Best Online CD Rates for 2020

Are you looking for the best CD rates available today? In this article, we provide you with a guide on everything you need to know about CD rates and who’s offering the best deals. Remember that many banks offer “special offers” or “internet only” CD rates, which are often higher than the CD rates available through local bank branches where you live. To ensure you are getting the best return on your money, take the time to compare the most current rates here.

-

-

Where to Find the Best CD Rates

CD rates will vary from bank to bank, especially when you factor in longer maturity dates. A CD with a longer term, let’s say 3 to 5 years, will generally deliver higher CD rates than a one year CD. We suggest you take a minute to look at the difference in rates among CDs with CDs with different maturities using the above tool. Banks will sometimes offer their best CD rates exclusively online because they know online shoppers tend to be more responsive to higher rates on Certificates of Deposit than those who walk into their local bank branches.

Why Invest in CDs

The certificate of deposit (CD) is the unappreciated cousin of fixed income securities. Like treasury bonds, CDs are steadfast and true; they provide consistent returns with no worries of losing value. But if the good times in interest rates ends, the rate on these short-term deposits declines more slowly than on more interest rate sensitive bonds. The lower volatility makes the reliable CD a better risk diversifier in an investment portfolio. In good times and bad, this low risk security deserves more attention.

What Is a CD or Certificate of Deposit?Your good-old savings account may not provide a high return on your money, but you know that your savings are insured and safe. What if you could have the safety of a savings account and earn a higher return on your money? A Certificate of Deposit (CD) is an account in which you deposit money for a fixed length of time, in order to earn a fixed or variable rate of return. Although a CD is considered a short-term investment, early withdrawal penalties apply, so you will want to invest money you do not need in the near term. The term may range from one month to five years. Just as with savings and checking accounts,CDs issued by banks and credit unions are insured for up to $250,000. Generally, CDs pay a lower rate of interest than higher risk investments that are not guaranteed against loss. The rates you see on this page are among the best CD rates available at this time.

Certificates of Deposit vs Bank Accounts

Here’s how CDs and Savings accounts differ

- With a savings account, you can deposit and withdraw funds whenever you like. A CD is a time deposit. You make a deposit and leave it untouched until the maturity date. In exchange for leaving your money until the maturity date, you are paid a higher interest rate. If you do want to withdraw money from a CD, you will be charged a high penalty fee.

- Most CDs pay a fixed interest rate, locking you into a rate for the life of the term. The interest rate paid on a savings account may be fixed or vary with market conditions.

Here’s how CDs and Checking accounts differ

- A checking account has all the features of a savings account. An important difference is you can make payments with checks and withdraw money with debit/credit cards at any time. In exchange for the ability to access your money at any time, banks pay lower interest rates on checking accounts than savings accounts or CDs.

- Like a savings account, money in a checking account is immediately available, whereas a CD locks in the money for typically six months to five years, although the term could be for a shorter or longer period.

Certificates of Deposit vs Stocks

Here’s how CDs and Bonds differ

- Both CDs and government bonds are safe haven investments. They are in essence low risk, low interest rate loans that pay an interest rate on a principal sum. When you purchase a CD, you become a lender to the issuing bank, and with a bond to the government. CDs are short-term savings vehicles, whereas bonds can be short, medium or long term; 20- and 30-year treasury bonds are commonly placed in retirement portfolios.

- The value of CDs and bonds move in the opposite direction when interest rates rise or fall. An increase in interest rates increases the average rate paid on CDs. If you sell your bond on the secondary market, it could sell for less than the face value. Nonetheless, at maturity, the bond will be redeemed at face value.

Here’s how CDs and Stocks differ

- Stocks have high market risk. A stock investor can lose a portion or all of his principal investment sum when the share price falls below the purchase price. Investments in fixed income securities (CDs, bonds, treasury securities), on the other hand, do not lose the principal amount. The return is based on the interest rate paid. The investor is exposed to interest rate, inflation, and reinvestment risk.

