We have multiple guides on how to choose a bond fund here.

Step 1: Passive vs. Active High Yield Bond Funds?

There are two types of high yield bond funds. Those that are passively managed which are also referred to as “Index Funds”, and those that are actively managed. The goal of a passively managed bond fund is to match the performance of an index as closely as possible. The goal of an actively managed bond fund is to beat the performance of an index.

The argument is stronger for actively managed funds in the high yield bond fund category. Many junk bonds do not trade very actively, making the market for those bonds much less liquid and less efficient than the market for investment grade bonds. This makes active management more valuable because a fund manager can avoid bonds which are trading at a price that is higher than the “true value” of the bond because of lack of buyers and sellers of that bond. This situation can also present opportunities that an active manager can take advantage of where a bond is trading at a price that is below its true value because a seller of the bond is having trouble finding buyers.

If you are not sure which option is best for you, read our article on the advantages of passive vs. active bond funds.

Step 2: High Yield Bond ETFs or High Yield Bond Bond Mutual Funds?

The large majority of popular Bond ETFs are passively managed. The large majority of Bond Mutual Funds are actively managed, however there are passively managed bond mutual funds as well. If you are not sure which option is best for you then read our articles on bond mutual funds vs. etfs, and are bond etfs really cheaper?

Step 3: How Much Credit Risk do You Want to Take?

High yield bond funds give you a higher yield because they are investing in bonds that are below investment grade. As you can see in our credit ratings table however there are 13 ratings below investment grade. This means that your high yield fund can range from risky to very risky depending on the credit quality of the bonds that it is holding. (Don’t know about credit risk? Go here.)

The default rates for high yield bonds are also much more sensitive to changes in economic conditions than investment grade bonds. During times of economic distress the default rates for the lower rated high yield bonds skyrockets. You can read more about this in our article the basics of high yield bond funds and what happens when a bond fund defaults.

(Note: One of the advantages of high yield bond funds is that they are much less sensitive to changes in interest rates than other types of bond funds. With this in mind interest rate risk is not generally a focal point with these funds, however I am mentioning here in case you have read our articles on other types of bond funds where it is mentioned.)

Step 4: Setup Your Screen

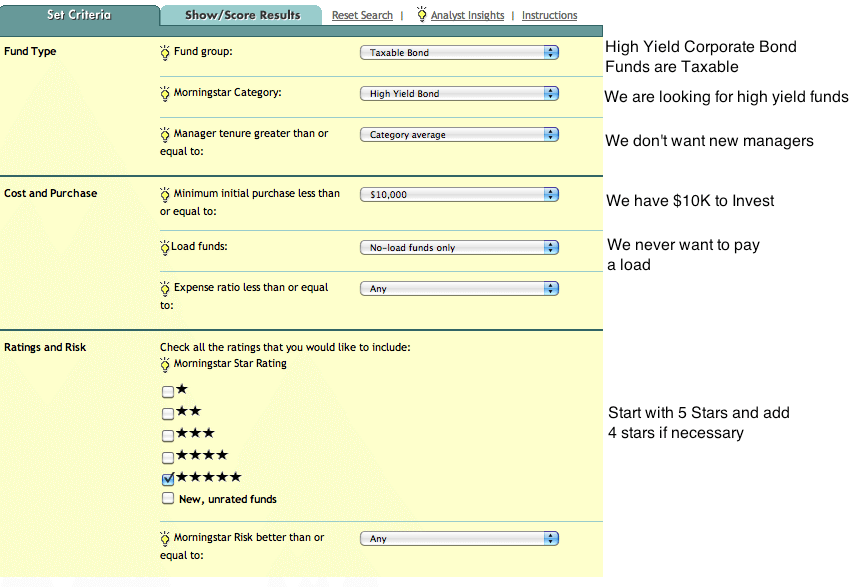

This step is best explained with an example. For this example lets say I have gone through the above steps and decided on Actively Managed High Yield Mutual Funds for my investment. I have $10,000 to allocate to a high yield bond fund initially.

To create the shortlist we recommend using Morningstar.com’s free mutual fund screener which you will find here. While the screener provides many options, we will focus on a few key ones and leave the rest blank. In this instance here are the settings we would use. For an in depth explanation of our bond mutual fund screener settings rational go here.

