What are Municipal Bonds?

Municipal bonds are issued by government authorities in the US, but locally. This could be by the state itself, or even at a city/regional level. Although municipal bonds operate in a similar nature to government bonds as you’ll receive a fixed rate of interest until they mature, they are not backed by the Federal Reserve.

This means that the risks of default are much higher, albeit, you’ll likely earn a more attractive yield. In this article, we explain the ins and outs of how municipal bonds work, how you can buy them, the types of yields you should expect, and what risks you need to consider.

-

- Option 1: Using an Online Broker

- Step-by-Step Guide: Buying Municipal Bonds from a Broker

- Step 1: Choose a Municipal Bond Broker

- Step 2: Open an Account and Deposit Funds

- Step 3: Deposit Funds and Purchase Municipal Bonds

- Step 4: Receiving Coupon Payments and Principal

- Option 2: Using a Municipal Bond Fund

- Step-by-Step Guide: Investing in a Municipal Bond Fund

-

- Option 1: Using an Online Broker

- Step-by-Step Guide: Buying Municipal Bonds from a Broker

- Step 1: Choose a Municipal Bond Broker

- Step 2: Open an Account and Deposit Funds

- Step 3: Deposit Funds and Purchase Municipal Bonds

- Step 4: Receiving Coupon Payments and Principal

- Option 2: Using a Municipal Bond Fund

- Step-by-Step Guide: Investing in a Municipal Bond Fund

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What are Municipal Bonds?

In a nutshell, municipal bonds are issued by local government authorities as a means to raise cash. This is typically to fund local projects or help pay for key frontline services. Either way, municipal bonds can be issued at a state, city, or regional level. For example, let’s say that the state of New York needed to raise $300 million to fund a new railway line.

By issuing bonds to investors, it would then be required to pay a fixed rate of interest until the bonds mature. At the end of the term, the state of New York would then be required to repay the $300 million that it borrowed back to its bondholders.

Much like any other bond type currently in the market, municipal bonds always come with a coupon rate and a maturity date. Once the bonds have been issued, they are often available to buy and sell on the secondary markets. The specific yield of the bonds will then go up and down, depending on market forces.

Let’s look at a quick example of how a municipal bond investment might work in practice.

- Your local county issues $250 million worth of municipal bonds, with each bond denominated in $1,000 instruments

- You decide to invest $10,000 so you’ve got 10 bonds

- The coupon rate on the bonds is 6.5% and they mature in 5 years

- This means that you will receive $650 in coupon payments annually for 5 years

- At the end of the 5-year term, you will receive your original $10,000 investment back in full

- Over the course of the term, you would have made $3,250 in coupon payments ($650 x 5 years)

As you can see from the above example, you were able to earn $650 per year in interest payments without needing to do anything. On the contrary, once the municipal bonds were purchased, you were able to enjoy 5 years worth of passive income. This is one of the biggest advantages of opting for municipal bonds, as they are ideal for those of you that have little experience or time to actively manage your money.

Understanding How Municipal Bonds Work

Before investing in municipal bonds you need to have a firm understanding of some key terms. This includes the coupon rate of the bonds, the maturity date, and the underlying risks of default. These three metrics will determine how much money you can make on your municipal bonds, as well as the likelihood of you receiving your original investment back in full.

Municipal Bonds Coupon Rate and Payments

The first thing that investors look at when assessing the viability of a municipal bond investment is that of the coupon rate. In a similar nature to corporate bonds and US Treasury bonds, all municipal bond investments will come with a fixed coupon rate. This is determined by the issuer themselves, and it allows investors to gauge the risks and rewards of the municipal bonds in question.

- The coupon rate is always expressed as a percentage

- For example, if the coupon rate is 4%, this is the amount of interest you will receive on each bond annually until they mature

- The higher the coupon rate, the higher the risk of default

- The coupon rate will never change

In terms of receiving your coupon payments, bond issuers typically distribute this every 6 or 12 months. If it’s the former, this allows you to grow your money faster, as you can reinvest the coupon payments as soon as they are received.

Municipal Bonds Maturity Date

The maturity of the municipal bonds refers to the term of the agreement. For example, if the maturity is 6 years, this means that the state, city, or region has 6 years to repay your original investment. During this time, you will continue to receive your annual/bi-annual coupon payments. In the case of municipal bonds, the maturity can start from just a few years, up to a number of decades.

