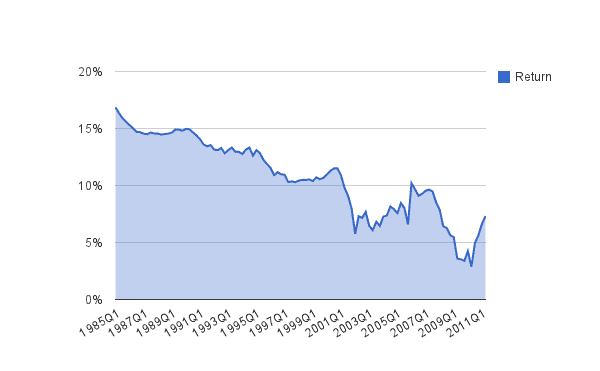

While peer to peer investing has only been around for a few years, business have obviously been lending money to individuals for quite some time. From 1986 to 2011, the average return for credit card lending exceeded 10.5% based on Federal Reserve data.

Credit Card Lenders Average Annual Return

This return is based on two numbers

- The average interest rate charged on credit card loans

- Charge-offs, which is the amount of debt that was not paid by the borrower.

If you subtract the charge-off rate from the interest rate, you get a baseline return. As the Fed data above does not factor in credit card fees and late penalties, the actual return on the loans was even higher.

Up until peer to peer investing was invented, it would have been difficult for income investors to get access to this investment.

Mr. Joseph Toms, the Chief Investment Officer of peer to peer investing company Prosper, suggests that over 80% of this debt is held directly on the books of 10 large US Banks. The implication is that unlike mortgages, which banks often sell to other investors, credit card debt is so profitable that the banks like to keep the loan on their books.

Peer to peer investing company Prosper and its main competitor, Lending Club , are opening up the market for investing in unsecured consumer debt to individual investors as well. Mr. Toms estimates the potential size of the P2P investing market to be $1.2 Trillion: $800 Billion in credit card debt and $400 billion in installment loans. Currently the main peer to peer investing companies originate around $1 billion in loans per year. As this is only a fraction of a percent of the overall market, there is lots of room for growth.

From a borrower perspective, there are major differences between a Prosper loan and using a credit card to pay for a purchase. The borrower in a Prosper loan is taking a loan for a fixed amount, on average around $7,500, and agreeing to make a fixed dollar monthly payment over a 1, 3 or 5 year period. Payments include both interest and principal. The payments are calculated so that at the end of the term the loan has been 100% paid back, and there is no additional money due.

Both peer to peer lending sites enable investors to open accounts with a minimum of $25, which is also the minimum investment you can make in one of the loans. Although this is the peer to peer investing minimum, a much larger amount is recommended in order to provide diversification, and maximize investment performance. Assuming 1 in 20 loans stop making payments, purchasing a portfolio of loans dramatically lower the chance that an investor will have more than 5% of their loans go bad. Investing $25 in 100 different loans would suggest a minimum account size of $2,500. Both companies offer services that automatically spread your investment out among many loans, based on the size of your investment and risk preferences.

So far there appears to be relatively slow consumer adoption of the peer to peer investing side of the product. Prosper states that they currently have around 15,000 retail investors using the platform with an average loan portfolio of $4,000 to $5,000. Why are these numbers so low? Two potential reasons: When the P2P investing was first launched (2005-2009) peer to peer loan returns were negative. Launching into a recession was not the best of timing. Add to this stigma associated with unsecured consumer debt, and investors have been cautious.

Are investors right to be cautious about P2P investing?

I think the market for peer to peer investing has greatly improved since 2009, and peer to peer returns on average should approach the 10.5% + historical levels enjoyed by banks on credit card debt. The tools offered by both companies to evaluate potential loans are fantastic. Investors can see the borrowers credit-score, the amount of credit available to the borrower from other sources, and the amount of money that they are borrowing compared to their income. More importantly, I think the Prosper and Lending Club

are now setting borrowing rates at appropriate levels to insure that investors get a good return.

More Articles On P2P Lending

Prosper vs. Lending Club Comparison

Does Prosper Or Lending Club Offer Better Returns On P2P Loans

P2P Loans: 10% Returns On Average For The Last 26 Years

Top 5 Peer to Peer Lending Sites for Investors

Articles From P2P Expert – Peter Renton

Peter Renton on P2P Lending: Are You Asking the Right Question?

What are the Risks People Associate with Peer to Peer Lending?

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account