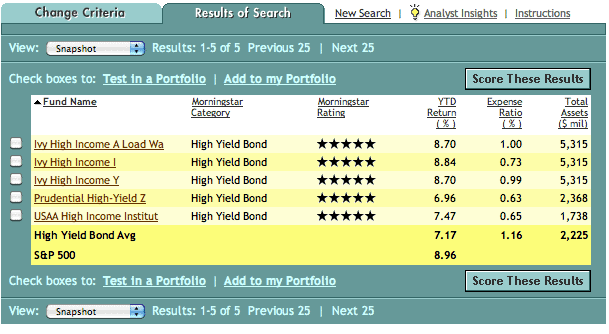

Below is a screenshot of what comes back after we hit the show results button at the bottom of the above screen.

As you can see the screen came back with 5 funds, however the top 3 are different share classes of the same Ivy High Income fund. (If you are not familiar with share classes go here) Normally difference between share classes are the size of the expense ratio and/or the load that the fund charges and the minimum account size.

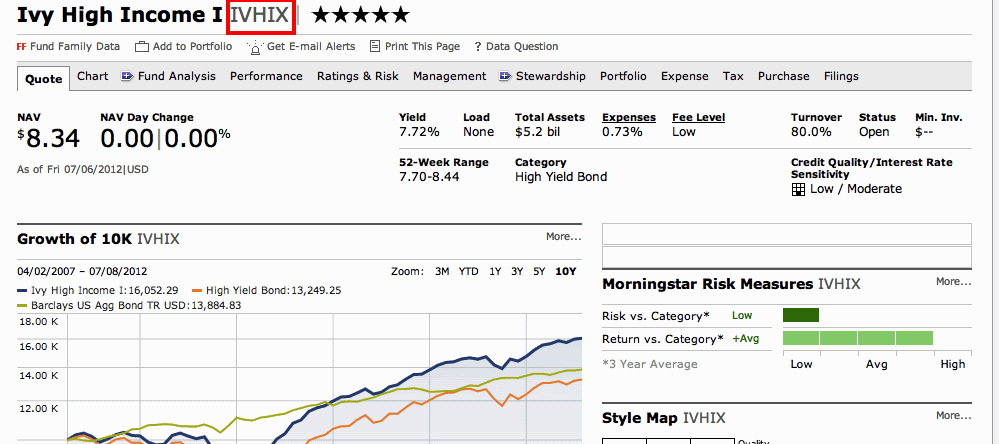

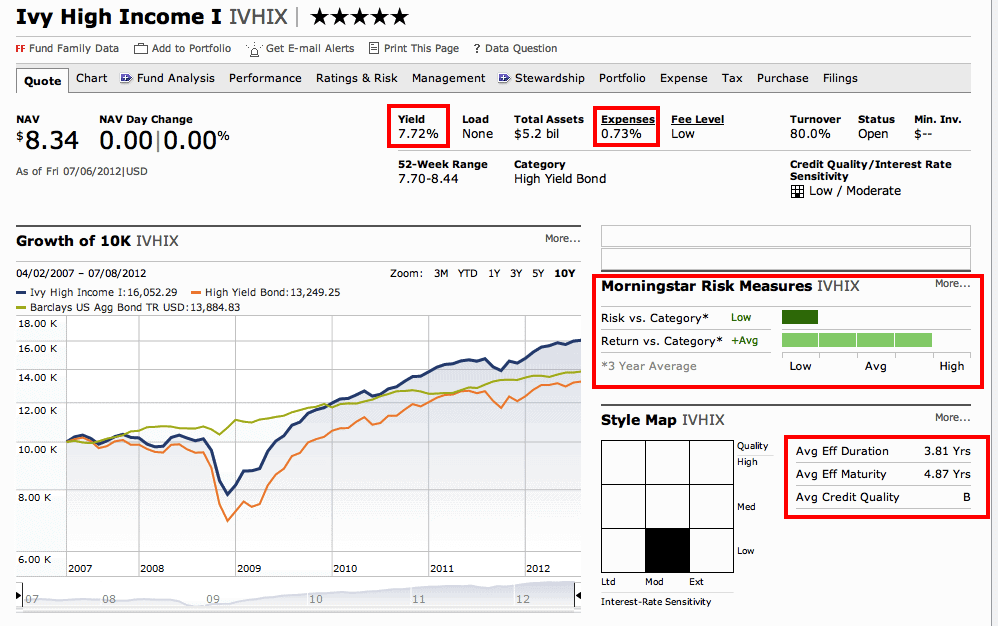

In this example we have screened for no load funds with minimums under $10,000, so we now want to choose the share class with the lowest expense ratio. As you can see by looking in the “expense ratio” column above the Ivy High Income I fund has the lowest expense ratio. Click on that fund as well as the other two funds in our shortlist and write down their ticker symbols from the quote page. It looks like this:

