Treasury Bonds | How to Analyze, Compare, and Buy Treasury Bonds

The bonds market is a multi-trillion-dollar trading arena. Not only does this include savings bonds and corporate bonds issued by blue-chip companies, but also bonds backed by governments. More specifically, Treasury Bonds are issued by central banks like the Federal Reserve in the US and the UK’s Bank of England.

By purchasing a Treasury Bond, you will be paid a fixed rate of interest until the bonds mature. This allows you to earn passive income that is virtually risk-free. You also have the option of deciding how long you wish to lock your money up for, with bond terms usually starting from 6 months, going all the way up to 100 years.

With that said, there’s much to learn about Treasury Bonds, as they are somewhat more complex in comparison to stocks and shares. We would suggest reading this comprehensive Treasury Bonds Guide. Not only will we explain the ins and outs of how Treasury Bonds work, but we’ll also show you how you can buy some today.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What are Treasury Bonds?

In a nutshell, Treasury Bonds are issued by governments as a way to raise money. This is typically to help pay for key government services that it can not fund itself. Once a government issues bonds, it will then sell them to investors, including big banks and financial institutions, as well as everyday retail investors.

In return for investing in Treasury Bonds, you will receive interest. This is usually paid on an annual or bi-annual basis, and the interest is fixed. In terms of getting your original investment back, you will get this when the Treasury Bonds mature.

Before we go any further, it’s probably best that we give you a quick example of how a Treasury Bond investment might work.

Example of a Treasury Bond Investment

- You invest $1,000 into US Treasury Bonds

- The bonds have a maturity term of 5 years

- The bonds pay a yield of 2% per year

- This means that you receive $20 in interest payments each year

- At the end of the 5-year term, you get your original $1,000 back

As you can see from the above example, you invested $1,000 into US Treasury Bonds that pay 2% per year in interest. This means that you would have received five annual payments of $20, taking your total yield to $100. You’ll also notice the original investment of $1,000 was locked-up until the term concluded, which was five-years. In some cases, you won’t be able to sell your bonds before they mature.

How do Treasury Bonds Work?

In order to understand how Treasury Bonds work, you need to have a firm grasp of two key terms – the yield and maturity date. These two terms will dictate how much money you will make from your investment, and how long you will need to wait before you get your original investment back.

Treasury Bond Yields

Let’s start with the yield. Like any investment, Treasury Bonds will always come with a yield. For those unaware, this is the amount of interest that you make on an investment, and it is always expressed as a percentage. For example, if the yield on a bond pays 5% and you invest $5,000, you will make $250 per year (5% of $5,000). It makes sense that you target Treasury Bonds with the highest yield, as this will allow you to make more money.

This is the case with all investment products, the higher the yield, the higher the risk. For example, a 50-year Treasury Bond will have a much higher yield than a 6-month bond. This is because the risks of default are greater as the issuer requires more time to repay the money. As noted earlier, the vast majority of Treasury Bonds will pay a fixed rate of interest. This means that you always know how much money you are going to make on your investment.