- If you are tempted to dip into your savings to go on a shopping spree, a CD can instill savings discipline. Because the return on CDs is known and stable, they are a good investment vehicle for saving for short-term goals, such as a car purchase, home deposit, and so on. A stock with an automatic dividend reinvestment plan can also help you save, although a decline in the stock price could erode your dividend gains. And unlike a CD, you can sell your stock whenever you fancy without penalty so they are not the best option to instill savings discipline.

[/su_note]CDs versus Bonds, Annuities and Money Market Funds

CDs, bonds and annuities are all fixed income investments. They pay a fixed interest rate on a regular schedule on a principal amount. At maturity, the full principal sum is repaid to the investor. But when considering taxes, time horizon and interest rates, they differ in many ways.

Here’s how CDs and Bonds differ

- Both CDs and government bonds are safe haven investments. They are in essence low risk, low interest rate loans that pay an interest rate on a principal sum. When you purchase a CD, you become a lender to the issuing bank, and with a bond to the government. Whereas CDs are short-term investments, bonds can be short, medium or long term; 20- and 30-year treasury bonds are commonly placed in retirement portfolios. Corporate bonds can be low to high risk. A high yield bond, also known as a junk bond, pays high interest rates to compensate the investor for a high risk of payment default.

- The value of CDs and bonds move in the opposite direction when interest rates rise or fall. An increase in interest rates increases the average rate paid on CDs. The interest rate on your bond is now lower than that of new bond issuance. If you sold your bond on the secondary market, it could sell for less than the face value. Nonetheless, at maturity, the bond will be redeemed at face value.

Here’s how CDs and Annuities differ

- Annuities are a life insurance product used to provide guaranteed income in retirement. They pay out the principal balance in a stream of regular, fixed payments or a lump sum at a future date. The interest payments on both CDs and annuities are treated as taxable income, although the principal on a CD is never taxed. For annuities, taxes are deferred on the principal until the annuity maturity date.

- An annuity has a long-term investment horizon of typically 5–30 years, whereas a CD term is up to 5 years. Annuities generally pay a higher interest rate. The best 5-year CD rates are paying around 2.20–2.35 interest (Bankrate.com) versus 2.50–3.60 on annuities (allthingsannuity.com).

What Are Money Market Funds?If you want to diversify your risk across all these fixed income securities, a money market fund may do. A money market fund is a type of mutual fund that invests in short-term fixed income securities, as well as cash. By investing in a money market fund with CDs, treasury bonds, commercial paper (a short-term debt issued by companies to pay expenses such as payroll) and other debt securities, you can diversify your risk. Better still, this low risk fund will pay you a regular dividend (usually quarterly) so you also have a steady income stream.

Buy CDs With Ally Today - Best for Step Up Rates

CD Rates 1-year 1.50% 3-year 1.55% 5-year 1.60% Ally is a popular one-stop online bank offering savings, checkings, CDs, IRAs, loans and online investing. Ally’s best 5-year rate has recently fallen by 0.15 percentage points but we decided to include this provider owing to several options to raise your rate. With the Raise Your Rate step-up CD, you can increase your rate once during a two-year term and twice during a four-year term should Ally’s rates rise. Ally also offers a 10 Day Best Rate Guarantee, whereby it will raise your CD rate if rates rise within 10 days of account opening. For retirement plans, the IRA CD (Traditional, Roth, SEP) comes with a 90-day best rate guarantee. Ally’s 18-month CD pays a higher 1.75% rate. Early withdrawal rates are on the lower end (1–5 year CDs: 60–150 days’ interest).

4

- Above average APY rates and no account minimum

- 10-day and 90-day (IRA) Best Rate Guarantee

- Opportunity to raise rates during term of 2- and 4-year CDs

- Could be locked into lower 1.50% 4-year Raise Your Rate CD if rates do not rise

- No physical branches

Buy CDs With American Express - Best for High Yield Rates

CD Rates: 1-year 1.85%, 3-year 1.95%, 5-year 2.00% Whether investing in short- or long-term CDs, American Express’ rates are hard to beat. If you already have a trusted Amex green card or the premium gold card, a CD account can offset those higher interest rates and annual fees. When you deposit money in an American Express savings or certificate of deposit account, American Express will pay you some of the highest rates in the market. With the CDs of under a year, though, you will earn more keeping your money in an American Express high yield savings account, currently paying an attractive 1.70%, although this rate is variable versus a locked-in fixed rate for a CD. Amex fees for early withdrawal from CDs are high, and so are its cash advances on credit cards, so budget accordingly and place only money you will not need in the short term in CDs.