- Much like a traditional loan, the longer the maturity, the higher the risk of default

- This is because the longer the bonds are outstanding, the chances of the issuer running into financial difficulties increases

- A longer maturity term usually results in a higher yield, which falls in-line with the increased risk levels

- The maturity on the bonds can never change

Although municipal bonds should be viewed as a long-term investment, some investors choose to sell them on the secondary market before the bonds mature. You might get less or more than you originally paid when offloading the municipal bonds before maturity. This is because the running yield will be determined by market forces.

Municipal Bonds Credit Rating

Much like any other investment product in the bond space, the risks are based on the financial strength of those issuing the municipal bonds. For example, if the city issuing the bonds suffers from a large unemployment rate and ever-growing debts, then the risks of default are going to be much higher. At the other end of the spectrum, bonds issued by a region that enjoys a thriving local economy will come with much lower risks.

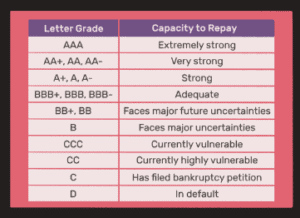

As a newbie investor, you might not have the required knowledge to perform an in-depth risk assessment on a DIY basis. The good news is that municipal bond issuers will be assigned a credit rating by Standard and Poor’s much like national governments do. This allows you to gauge the risks and rewards of the investment prior to parting with your money.

Here’s what you need to know about Standard and Poor’s credit rating system on municipal bonds.

- The credit rating agency will award a letter grade rating from AAA to D

- AAA means that the capacity to repay is ‘Extremely Strong’, while D means that the bonds are already in default

- For bonds that are yet to be issued to investors, a rating of CCC would indicate that the capacity to repay is ‘Highly Vulnerable’

- The ratings employed by Standard and Poor’s will go up and down depending on the financial standing and creditworthiness of the state, city, or region

If you’re looking to invest in super low-risk municipal bonds, then you’ll like want to stick with a rating of AAA or AA+. Take note, the coupon payments will be somewhat low though, which falls in-line with the high-grade nature of the bonds.

Municipal Bonds Yield

We noted earlier that the coupon rate, which refers to the amount of interest that you will be paid on your municipal bonds, will never change. As such, were you to hold on to the bonds until maturity, you would know exactly how much money you are due to make over the course of the term. However, we also noted that some investors will choose to offload the bonds before maturity, in order to do this, investors need access to the secondary markets.

Before we explain how this works, it is important to note that as an everyday investor you will unlikely be able to access the secondary marketplace. This is because bond markets are typically reserved for institutional money, not least because you are required to meet minimum lot sizes. The workaround to this is to use a mutual fund that invests all, or some, of its money into municipal bonds.

Below we explain how the running yield can affect the value of your municipal bond investment.

Running Yield

The running yield refers to the current yield of the bonds available on the secondary market. It will likely be different from the coupon rate, as per market conditions. For example, let’s say that you are holding bonds with a coupon rate of 5%.

If the bond issuer has since run into financial difficulties, it’s likely that the yield will go up. This is because investors need to be compensated for the increased risk levels.

Yields That Increase

Sticking with the same example as above with the yield increasing because the issuer runs into financial problems, this means that you would be required to sell your bonds at a discount. This is because the coupon rate can never change, meaning that the only way you can offload the bonds is to sell them for less than you paid.

Those that purchase the bonds from you will still get the original coupon rate of 5%, albeit, they will get a higher yield because they were able to get the bonds at a discount.

Yields That Decrease

There might come a time where you invest in municipal bonds, and the issuer improves their financial standing. This might be because the local economy is performing better than expected, or because the state has increased its year-on-year tax revenues. Either way, this would be beneficial for you as a municipal bondholder, as you would have the option of selling the bonds at a premium.

For example, let’s say that the bonds come with a coupon rate of 6%. As the risks of default are now lower, new investors should expect a smaller yield, say at 3%. New bondholders will still receive coupon payments at a rate of 6%, although they would need to pay you a premium to make the purchase. In doing so, you would be able to lock-in your profits and cashout your original investment amount.