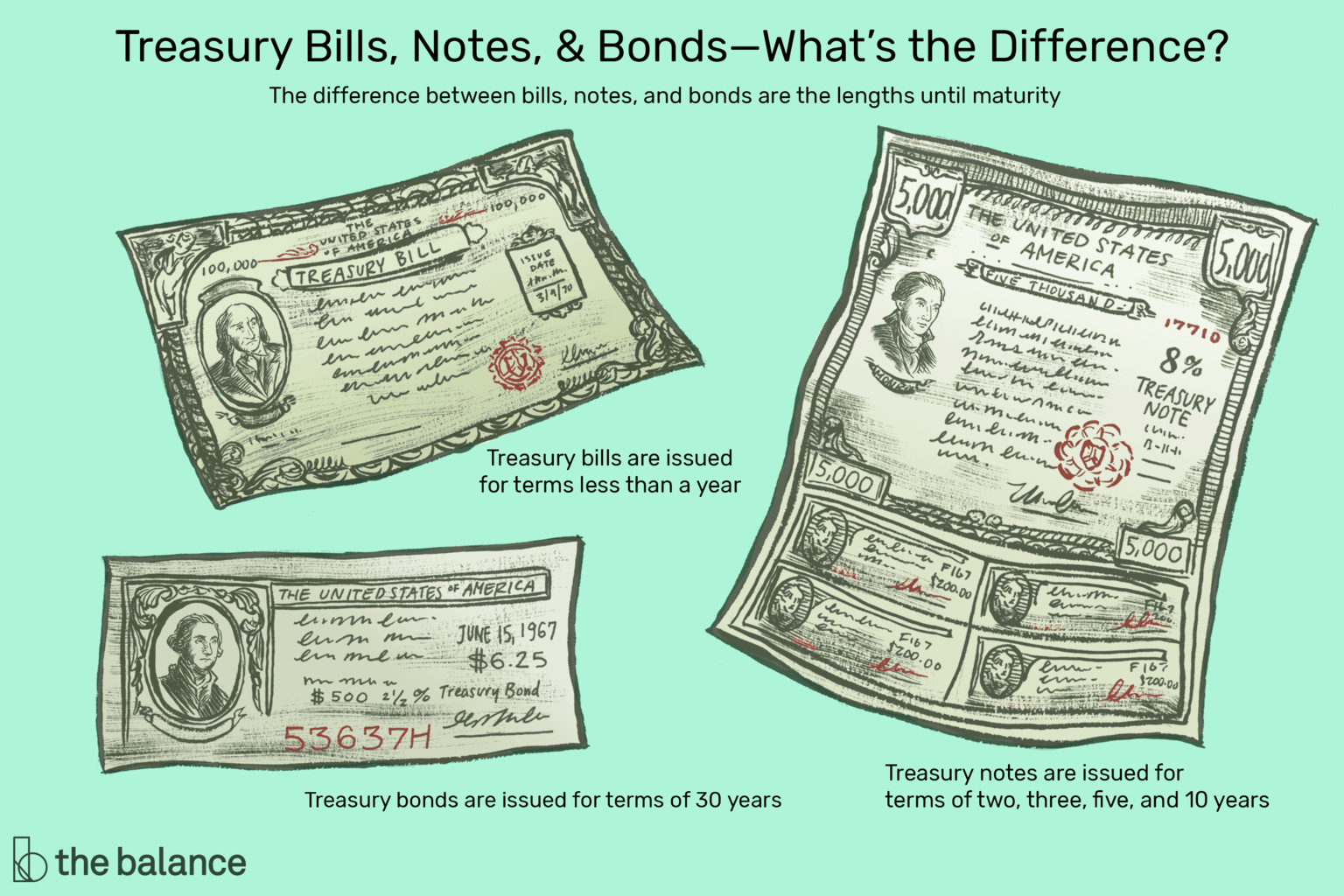

Treasury Bond Maturity

So now that you know what the yield is, let’s explore how the maturity works when buying Treasury Bonds. When governments like the US issue bonds, they will set a maturity date. In Layman’s Terms, this is the length of time in which the government needs to borrow the funds. For example, if you buy Treasury Bonds at a term of 10-years, this means that you will receive your principal back in 10-years time.

Sticking with the same example of a 10-year Treasury Bond, you would receive interest payments during the course of the term. If the bonds pay-out annually, this means that you will receive 10 fixed interest payments, and then the principal amount at the end of the 10-year term. As we cover in more detail further down, the longer the maturity date, the more risk that comes with the investment, but you’ll usually be paid a higher yield.

How Much do Treasury Bonds Pay?

The amount of yield that Treasury Bonds pay will ultimately depend on the underlying risk. This is based on two key factors; the government issuing the bonds, and the length of the term. For example, if the bonds are being issued by the US government, and the term is for 2-years, then the risk is super-low which means that the yield will also be low. At the other end of the spectrum, 20-year Treasury Bonds issued by the government of Turkey would be ultra-risky, so the yield on offer would be a lot larger.

Below we have outlined some examples of Treasury Bond yields. These are based on prices at the time of writing.

US Treasury Bond Yields

US Treasury Bonds offer good value if you’re looking to earn passive income in a virtually risk-free manner. This is because the bonds are backed by the Federal Reserve. The key point is that were the US government to experience a short-fall in cash reserves when it comes to repaying investors, it would simply print more money.