4.5

- High yield rates

- No minimum balance

- Automated CD ladder tool

- High early withdrawal rates (1–5 year CDs: 270–540 days’ interest)

- No physical branches

Buy CDs With Barclays Today - Best for Low Early Withdrawal Fees

CD Rates 1-year 1.83%, 3-year. 1.85%, 5-year 1.85% If you are happy with your banking services, but are seeking higher yielding CDs to top up your savings, signing up and purchasing Barclays CDs online is worth a few minutes of your time. While full service branch banking is offered in the UK, where Barclays is a top five retail bank, US customers can sign up for its high yielding savings and CD accounts through its convenient and fast US online banking services. The reputable bank is a safe and trusted CD provider, having out-survived many competitors over its 329 years in business. The US CD and savings accounts currently pay some of the highest interest rates in the market.

4

- High yield rates

- No minimum balance

- Lower early withdrawal rates than many competitors (>1–5 year CDs: 90–180 days’ interest)

- Full banking services not offered (No checking, only savings accounts in US)

- No physical branches in US

Buy CDs With CIT Today - Best for No Withdrawal Penalty CD

CD Rates. 1-year 1.86%, 3-year 1.30%, 5-year 1.70% If you want to park all your banking services in one place, CIT is an online bank (with full bank branches in California). Personal accounts include savings and echecking accounts, and CDs and money market funds. Four CD products are offered. Term CDs (rates displayed above) require a $1,000 minimum deposit. CIT’s No-Penalty, 11-month CD is worth a look. You may withdraw your funds at anytime without the high penalties charged by traditional CDs while still receiving a high rate of 1.70%. Jumbo CDs , requiring a minimum account deposit of $100,000, are available for terms of 2–5 years but offer only slightly higher rates (3-year: 1.40%, 5-year: 1.75%). RampUp CDs, step up CDs allowing one rate increase during the term, are not currently available to new accounts.

4

- Above average APY rates

- 11-month, no withdrawal penalty CD

- Automatic renewal at same rate

- $1,000 minimum deposit

- High early withdrawal rates for long-term CDs (1–5 year: 90–360 days)

Buy CDs With Marcus Today - Best for Rate Guarantees

CD Rates 1-year 1.83%, 3-year 1.85%, 5-year 1.85% Goldman Sachs is better known for its white shoe investment banking services. With its more down-to-earth moniker and fast, easy online signup, Marcus provides high CD rates with the safety of an established, respected banking institution. For those who are apprehensive about locking into fixed interest rates for 1–5 years (a condition of all CDs), especially in a rising interest rate environment, Marcus offers a 10-Day CD Rate Guarantee. If the rate rises within 10 days of funding your account, you will receive the new higher rate. In this case, you may also want to take advantage of a 30-day window to fund a High-Yield CD. Marcus offers a six-year term CD, but if you withdraw early, it will cost you 365 days in interest.

4.5

- High yield rates

- 10-day CD interest rate guarantee

- Funds can be added to High-Yield CDs up to 30 days after opening

- $500 minimum balance

- High early withdrawal rates (1–5 year: 270 days’ interest, 6-year: 365 days)

What Are the Benefits of a CD?

To recap, the top benefits of CDs are:

- Higher interest rates – The biggest benefit of CDs is a higher rate of return via higher interest rates than that paid by other short-term investments like savings accounts, treasury bills and money market accounts.

- Fixed interest rates – Your interest rate is locked in and will not fluctuate with market interest rates. If the central bank lowers the funds rate – which is the rate banks use to set interest rates – you will still receive the same rate for the term of the CD. If interest rates are raised, on the other hand, you will be stuck with the lower rates.

- Fixed term – If you cannot beat the urge to splurge, CDs can help you reach savings goals. Your money is locked into a CD for a fixed term, typically ranging from six months to five years. If you withdraw funds early from the CD, you will have to pay an early withdrawal penalty fee.

