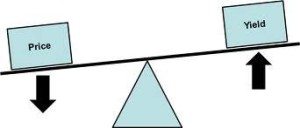

Given the 30-year “bull run” that bonds have experienced, many investment strategists are urging caution on buying/holding fixed-income securities. The commonly held belief is that rates will trend higher, spelling problems for those that own bonds. While there may be a general “risk” to owning bonds in a rising rate environment, the peril is generally quite different from the hazards endemic to the stock market.

1) The holder is forced into selling before maturity and may have to accept a price that is much lower than purchase.

2) The holder suffers “opportunity cost” by holding a bond with a much lower coupon than becomes available from the same issuer as borrowing costs rise.

What Is Opportunity Cost?

According to Investopedia, opportunity cost is defined as the following:

“The cost of an alternative that must be forgone in order to pursue a certain action. Put another way, the benefits you could have received by taking an alternative action.”

So with regard to bonds, the general opportunity cost could be viewed as owning lower coupon bonds when higher coupon bonds become available. Or, one could also see opportunity cost in making the decision to own longer-term bonds, thinking that rates would stay the same or go down, but seeing them in fact go up. In that case, the better decision would have been to own a shorter-term bond and be able to reinvest at a higher coupon sooner as rates rise.

But what do these choices/decisions actually cost an investor and what should you consider in a bond investment strategy? Let’s take hypothetical stock XYZ that offers three bond choices, a 10-year note yielding 4% (8.3 duration), a 30 year note yielding 7 percent (13 duration), and a 5-year note yielding 2.75% (4.7 duration). If immediately after buying one of these bonds, interest rates shoot up 300 basis points, the 10 year bond would lose about 25% of its value, the 30-year bond would lose about 40% of its value, and the 5-year piece would lose only about 14 percent. Obviously an immediate basis point move is not a likely scenario, but it does give one an idea of how rates impact short- and long-term bonds differently.

If rates do, in fact, move higher, the best strategy is to keep duration to a minimum, as you will be able to reinvest matured bonds at a higher rate in the future. If you are stuck holding long-term term bonds, you could be sacrificing a tremendous amount of income by doing so. Of course, despite the drumbeat of the bond bears, rates have not embarked on a protracted upside move. If you decide to own short-term bonds in anticipation of a rate rise that never occurs, you will similarly endure an opportunity cost. This is because you could have been owning higher coupon, longer duration bonds, instead of lower coupon, shorter duration ones.

So while the bond bears like to tell you why not to buy long-term bonds or bonds at all, opportunity cost could really be a double edged sword if you heed their advice and rates stay low for decades.

Strategy Session

Depending on what the goal for your bond portfolio is, you have a number of options. The most agnostic strategy for a cash flow oriented individual bond investors is to develop a bond ladder that possesses a relatively intermediate blended maturity profile. By owning bonds with near-, short-, intermediate-, and longer-term maturities, one can achieve broad diversity that hopefully ever mitigates the need to sell bonds at a loss, even in a rising rate climate. With bonds maturing every year, or couple of years, one does not have to get bogged down into researching, predicting, or guessing what will happen to the bond market.

Other investors might want to get tactical. Today, that might mean shortening up on maturities given relatively lackluster yield on the long-end, with the thought that rates will eventually begin to rise. Of course, as was mentioned above, there could be opportunity cost in doing so, if rates stay low in perpetuity.

In the end, arguably there really is no “right” or “wrong” way to construct a bond portfolio. However, amongst other strategic details, consideration of opportunity cost and how bonds of different maturity/duration can be impacted during different interest rate scenarios should be contemplated before you make your decisions.

About the author:

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account