Are Municipal Bonds Risky? Can I Lose Money?

Irrespective of what you are investing in, there will always be a risk that you can lose money. The risks will vary considerably depending on the type of investment, as well as the issuer behind the asset. Even US Treasury bonds are not 100% risk-free.

Sure, the US government can simply print more money if it encounters a shortfall in cash reserves, but risks still exist. With that being said, the biggest risk that you face when investing in municipal bonds is that of a default. This could be a default on your coupon payments or worse, a default on the principal investment.

Although municipal bonds are issued by government authorities, they are not backed by the federal government. This means that a default is significantly more likely in comparison to US Treasuries and T-Bills. In order to showcase the very real realities of a municipal bond default, one only needs to look at the case of Detroit in 2013.

City of Detroit Defaults on Municipal Bond Obligations

- In July 2013, the city of Detroit filed for bankruptcy to the tune of $18.5 billion

- Of this amount, $7 billion of debt related to outstanding municipal bond obligations

- This resulted in investors losing a considerable amount of money

- While some were able to get 75 cents on the dollar back, others received just 14 cents

The important point to note in the case of Detroit is that the US government did not step in to save investors. As such, if the state, city, or region defaults on your municipal bond investment, you should expect to make significant losses.

Tax Advantages of Municipal Bonds

On top of higher-than-average yields and the chance to earn passive income, municipal bonds are sought after by investors because of their favorable tax treatment. More specifically, any gains that you make from your municipal bond investments are 100% tax-free.

This is in stark contrast to corporate bond profits, which are liable to be included in your capital gains tax return. As such, if you’re looking for a low-risk, high-grade investment product that allows you to enjoy passive income without having your profits diluted by tax, it’s well worth considering AAA-rated municipal bonds.

How do I Invest in Municipal Bonds?

Like the sound of municipal bonds and think that they fit within your long-term investment goals? If so, your options will be somewhat limited as a retail investor. This is because states, cities, and regions will typically issue bonds in large lot sizes, directly to the institutional space. With that said, you can still gain exposure to the multi-trillion dollar municipal bonds market by using a third-party broker, or by investing with a bond fund.

Option 1: Using an Online Broker

If you are looking to buy specific municipal bonds, then you will all-but-certainly need to use an online broker. The broker will have direct access to the municipal bond market, not least because it can meet minimum lot sizes. Once the broker purchases the bond, usually based on client demand, it will then allow members of the platform to make an investment.

For example, the broker might purchase $20 million worth of municipal bonds issued by the state of Virginia. Each bond might come with a face value of $500, which will then allow you to make a purchase on a bond-by-bond basis. If you wanted to invest $2,000, you’d then be in possession of 4 municipal bonds.

- You will need to choose the specific municipal bonds that you wish to invest in

- The broker will only list a select number of municipal bonds on the platform, so you might need to join a broker based on the bonds it has for sale

- You will need to pay a fee to pay to purchase the bonds

- You will likely need to pay an annual maintenance fee for as long as you have the bonds

Step-by-Step Guide: Buying Municipal Bonds from a Broker

Follow the guidelines listed below to invest in municipal bonds with an online broker.

Step 1: Choose a Municipal Bond Broker

You will first need to find an online broker that lists the specific municipal bonds that you wish to invest in. Once you do, you’ll need to look at other metrics before signing up. For example, explore minimum investment amounts, supported payment methods, fees, regulation, and withdrawal times.

Step 2: Open an Account and Deposit Funds

Once you’ve chosen a broker, you’ll then need to open an account. The broker will need to know who you are, so you’ll be asked to enter a range of personal information. This will include your full name, nationality, home address, date of birth, social security number, and contact details.

You will then be asked to verify your identity. This usually requires an upload of your government-issued ID (passport or driver’s license) and a proof of address (bank statement, utility bill, etc.)

Step 3: Deposit Funds and Purchase Municipal Bonds

Now that you’ve verified your account you can proceed to deposit some funds. Most brokers support a bank transfer (ACH or wire), and some even allow you to use a debit/credit card or e-wallet.

Once the funds have been credited, you can purchase your chosen municipal bonds.

Step 4: Receiving Coupon Payments and Principal

Once you’ve purchased the municipal bonds, you will then be entitled to coupon payments. The payments will be made every 6 or 12 months and paid directly into your brokerage account. Once the bonds mature, you will then receive your initial investment back in full.