- Deposit insurance – If your CD is held with a bank, you are insured for up to $250,000 by the Federal Deposit Insurance Corporation (FDIC), and if it’s held with a credit union, the National Credit Union Administration (NCUA) insures your account for the same amount.

What Are the Risks of Investing in a CD?

A CD is a low risk-low reward savings vehicle. Because your money is guaranteed by deposit insurance, you are guaranteed your principal plus the interest accrued at the end of the investment period. You are paid a rate above savings deposits for keeping your money in the CD for a fixed term. In comparison, a high yield corporate bond is a high risk-high reward investment. If you invest in SpaceX’s high yield bonds – recently issued to raise research and development funds for satellite and rocket launches, and to settle humans on Mars – you will be paid a high interest rate (about 4.25% more than the average CD rate) because you have no guaranteed return on this high risk venture.

Who Are CDs Suitable for?

Any investor would be wise to include CDs in a diversified investment portfolio. They are placed under Cash and Cash Equivalents, which along with Stocks and Bonds make up the three major allocations of a portfolio. Cash and cash equivalents are the most liquid assets in an investment portfolio, meaning they can be converted into cash in a year or less time. They include certificates of deposit, treasury bills, money market funds and short-term government bonds. Because the returns on cash equivalents and bonds have a negative correlation to those of stocks, adding CDs to your portfolio is a way to diversify market risk. When stock prices are falling, investors run to the safety of these lower risk investments.

But how much money should you invest in CDs? An investor with a low risk appetite such as a person saving for retirement will have a higher percentage of their money in cash and cash equivalents whereas a millennial with a steady income will place more money in stocks and bonds, and may even dabble in high yield bonds. Reviewing the following investor profiles will help you to determine how much money to place in CDs.

The Investment Portfolio

Given the low risk and guaranteed return of a CD, this stable investment instrument has a place in almost any investment portfolio. Below are sample portfolios for five investors with different risk profiles and their typical CD allocations.

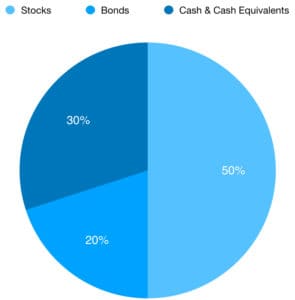

👨💼The Conservative Investor (The Retirement Saver) – CDs have the ideal risk-return profile for a retirement portfolio. Retirement portfolios are comprised of mostly conservative investments. As much as 30 percent of a retirement portfolio is in cash and cash equivalents.

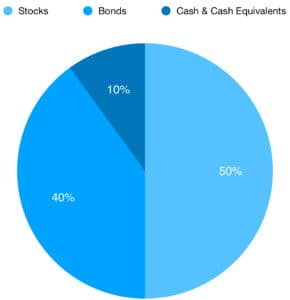

👩💻The Balanced Investor – The balanced investor has an allocation of fixed income securities, and value and growth stocks. This investor uses a high bond allocation to diversify risk exposure to the stock market. CDs and other short-term investments make up about 10 percent of the portfolio.

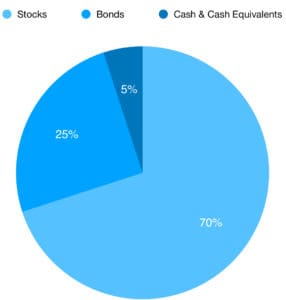

🤵The Growth Investor (The Millennial) — The growth investor has a 70 percent stock allocation, with as much as half invested in high growth and foreign stocks. Only 30 percent of the portfolio is diversified into bond and short-term investments. An alternative asset class (e.g., real estate, hedge funds, cryptocurrencies) may also be included in the Balanced and Growth portfolio.

👨🚒The Emergency Saver— CD ladders are often used to ensure access to emergency funds. To create a CD ladder, invest in multiple CDs with staggered maturities (as short as one month). If you do not need the funds in the CD when it matures, you can roll over the CD into a new one. Rolling over a short-term CD on a regular basis allows you to earn higher interest rates than a savings account while having access to your money in the case of an emergency.

👩🎓The Goal Saver – A CD is a good way to save for a future investment goal. The saver can earn above the savings account rate while saving for college, a house, a wedding, and other important life events.

