Tesla Motors Inc (NASDAQ:TSLA) revealed a record number of sales for the first quarter after a surprise release of its sales numbers on Friday afternoon. The company sold 10,030 cars in the quarter according to the official numbers. Just as the stock market celebrates those figures, questions about the company’s finances are beginning to be asked.

On this morning’s market shares in Tesla Motors Inc (NASDAQ:TSLA) were trading strongly up on the sales numbers. At time of writing the firm’s shares were selling for 205.28, up 7.48% on this morning’s open. A Bank of America Merril Lynch report, authored by analyst John Lovall II, suggested that the numbers represented a “very weak” financial situation for the company which should be apparent in its first quarter earnings numbers.

Analyst questions Tesla sales

According to Lovall the Tesla Motors Inc (NASDAQ:TSLA) sales revealed in the recent release do not represent a very positive quarter for the company. The analyst pointed out that the number represents just 2% growth from the same three months of last year, and also noted that the 10,030 is well below the company’s production capacity for the quarter.

Tesla Motors Inc (NASDAQ:TSLA) says that it can build roughly 1,300 Model S sedans per week. That implies capacity deliveries of 16,900 per quarter. The analyst also reckons that 1,400 sales from the fourth quarter were shipped in the first quarter of the year, meaning that adjusted deliveries should be recorded at 8,630.

All of this makes Lovall less than optimistic heading into the release of Tesla Motors Inc (NASDAQ:TSLA) earnings. He has a price target of just $65 on the company’s shares. On this morning’s market stock in the Palo Alto, California company was trading for more than $207 each.

The 70% downside represented by the Bank of America Merril Lynch Price Target is justified, in Lovall’s eyes, by an inability to sell cars as expected by investors at current prices. Lovall reckons that the company’s target of 55,000 units sold in 2015 is in significant doubt already.

Transparency may not be clear

Just because Tesla Motors Inc (NASDAQ:TSLA) is being transparent by releasing its sales data, doesn’t mean it’s representing that data in the most clear and frank way possible. Lovall, for example, believes that Elon Musk may be obfuscating Tesla sales after getting rid of a wealth of discounted Model S sedans at the end of the quarter in order to meet ales targets.

If Lovall is right and Tesla did indeed create the conditions that allowed it to beat sales targets, the company’s shareholders could be in for a rude awakening when the company does reveal its financial state. Tesla Motors Inc (NASDAQ:TSLA) is due to release its earnings report for the first quarter of 2015 on May 5.

If Tesla has indeed been making a large proportion of its sales off of discounted models that will likely be reflected in the company’s overall gross margin for the quarter. The gross margin is the difference between the sales price divided by the total cost of the product divided by the total cost of the product. Tesla had a gross margin of 27.36% at the end of the fourth quarter.

The company’s gross margin ranged between 25% and 30% through last year. If there’s a significant drop in the margin, a number that Tesla Motors Inc (NASDAQ:TSLA) CEO Elon Musk often talks about as vital to the business, without reasonable explanation, the average sales price of the company’s Model S sedans may have been lower due to selling of display models and other lower priced units as Lovall asserts.