Option 2: Using a Municipal Bond Fund

The second option that you have available to you is to invest with a mutual fund. The fund will either purchase municipal bonds exclusively or alongside a portfolio of other bond types like corporate bonds and US Treasuries. Funds rarely hold onto municipal bonds until maturity, as they will continuously buy and sell the bonds on the secondary marketplace. This gives you the chance of earning passive income via coupon payments and capital gains.

- Municipal bond funds will typically hold thousands of bonds within its portfolio

- Its bond basket will contain municipal bonds of varying risk levels and maturity dates

- You will receive coupon payments on a monthly basis

- You will be entitled to a share of any capital gains made, which is paid once per year

- You can normally cash out your investment at any given time

Learn More: Read our in-depth guide on how bond funds work.

Step-by-Step Guide: Investing in a Municipal Bond Fund

Prefer to invest with a municipal bond fund as opposed to choosing your own investments? If so, follow the step-by-step guidelines listed below.

- Step 1: Choose a Municipal Bond Fund Provider

- Step 2: Open an Account and Verify Your Identity

- Step 3: Deposit Funds

- Step 4: Receive Your Share of Coupon Payments Every Month

- Step 5: Revive Your Share of Catpial Gains Annually

Conclusion

In summary, municipal bonds are a great alternative to US Treasuries as they typically come with a much higher rate of return. They also come with the added benefit of tax-free profits and by holding onto the bonds until maturity, you’ll get to enjoy a passive income stream. However, municipal bonds are riskier than US Treasuries, as issuers cannot rely on the Federal Reserve in the event of cash flow shortage.

This means that you need to have a firm understanding of the risks before purchasing municipal bonds, much like you would with any other investment type. A good starting point is to assess the Standard and Poor’s credit rating of the municipal bond issuer.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

FAQs

How do I make money with municipal bonds?

You will be paid a fixed rate of interest when you hold municipal bonds. Known as the 'coupon rate', the amount you receive will depend on the financial standing of the issuer.Can I sell my municipal bonds before they mature ?

You might find it difficult to offload your municipal bonds prior to maturity unless you are using a broker that has access to the secondary markets.What is the difference between the yield and coupon rate on municipal bonds?

Although the coupon rate remains fixed until maturity, the running yield will go up and down depending on market forces. This is only relevant if you plan to sell the bonds before they mature.Who issues municipal bonds?

Municipal bonds can be issued at a state, city, or regional level.What is a municipal bond maturity date?

The maturity date on municipal bonds is the length of time that the issuer has to repay your investment back in full. Throughout the term you will receive coupon payments, which is typically paid every 6 or 12 months.Are municipal bonds risk-free?

Municipal bonds are not risk-free, as there is always the possibility that the issuer defaults. This happened in 2013 on the municipal bonds issued by the city of Detroit.How can I check the credit rating on my municipal bonds

Leading credit agency Standard and Poor's issues ratings on municipal bonds. This ranges from AAA to D.Victoria Briano

WARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.

Copyright © 2022 | Learnbonds.com

In a nutshell, municipal bonds are issued by local government authorities as a means to raise cash. This is typically to fund local projects or help pay for key frontline services. Either way, municipal bonds can be issued at a state, city, or regional level. For example, let’s say that the state of New York needed to raise $300 million to fund a new railway line.

In a nutshell, municipal bonds are issued by local government authorities as a means to raise cash. This is typically to fund local projects or help pay for key frontline services. Either way, municipal bonds can be issued at a state, city, or regional level. For example, let’s say that the state of New York needed to raise $300 million to fund a new railway line.  Much like any other investment product in the bond space, the risks are based on the financial strength of those issuing the

Much like any other investment product in the bond space, the risks are based on the financial strength of those issuing the  Irrespective of what you are investing in, there will always be a risk that you can lose money. The risks will vary considerably depending on the type of investment, as well as the issuer behind the asset. Even US Treasury bonds are not 100% risk-free.

Irrespective of what you are investing in, there will always be a risk that you can lose money. The risks will vary considerably depending on the type of investment, as well as the issuer behind the asset. Even US Treasury bonds are not 100% risk-free.