CD Terms and Questions to Ask

Before shopping for the best CD rates, familiarize yourself with these terms to ensure you get the best overall CD deal.

Interest rate – The interest rates on CDs are determined by the benchmark interest rate set by central banks. They also are influenced by the rates set by competing banks. Do not assume the advertised rate is the final offer. Always ask if the interest rate is negotiable. You will be able to get higher interest rates on CDs with a longer time to maturity and a higher initial investment.

APY – When shopping around for CDs, you may find one CD paying 2 percent interest compounded daily and another paying 2.25 percent compounded monthly. Which offer is best? The annual percentage yield (APY) considers the annual interest rate and compounding frequency to provide a comparable rate of interest earned over the year. The APY allows you to compare apples-to-apples to decide which is the best deal.

Total return – The interest rate plus principal (or APY), term of the CD and compounding frequency will determine your total return on a CD investment. Use our CD rate calculator to easily compare CDs.

Minimum deposit – The minimum deposit can vary from $0 to $10,000. High deposit minimums should fetch higher interest rates.

Withdrawal penalty – The fee charged for withdrawing your funds early can be steep. An issuer, for example, could charge 12-18 months of interest. With an 18-month penalty, if you withdrawal after 12 months, your principal will be negative (principal minus 6 months of interest). The withdrawal penalty often increases with the length of the CD.

Other fees – Check for maintenance fees and broker fees, if you are not buying directly from a bank.

What Types of CDs Can I Buy?

Banks and brokers often have preferred products they would like to sell you. These CDs may not be ideally suited to your investment objectives. Ask about the full range of CD products on offer. Always ask if the interest rate is negotiable. If interest rates are rising, you will likely regret locking in at a fixed rate at current rates The following CDs provide the investor some flexibility in changing interest rate environments.

Liquid CD – Also called no penalty CDs, liquid CDs enable you to withdraw your money at any time without paying a withdrawal penalty. You may receive a lower interest rate for this withdrawal privilege.

Bump-up CD – Also called adjustable-rate CDs, this CD allows you to upgrade to a higher interest rate. If the central bank announces plans to gradually increase interest rates over the next two years, with an adjustable-rate CD, you do not have to be locked into a lower rate.

Callable CD – A callable CD gives the issuer the option to call the CD before the maturity date. In exchange, the investor is paid a higher interest rate. If the prevailing interest rate falls from 3 percent to 2 percent, the bank may exercise its right to recall the CD. Although the investor faces the risk of not being able to reinvest the money in another CD at 3 percent.

Add-on CDs – Add-on CDs allow you to increase your principal investment. The terms can vary from one-to-two to unlimited add-ons. If you invested in a three-year add-on CD at 3 percent and interest rates are falling, you may choose to place more money in the CD than a new CD or other investment (annuity, bond) that are currently paying lower rates.

4 Steps to Buying a CD Online

Now that you have determined the type of CD you want to buy, you are ready to shop for the best CD rates. By making use of LearnBonds free CD comparison tools, you can ensure you get the most attractive rates and terms in the market. Here’s how:

1. Shop around for the best rates – You can quickly compare the CD interest rates using our comparison tool above. Check the compounding frequency. Daily compounding will have a higher APY than monthly compounding.

2. Choose the CD term length – The term will be determined by your investment goal. If the CD is part of a retirement fund, the term may be 5–10 years while a CD allocated to an emergency fund may be rolled over every six months.

3. Choose the payout frequency – Some issuers will give you an option on how frequently to receive your interest rate payments – monthly or annually, for example.

4. Use our CD Calculator – The CD Calculator will help you assess how different interest rates, compounding frequency and maturities, as well as taxes and inflation, will affect your total return.

Remember to choose a deposit insured issuer. CDs can be bought from brokerages, banks and credit unions. Ensure the issuer is insured with deposit insurance.

