Best Investment Platforms in the UK for 2024

Finding an investment platform that’s worthy of your trust and offers plenty of options for beginner and advanced investors alike can be difficult.

To make the process easier, this guide highlights some of the best investment platforms. We’ll walk you through what features allow each of them to stand out, plus explain what you should be looking for when choosing an online broker for you.

Best Investment Platform in the UK

Before we take a more in-depth look at investment platforms, let’s take a quick look at two popular platforms available in the UK right now.

-

-

Best UK Investment Platforms for 2024

The number of online brokerages has exploded in recent years. That means you have more choice than ever before and the competition between brokers is more fierce than ever when it comes to choosing an investment platform. So, without further ado, here is the best UK platform for investing.

1. Plus500

Trade commissions have largely fallen by the wayside, but that hasn’t stopped many brokerages from charging an arm and a leg for trades through high spreads. Plus500 is widely renowned for having some of the most competitive spreads on the market. This online investment platform offers generally lower spreads although variable spreads on CFD trades on stock, option, commodity, forex, and cryptocurrency.

To some extent, prices at Plus500 are able to remain competitive by keeping overheads low. You won’t find many research tools available through this investment platform, for example. The technical charts are bare-bones, with few technical studies. While you can set trade alerts, Plus500 doesn’t have a vast amount of financial data or market news to offer stock traders.

For the majority of investors, none of this will be a problem. There are plenty of other free research platforms available, and the money you save with Plus500 can be put towards other tools for improving your investment strategy.

One important thing to note about Plus500 is that all assets are traded with CFDs. That’s a huge plus if you want to trade with leverage, as this platform allows you to take on trades at margins of up to 300:1. If you’re planning to invest in stocks, you’ll want to be aware that you’re not eligible for dividends when trading shares and stock CFDs.

- Assets: Stocks, ETFs, Options, Cryptocurrencies, Forex, Commodities (all as CFDs)

- Demo Account: Yes

- Trade Commissions: No

- Research Tools: Basic charts

- Minimum deposit: £100

Our Rating

Sponsored ad. 80.5% of retail CFD accounts lose money.What Should You Look for in an Investment Platform?

Now that you know more about our favourite UK investment platforms, it’s time to think about what you really need out of your broker. Brokers vary quite a bit in what tools and features they offer, and these differences can have a major impact on your investing success. So, let’s take a look at the most important factors you should consider when choosing an investment platform.

Asset Classes

A good place to start when deciding which investment platform is suitable for your needs is to look at what asset classes each platform offers. Almost every online broker includes stock trading, but not every broker gives you access to major exchanges around the world. That’s important, since growth prospects for companies listed on the London Stock Exchange may be very different from those for companies listed on the Tokyo or Hong Kong exchanges.

Illustrative Prices

In addition, there’s a whole world of investing beyond the stock market. Forex trading and commodities trading are potential ways that you can differentiate your portfolio so you’re not relying entirely on corporate growth to drive gains over time. At the same time, an increasingly large number of brokerages are now offering cryptocurrency investing in a handful of the most popular digital currencies.

On top of thinking about what assets are available, it’s also important to consider how your broker will allow you to trade them. Some investment platforms allow you to directly own stocks and cryptocurrencies. This is good for long-term investors since you’re eligible for dividends if they’re paid out and there are no fees associated with simply holding your assets for months or years.

If you trade with CFDs, you don’t actually own the underlying asset, instead, you’re only speculating on the price. This is generally good for forex and commodities, since taking ownership of foreign currency or barrels of crude oil comes with quite a few headaches. CFD trading can also be good for stock traders since you can trade with leverage when using CFDs, and thus free up money for additional positions. But, if you’re holding stocks for the long term, you may find yourself paying monthly fees to automatically roll over your contracts from month to month.

Technical Research Tools

Another factor to consider when choosing an investment platform is whether they offer tools to help you research assets and develop a profitable trading strategy. Most brokers include some form of technical charts, which form the basis of stock, currency, and commodity price analysis. But, the quality and depth of these charts can vary widely.

