield bond funds see cash outflow in first reading of 2014. – Retail cash outflows from high-yield funds totaled $643 million for the week ended Jan. 1, according to Lipper, a division of Thomson Reuters . The negative start to the new year saw a fairly even split, with outflows from mutual funds at 45% of the sum, and exchange-traded funds at 55%.

Emerging Markets

Brad Zigler: – Emerging market debt’s wild ride. – It’s fair to ask why emerging markets would have been hit so hard by a prospective end to the Federal Reserve’s bond buying program. The answer is fairly simple. Much of the money that the Fed program pushed into the U.S. economy ended up looking for yield overseas. American investors became the world’s biggest investors in foreign debt as this hot money flooded into high yield markets such as Turkey, Brazil, Mexico and Indonesia.

Bond Funds

Bloomberg: – Gross’s mistake on Fed taper echoes across Pimco funds. – Bill Gross, the money manager known as “The Bond King,” misjudged the timing and impact of the Federal Reserve’s plan to scale back its asset purchases in 2013, spurring the Pimco Total Return Fund (PTTRX) biggest decline in almost two decades.

NewsObserver: – Bond market’s changes are going unnoticed. – While the remarkable gains of the stock market in 2013 garnered deserved attention at the end of the year, something else was happening in the much larger bond market.

InvestmentNews: – Bond funds post record withdrawals in 2013. – Bond mutual funds in the U.S. posted record investor withdrawals of $80 billion in 2013 as investors fled fixed income in anticipation that interest rates will rise further.

WSJ: – Year rewarded bond funds that took risks. – Bond funds that purchased stocks, distressed debt and high-yield securities generally outperformed those that bought corporate, U.S. Treasury and mortgage bonds in 2013, underscoring the perception that fixed-income markets are increasingly volatile and potentially perilous places for investors.

Business Insider: – Investors still bullish on bonds should turn to the ‘dogs of the dow’ strategy instead. – David Rosenberg says if you’re still bullish on bonds it’s time to turn into a dog of the dow.

IndexUniverse: – 7 most popular short-term bond ETFs in 2013. – U.S. fixed-income ETFs attracted a modest $9.58 billion in fresh net assets in 2013—or roughly a fifth of the inflows the asset class saw a year earlier in 2012—but that’s not to say that demand for fixed-income exposure was muted across the board.

Kiplinger: – The five best load funds for 2014. – There used to be a simple distinction between mutual funds based on the way they were marketed. No-load funds, which don’t charge commissions, were marketed to do-it-yourself investors. Brokers and advisers, by contrast, sold load funds, which charged commissions. The proceeds from those fees were used to compensate the intermediary.

Financial News: – The best and worst global bond funds of 2013. – The three best performing funds in the global bonds sector were all European high yield bond funds.

Gross: Don’t be so sure a risk adjusted position in 1-5 year bonds won’t outperform stocks in 2014.

— PIMCO (@PIMCO) January 3, 2014

With auctions and employment week coming up, USTs have a hard time rallying. #StuckInMud..

— Ed Bradford (@Fullcarry) January 3, 2014

https://twitter.com/cate_long/status/419160074884370432

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account