Pros and Cons

Pros

- Higher interest rates than bank accounts

- Higher interest rates with longer terms and deposit amounts

- Adjustable rate and other flexible terms available

- Regular income stream

- Tax advantages in retirement accounts

Cons

- Lower return than stocks

- Fixed locked-in investment term

- Interest rates could rise during the locked in term

- Funds may not be accessible for emergencies

- High penalty for early withdrawal

As you can see, CDs have many fine qualities making them deserving of an investor’s attention. They can serve you as both a valuable investment and money management tool. As part of your investment portfolio, these stable, consistent earners can help offset losses. If you are an impulsive spender, best to move the temptation out of your savings account and into a CD for a fixed period. The withdrawal penalty will discourage you from engaging in reckless spending. Meanwhile, your money could be earning higher returns than other short-term investments.

FAQS

What is the minimum investment amount in a CD?

The minimum investment set by banks varies from no minimum investment to $10,000. Most minimums fall in the range of $500–$5,000. Higher minimums tend to pay higher interest rates.What is a CD ladder?

A CD ladder is an investment approach designed to provide you with regular income year after year. For example, you could buy five CDs each with a different maturity: one, two, three, four, and five years. The longer the term, the higher the interest rate paid, as in the below example. 1-year CD – 2% 2-year CD – 2.25% 3-year CD – 2.50% 4-year CD – 2.75% 5-year CD – 3.00% Each year, you can move the money into a checking account to live off of or reinvest it in another one-year CD. If you choose to reinvest, after five years, each CD will be earning the highest interest rate. If you choose to reinvest the principal and create a recurring income stream, the interest earned may be used to pay for expenses, such as car payments, condo fees or vacations.How is interest calculated on a CD?

The interest on a CD is compounded. This means the interest earned is added to the principal and the next period’s interest is calculated from this new balance. Interest on a CD can be compounded daily, monthly or quarterly. On a five-year CD, a $10,000 deposit at 3 percent interest compounded over the first year would equal a balance of $10,300. Adding the 3 percent interest to the new balance would create a balance of $10,609 in the second year, and so on. At maturity in the fifth year, the balance would be $11,592.74.How much is my CD insured for if my bank goes bankrupt?

The FDIC insures CDs for up to $250,000 for each depositor.How do I cash out of a CD before its maturity date?

To cash out of a CD early, contact your bank or broker. Also check to see if your CD is set up to automatically renew. If it is not your intended wish to renew, you could end up paying a withdrawal fee to cancel the CD.Can a certificate of deposit be used as collateral?

Yes, a certificate of deposit is a low risk financial asset. Loans can be taken out against CDs. Because CDs are a secure financial asset with low credit risk, you may be able to obtain a lower loan rate with CD backing. Ask your banker about CD loans.How can I get the highest interest rate?

Higher interest rates are offered for longer term and higher deposit amounts on CDs. The rates paid by CD issuers vary. Shop around for the best CD rates. Remember to ask about the early withdrawal penalty. A high penalty could leave you with a lower principal balance than your initial investment. Compare rates on our best CD rates comparison tool, which is updated daily.Is tax payable on a CD?

The interest earned on CDs is taxed, in the same way, the interest on a savings account is taxable. However, if you hold a CD within an IRA retirement account, interest earnings may not be taxed and contributions may be tax deductible. If you have withdrawn money before maturity from a CD, you can deduct the withdrawal penalty from your taxes.Maggie Smith

Maggie Smith

Maggie is an investment expert with 10 years experience in dividend stocks and income investing. She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs.View all posts by Maggie SmithWARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

Scroll Up

If you want to diversify your risk across all these fixed income securities, a money market fund may do. A money market fund is a type of mutual fund that invests in short-term fixed income securities, as well as cash. By investing in a money market fund with CDs, treasury bonds, commercial paper (a short-term debt issued by companies to pay expenses such as payroll) and other debt securities, you can diversify your risk. Better still, this low risk fund will pay you a regular dividend (usually quarterly) so you also have a steady income stream.

If you want to diversify your risk across all these fixed income securities, a money market fund may do. A money market fund is a type of mutual fund that invests in short-term fixed income securities, as well as cash. By investing in a money market fund with CDs, treasury bonds, commercial paper (a short-term debt issued by companies to pay expenses such as payroll) and other debt securities, you can diversify your risk. Better still, this low risk fund will pay you a regular dividend (usually quarterly) so you also have a steady income stream.