Tesla release tests waters

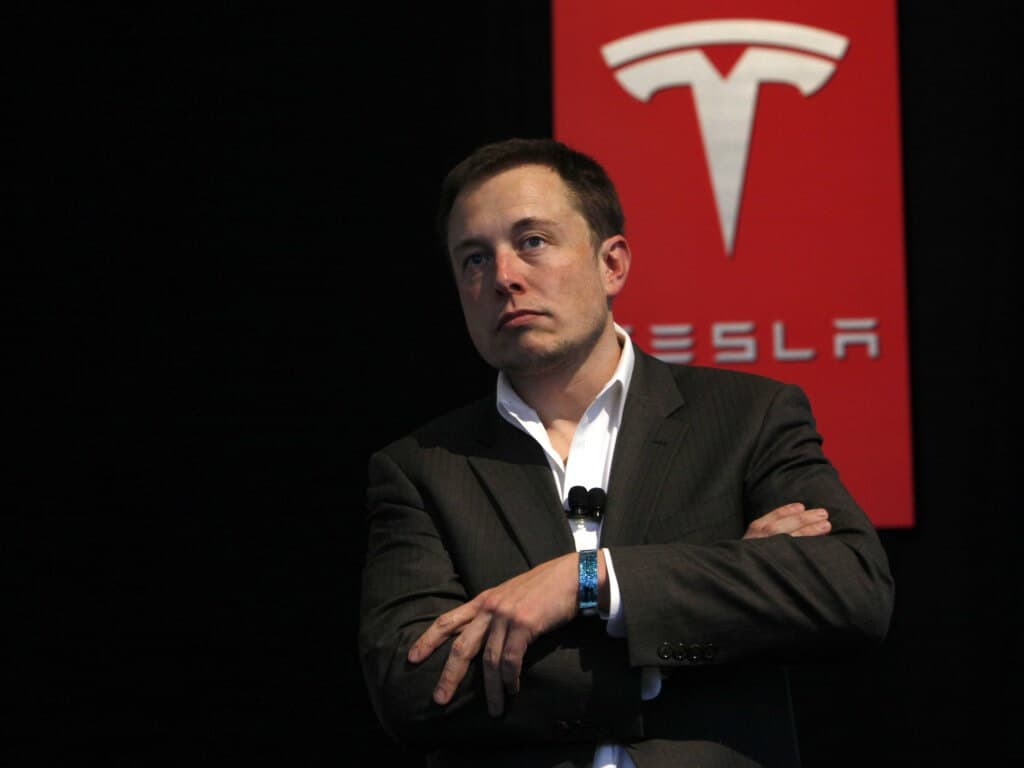

The behavior of Elon Musk, Tesla’s larger-than-life CEO, in releasing sensitive information has been questioned in recent weeks, and the release of sales numbers before the company’s earnings report may give investors another reason to wonder about the carry on of Tesla management. The release of better than expected earnings numbers could be seen as a way for the company to control the news cycle when it has no better news to deliver.

In recent weeks Tesla has made a couple of attempts to stay in the headlines. Elon Musk tweets promised an “end to range anxiety” which the company followed through on with a software update in March. The company has also revealed that a new product announcement will take place at the end of April.

The Tesla Motors Inc (NASDAQ:TSLA) PR department is hard at work seven days out of every week, and the company has certainly gained from their efforts. Whether or not investors become jaded, or sceptical of the stream of information from the company will be interesting to track going forward. Perhaps it all depends on the financials that the company reveals in its first quarter report.

Most analysts remain positive

Though the company isn’t going to release its earnings numbers for another month, the release of the company’s sales figures for the first quarter gives some insight into Tesla Motors Inc (NASDAQ:TSLA) performance in the first three months of the year.

Mr. Lovall’s opinion of the company’s sales numbers are not the mainstream among analysts following the company. Credit Suisse Group AG put a price target of $290 on the company’s shares last Thursday and Goldman Sachs put a target of $214 on the company’s shares last Tuesday, both before the firm’s sales numbers for the first quarter were released.

Baird analyst Ben Kallo reiterated his price target of $275 on the company after seeing the sales numbers. He said that “TSLA remains our favorite pick.” Kallo was also a fan of the release of sales data at the end of each quarter. He said “this is a good decision as it will reduce speculation and erroneous reports of demand during the month between the end of the quarter and quarterly report.”

Pacific Crest analyst Brad Erickson echoed that idea and added that “We continue to believe that TSLA shares have weathered undue pessimism recently on account of oil pricing, woes in China, longer-term competitive concerns and skepticism around execution risk.”

Tesla earnings incoming

Though the majority of anlaysts seem to be positive about the prospects of Tesla Motors Inc (NASDAQ:TSLA) heading into the release of the company’s first quarter earnings report, there are some reservations as delineated by Lovall’s report for Merril Lynch.

Tesla has been a very volatile stock in the weeks leading up to the delivery of its earnings report, but the fact that the company’s release schedule is now knowable may lower the range that the company’s stock trades in this time around.

Lovall’s idea of “very weak” financials is almost definitely going to be realized, however. Elon Musk says that he himself doesn’t expect Tesla Motors Inc (NASDAQ:TSLA) to be profitable until 2020 when the firm is selling around 500,000 vehicles a year. Until then the company’s shares are going to trade on the likelihood of reaching that promised land, a path that most of the analysts following the company have apparently already bought into.

Tesla remains one of the most divisive companies in the United States, and the company’s performance is used as a proxy for many ideological and economic conflicts. None of that really drives the company’s share price, however, only sales and the progress of its other projects are going to do that.

The company’s earning are due the first week of May, but the firm will release information about its newest product line at the end of April. Depending on what that is, it may drive big movements in the firm’s stock price.

Update 15:55 EST: Added clarifying paragraphs 9 and 10 to better explain the nature of any manipulation of sales numbers at Tesla Motors Inc. (NASDAQ:TSLA).

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account