- 6-months: 1.54%

- 2-years: 1.42%

- 5-years: 1.41%

- 10-years: 1.57%

- 30-years: 2.01%

In order to get the highest yield at 2.01%, you would need to enter into a 30-year term. However, the US dollar is the strongest currency in the world, so you wouldn’t be required to hold on to the bonds for the full term if you wanted to offload them. Instead, you could sell them on the open marketplace.

UK Treasury Bond Yields

UK Treasury Bonds are commonly referred to as ‘Guilts’. They work in exactly the same way as US Treasury Bonds, but they are backed by the UK’s Bank of England. Although the pound sterling is less demanded in comparison to the dollar, it’s still a very strong currency. As such, the risks of default are virtually zero.

- 2-years: 0.51%

- 5-years: 0.46%

- 10-years: 0.60%

- 30-years: 1.08%

With that said, the yields on UK Treasury Bonds are really low at the moment. As you can see from the above, you’ll need to invest in a 30-year term just to get your yield above 1%.

Japan Treasury Bond Yields

Japan has one of the strongest economies in the world, which is why its bonds have always come with an unattractive yield. However, Japan Treasury Bonds are in an unprecedented situation at present, insofar that they are paying a negative yield, which means that you will lose money by investing in some of the shorter term Japanese bonds.

- 2-years: -0.16%

- 5-years: -0.16%

- 10-years: -0.06%

- 30-years: 0.23%

So that beggars the question, why would anybody in their right mind choose to invest in a financial instrument that loses money? The answer to this is that the Japanese government is trying to discourage people from hoarding money. Instead, they want to boost the economy by motivating people to invest in the private sector, such as stocks and shares.

Types of Treasury Bond Investments

There are typically two different types of investments that you can make when buying Treasury Bonds. This includes the traditional method of simply buying them directly from the issuer in question. For example, you might decide to buy T-Bills directly from the US Treasury website, or UK Guilts from the Debt Management Office. Alternatively, you also have the option of investing in a Treasury Bond ETF.

Let’s break down how each bond type works, alongside its pros and cons.

Buying Treasury Bonds Direct From the Issuer

If you’re looking to invest in Treasury Bonds in the traditional sense, you will need to purchase them directly from the respective issuer. This gives you 100% ownership of the bonds, meaning that you will be entitled to receive interest on your investment. This also allows you to sell the bonds before they mature, if a marketplace exists.

Not all governments allow you to purchase bonds directly, and you might need to be a resident of the country in question. For example, if you’re not a US citizen, you won’t be able to buy T-Bills directly from the Treasury website. Instead, you will need to use a third-party broker, which might come with an additional fee.

- You can often buy the bonds directly from the government that issued them

- You own the bonds 100% outright

- You are entitled to receive interest payments until the bonds mature

- You might be able to sell the bonds before they mature if a marketplace exists

- You will always receive a fixed yield of interest

- Offloading your shares before maturity is not always a straightforward process

- Buying directly from the issuer is usually only available to residents of the country in question

- If you need to use a third-party broker to buy the bonds, this could be costly

Treasury Bond ETFs

The second option that you have available to you is to invest in a Treasury Bond ETF (Exchange-Traded Fund). For those unaware, an ETF allows you to invest in an asset, or group of assets, without owning the underlying instrument. Instead, they merely allow you to speculate on which way the asset will go in the financial markets. In the case of a Treasury Bond ETF, you will not own the bond and you won’t be entitled to any interest yields.

The purpose of investing in a Treasury Bond ETF is to speculate on the future price of the bond. Although bond yields are fixed, the value of the bond will go up and down in the open marketplace. The specific price increase/decrease is based on market forces, so if the economy of the issuer is performing well, the price will go up, and visa-versa.

Treasury Bond ETFs are great if you want to gain exposure to a particular economy, but don’t want to have your funds locked away. ETFs also allow you to go ‘short’, so you can speculate that the value of the bonds will go down.