This gives me the ticker symbols for the three funds in my shortlist:

Ivy High Income I – IVHIX

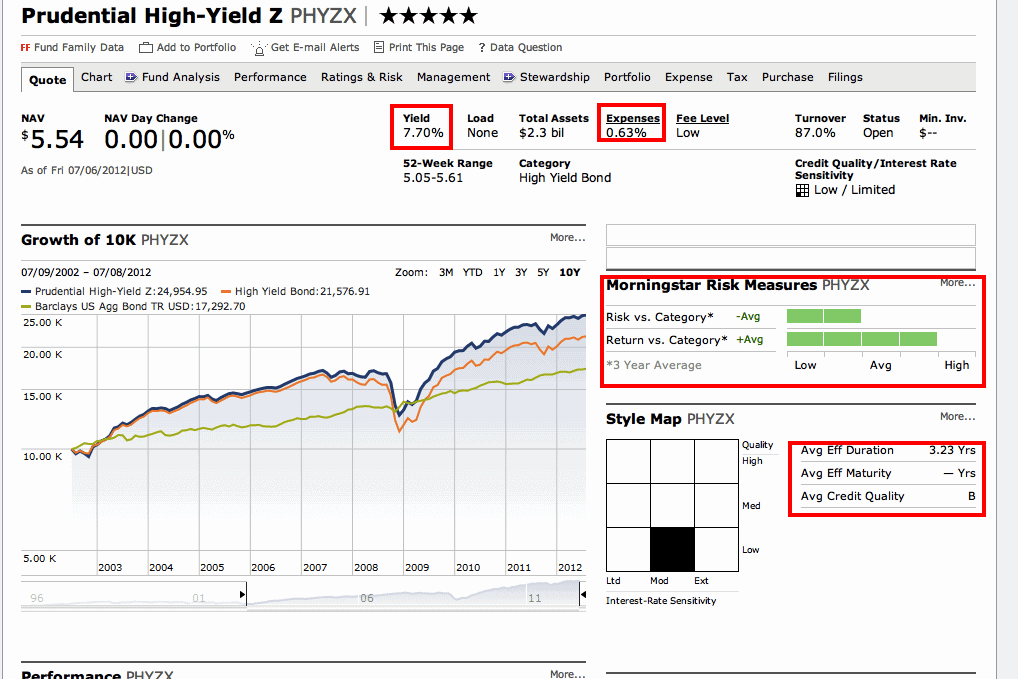

Prudential High Yield Z – PHYZX

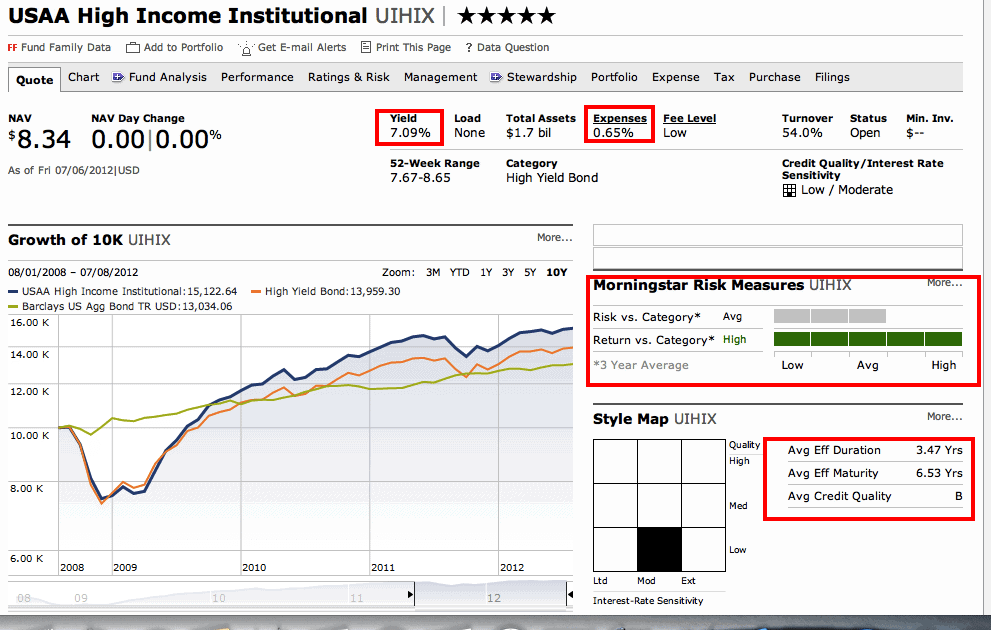

USAA High Income Institutional – UIHIX

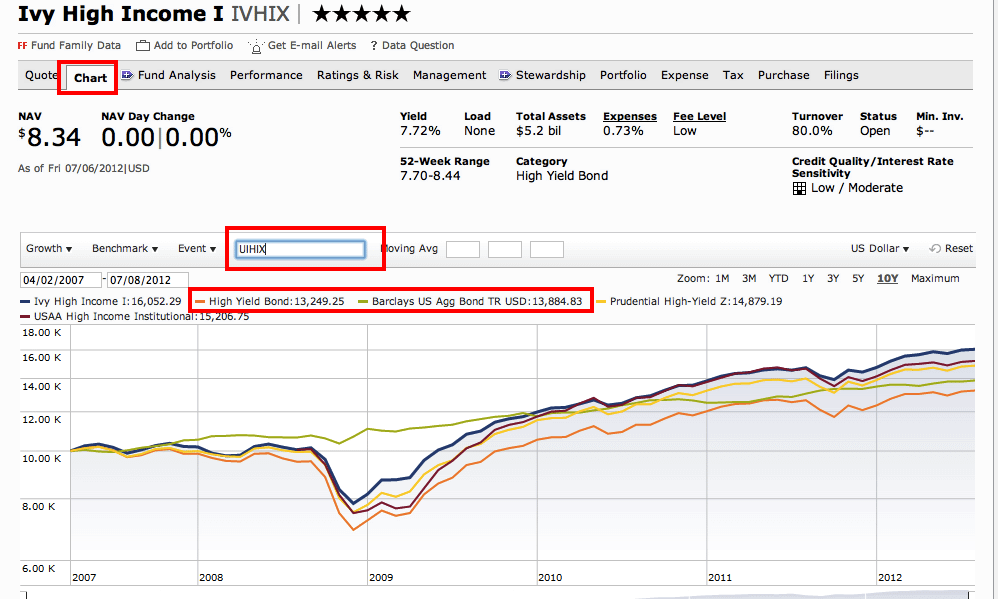

Step 5: Compare Performance

Enter the quote for the first fund into the quote box at the top of the morningstar page which will bring you to the quote page for the fund. Then click the “chart” tab at the top and enter each of the symbols from the above list int the the “compare to symbol” box at the top of the chart. Then click the x beside the two indexes which will be listed at the top along with the funds so it removes the performance for the two indexes and leaves just the three funds from the short list on the chart. I have highlighted where to do this as well as what the chart looks like after following this step using the funds in this example:

Now that we see what the growth of a $10,000 investment made 10 years ago would look like there is one fund, the Ivy High Income I fund that has consistently lead the pack over the last 10 years. Lets go to the quote page for this by entering its ticker into the quote box at the top of the page and then do the same thing for the three other funds on the list:

Step 6: Choose your Fund

Normally after finishing this process there are still significant differences between the funds on my shortlist. In this example however we have three very similar funds all with around the same expense ratio, yield, average duration and credit quality. The only two things that really stand out are both in relation to the Ivy High Income Fund which:

1. Had slightly better performance than the other two funds on my shortlist

2. Accomplished that performance with less risk (as you can see in the “morningstar risk measurement boxes in the screenshots above).

So in this instance while I think any of these three funds would be a fine pick I am going to go with the Ivy High Income Fund.

Still not sure about how to choose a high yield bond fund? Hit us up in the comments section. For more information on bond mutual funds and ETFs visit the bond funds section here at Learn Bonds.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account