Illustrative Prices

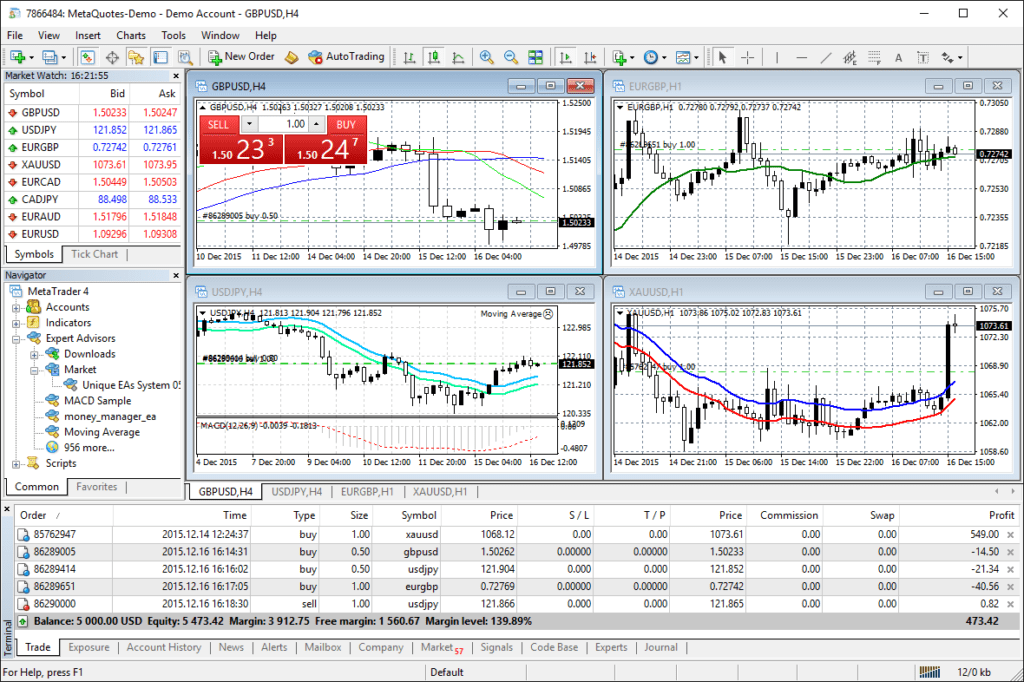

In general, charts that offer more technical studies, the ability to create custom indicators, and backtesting features are better for analysing assets. Some brokers give all clients access to MetaTrader 4, which is the gold standard software for technical analysis. Of course, beginner investors might not always be thrilled about having more complex tools at their disposal. In that case, you might be better off choosing an investment platform that focuses just on the essentials.

If you trade based on fundamental rather than technical indicators, it’s just as important to have access to the data you need to draw conclusions about your investments. Corporate financial data and filings are included for free at many brokerages, but you may have more difficulty finding detailed currency and commodity reports. Be sure to check what different brokers offer in this respect before committing to an investment platform.

Social Trading

While not essential, social trading features can also contribute to your decision to opt for one investment platform over another. Social trading is particularly useful for entry-level investors since interacting with other investors gives you a chance to learn the ropes. For example, you can quickly pick up on successful trading strategies through copy trading or find out why other traders do or do not like a particular asset by reading through discussion boards.

In that sense, social trading features can also contribute to your research. Discussion boards offer an easy way to gauge investor sentiment around a company or asset. Meanwhile, following other traders’ positions can help you pick up on unique technical combinations that you can then integrate into your own trading strategy.

Low Fees

No discussion of investment platforms is complete without talking about fees. Thankfully, flat trade commissions have largely disappeared from online brokerages. If you do find an investment platform that’s still charging a flat fee every time you make a trade, it’s probably a good idea to steer clear.

That said, investment platforms still make money every time you trade through the spread. This is the difference between what you pay for an asset and what the seller receives for selling it. Spreads can vary widely between brokers, so it’s worth taking a close look at what’s being charged for different types of assets. For example, spreads at Plus500 are often less than 0.1%.

In addition, you’ll want to look carefully at what other fees your investment platform might charge you. Most brokers don’t have a monthly subscription fee for data, but you do have to place at least one trade every month or two to avoid inactivity fees. Some brokers also charge deposit or withdrawal fees, which can add up over time. If you’re trading CFDs, watch out for fees associated with holding leveraged positions overnight or with rolling over contracts from one month to the next.

Conclusion

Finding an investment platform is an important part of succeeding as an investor. The right platform ensures that you have the tools you need to trade profitably and to diversify your portfolio. FCA-regulated brokers are also trustworthy and won’t slowly drain your account balance with hidden fees.

FAQs

How much do brokerages charge through the spread?

The amount that brokerages charge using spreads varies widely between platforms and across asset classes. We’ve seen spreads that are well under 0.1% on stocks and bonds at low-cost brokerages like Plus500. We’ve also seen spreads that are as high as 0.5% on some lesser traded commodities like oranges.Will my brokerage roll over my CFD contracts automatically?

CFD contracts come with an end date, which is usually the end of the month that the contract was issued during. But, you typically don’t have to worry too much about this end date. Most investment platforms that offer CFD trading will automatically roll over your open contracts into contracts for the next month at no cost and without any action on your part.Do any UK investment platforms offer mobile apps?

Many UK investment platforms, offer mobile apps. You can often access most of the same features, including MetaTrader 4 charting tools when using their mobile app.What can I do if the investment platform I want doesn’t offer research tools?

If your preferred investment platform doesn’t offer the research tools you need, don’t worry. There is a huge number of third-party stock, commodity, and forex research platforms that you can turn to for help. Some of these are free, while others require a licence or subscription to use.Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

Scroll Up