- Speculate on the future price of Treasury Bonds without owning the asset

- You can sell the bonds whenever you want

- No requirement to lock your money away

- Gain exposure to Treasury Bonds that would otherwise be difficult to buy

- ETFs also allow you to go short, so you can speculate on the bonds going down in value

- You won’t own the underlying bond, so you won’t be entitled to interest payments

- Not suitable for those wishing to earn passive income

- Most brokers charge an annual fee to invest in ETFs

How do I Buy US Treasury Bonds?

Do you like the sound of what US Treasury Bonds offer for your long-term investing goals, and want to make a purchase today? If so, we would suggest following the step-by-step guidelines outlined below.

Step 1: Visit the US Treasury Office Website

You will first need to head over to the US Treasury Office website and register an account.

Step 2: Enter Personal Information

You will now need to provide some personal information. This will include your first and last name, home address, telephone number, date of birth, and your social security number.

Step 3: Choose Bond Yield and Term

Once your account is set up, you will then need to choose the specific Treasury Bonds that you want to invest in. This starts from just 6-months, up to a maximum of 30-years. Although the US government has issued a 100-year term, this is only available to institutional investors.

Step 4: Select Size of Investmentment

When buying Treasury Bonds directly from the issuer, you will need to purchase them in increments of $100 bills. As such, enter the amount that you wish to buy.

Step 5: Make Payment

Finally, you will need to enter your payment details to complete the purchase. Once you do, you will own the bonds outright. You will then be entitled to annual interest payments, which will be paid directly into your account.

How do I Buy UK Treasury Bonds?

Are you based in the UK and want to invest in UK Guilts? If so, you can do this directly with the Debt Management Office website. Take note, you’ll need to be a UK resident to do this.

Step 1: Visit the UK’s Debt Management Office Website

You will first need to head over to the Debt Management Office website and register an account.

Step 2: Enter Personal Information

You will then be prompted to enter some personal information. On top of your first and last name, home address, and date of birth, you also need to provide your National Insurance number.

Step 3: Choose Bond Yield and Term

You will now need to choose the term of the bond that you wish to buy. This starts at 2-years when buying directly from the Debt Management Office.

Step 4: Select Size of Investmentment

UK Guilts are issued in increments of £100 bills. Select how many you wish to buy.

Step 5: Make Payment

To complete the purchase, you will need to enter your payment details. Once confirmed, you will then own the bonds, meaning that you will receive interest payments until the bonds mature.

How do I Buy Treasury Bond ETFs?

Not a resident of either the UK or US? Or maybe you want to gain exposure to government bonds that are otherwise difficult to reach for non-residents? Either way, you will need to use a third-party broker like eToro to invest in Treasury Bond ETFs.

Step 1: Open an Account With eToro

You will first need to visit the eToro website and open an account. You will be required to enter a range of personal information.

Step 2: Verify Your Identity

In order to remain compliant with anti-money laundering laws, you will need to verify your identity before you can make an investment at eToro. Simply upload a copy of your government-issued ID, such as a passport or driver’s license.

Step 3: Deposit Funds

You will now need to fund your eToro account. The broker offers a variety of payment methods, including debit/credit cards, bank transfer, and e-wallets like PayPal and Skrill.

Step 4: Choose a Treasury Bond ETF to Invest in

Once your account is funded, you will then need to decide which Treasury Bond ETF you want to invest in. Next, you’ll then need to decide whether you want to go ‘long’ or ‘short’. The former means that you believe the value of the bond will increase in the open market, and the latter means the opposite.

Step 5: Place Your Order

To place your order, you will need to enter the amount that you wish to invest. There is no need to purchase or sell bonds in whole amounts, so you can invest as much or as little as you like.

Conclusion

If you’ve read this guide from start to finish, you should now have a firm grasp of what Treasury Bonds are and how they work. As we have discussed throughout our guide, Treasury Bonds come in a range of shapes and sizes. Not only do you get to choose which term and yield you wish to invest in, but you can also expose yourself to Treasury Bond ETFs.

We have also given you a step-by-step overview of how you can buy Treasury Bonds today. Whether that’s US T-Bills, UK Guilts, or Treasury Bond ETFs, you should now have the required tools to make an investment on a DIY basis. Ultimately, just make sure you understand the risks of investing in Treasury Bonds prior to parting with your money.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform