R.R. Donnelley & Sons Company is a global provider of communication services. It has over 60,000 customers, including most of the Fortune 500, solid product diversification, and expected 2014 revenue in the $11.5 to $11.8 billion range. As of June 30, 2014, R.R. Donnelley had $3.428 billion in long-term debt and plenty of CUSIPs trading on the secondary corporate bond market. Based on the combination of price, yield, maturity, and protective provisions, my favorite of the bunch is the April 1, 2024 maturing senior unsecured notes.

The 6.00% coupon, 2024 maturing notes, CUSIP 257867BB6, were recently offered for 99.199 cents-on-the-dollar, a 6.112% yield-to-worst. Additionally, there is a make whole call and a conditional put for a change of control. The put price is 101 cents-on-the-dollar. For further details, please consult the prospectus supplement.

Why might many investors have overlooked the 2024 notes and other R.R. Donnelley bonds? A couple of reasons come to mind. First, R.R. Donnelley senior unsecured notes are rated Ba3/BB- by Moody’s and S&P respectively. This is down from the Baa2/BBB+ ratings R.R. Donnelley senior unsecured notes were assigned nearly six years ago, in early 2009. As the company’s ratings have migrated three notches deep into non-investment grade, there are likely many people who will never come across the notes, because the notes are now considered “junk.” Second, R.R. Donnelley is known for its publishing and printing businesses—businesses going through challenging and changing times.

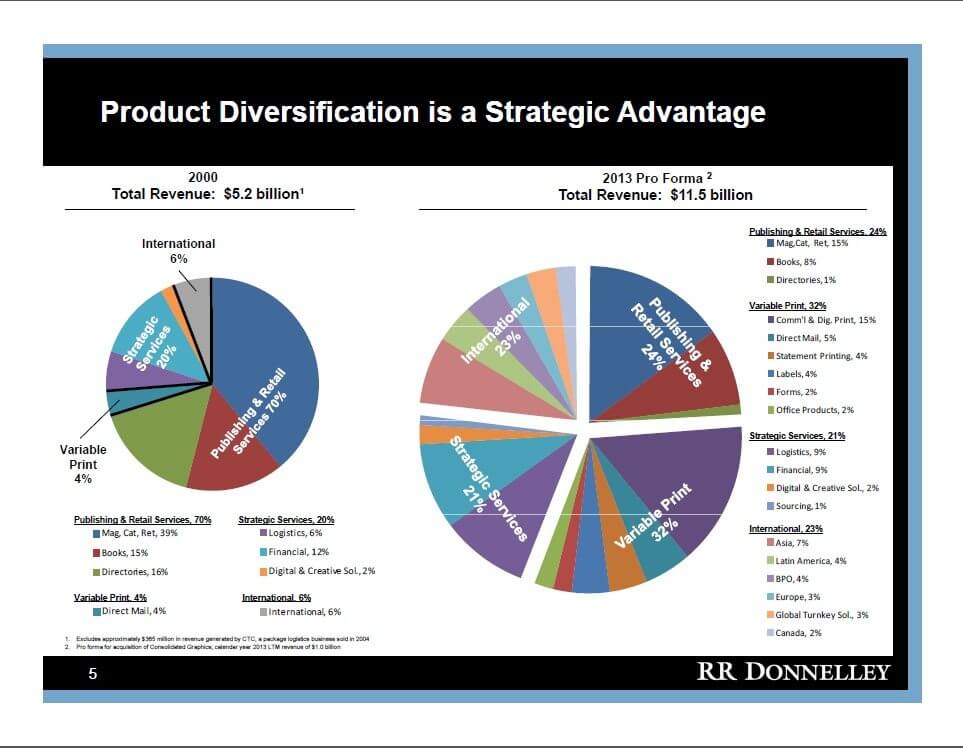

With that said, there are some clear positives worth mentioning. As the following slide from the February 26, 2014 Investor Meeting shows, R.R. Donnelley has been adjusting to its new realities for quite some time. This is evident by its shift in product diversification since the year 2000.

Moreover, (1) the company demonstrated its ability to maintain strong free cash flow during the recent financial crisis, (2) capital expenditures are only in the 2.0% to 2.25% of revenue range, (3) the company recently extended and upsized its existing bank credit facility to $1.50 billion due September 9, 2019, (4) interest expense in the $275 to $285 million range is manageable, and (5) management is aware of the necessity to deleverage. Additionally, as Moody’s recently noted, it is expected that “virtually all of the company’s nearly $300 million of annual post-dividend free cash flow [will be] applied towards debt reduction.” It is also important to mention that Moody’s recent R.R. Donnelley Rating Action (linked above) also said, “our rating presumes more than $900 million of debt repayment through 2016,” and “The rating continues to benefit from the company’s resilient cash flow profile.”

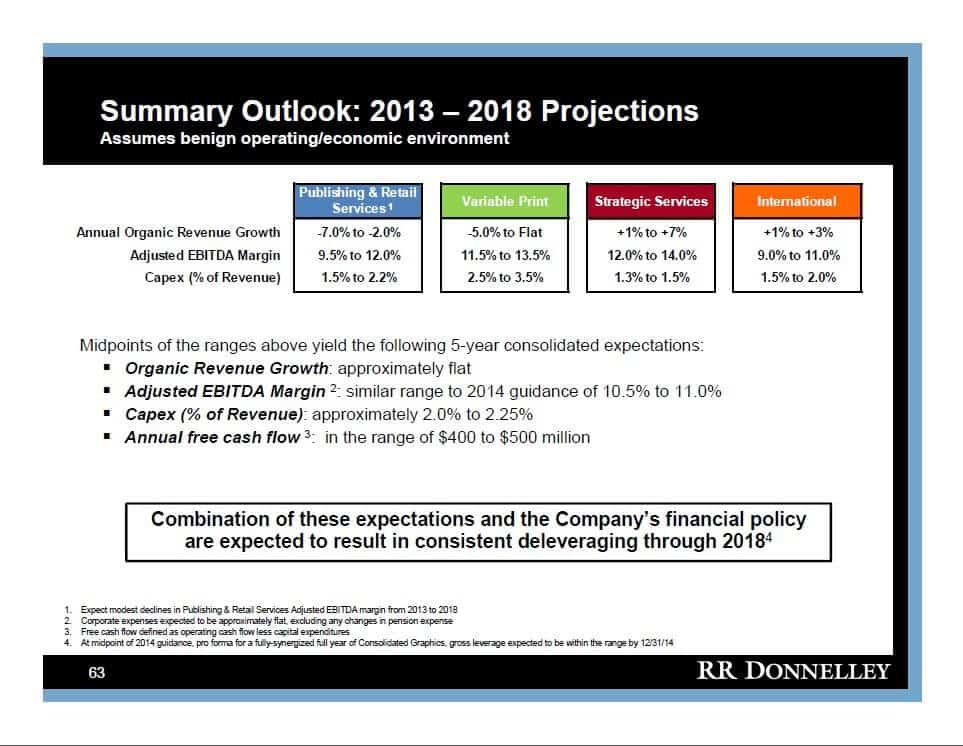

There is obviously significantly more information investors will want to review before deciding to purchase the aforementioned notes. On a closing note, I will leave investors with one more slide from the company’s 2014 Investor Meeting. It outlines R.R. Donnelley’s high-level projections through 2018.

If you are looking for more information on US Bonds please follow the link: LearnBonds.com/Bonds

If you are looking for more information on UK Bonds please follow the link: Learnbonds.com/UK/Bonds

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account