While it feels pretty good to consistently pick stocks that shoot to the moon, the reality is that most investors will have both aggressive hits and misses in their portfolios over time. Some will swing and miss more often than they should. Further, if you are looking in the right sector but fail to pick the right stock, your performance can dramatically underwhelm had you simply invested in a more diversified fashion.

Enter the ETF

An ETF, or exchange traded fund, is a basket of stocks that functions like a traditional open-ended mutual fund, but trades on a market exchange. Therefore, you will need a broker to own one.

The growth of the ETF space has been monumental over the past couple of decades. BlackRock, Inc. iShares ETF franchise itself offers hundreds of options. Outside of iShares, you can own ETFs from dozens of other sponsors with seemingly limitless investment strategies for generally nominal annual expense.

The ETF can serve the core needs of investors through products such as indexes and more conservative dividend growth portfolios. But the ETF can also offer satellite, targeted exposure for those lacking specific sector expertise or in cases where the investor is looking for a simple solution to increase portfolio diversification.

3 ETFs – 3 Sponsors – 3 Aggressive, Yet Different, Investment Paths

Today, I’m going to mention 3 funds that fit into the latter level of service, and should be only considered by aggressive, long-term investors, or potentially traders willing to move in and out what will be likely be fairly volatile future pricing.

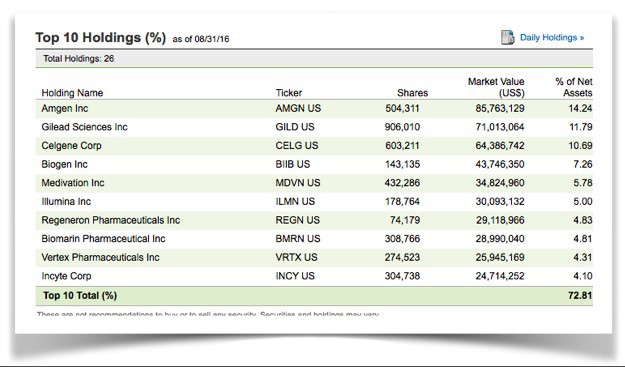

BBH – VanEck Vectors Biotech ETF – This ETF is made up of about 25 companies involved in the development of drugs designed to improve length and quality of life. Market weighted, the fund provides exposure to mega-cap biotechs like Amgen, Gilead, and Celgene (~28% of assets), but also to smaller names with likely larger growth potential.

Just to show how much of a performance difference there can be within the same space consider the fact that if you bought Gilead (GILD) — and just Gilead — about a year ago when it was at a high of $111 a share, you’d be down 30 percent today based on that decision. On the other hand, if, instead of Gilead, you had purchased little known cancer-drug-developer Medivation (MDVN), you would have doubled your money with the company being bought out by Pfizer earlier in the year.

While you wouldn’t have doubled your money by owning BBH, in fact you’ve lost money over the past year, but no where near as much had you just owned Gilead.

FDN – First Trust Dow Jones Internet Index Fund – Like BBH, FDN is market cap weighted fund, but currently owns about a dozen more names. The fund hones in on companies that generate at least 50% of their revenues from Internet operations. You’ll gain exposure to usual suspects like Amazon, Facebook, Alphabet, eBay, and Yahoo!, but also to smaller-caps like Akamai, TrueCar, and Rackspace Hosting.

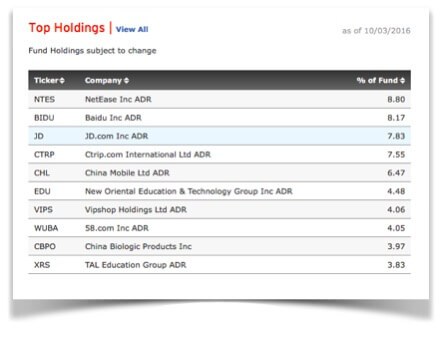

Finally, I’ll mention FGJ – PowerShares Golden Dragon China Portfolio – While China equities have struggled over the near-term, this fund has a good track record and possesses an interesting mix of technology and consumer discretionary exposure. Despite its many challenges, I think this is a country the aggressive investor should be looking at to own longer-term.

Summary

The ETF space continues to be a convenient, cost effective method for Do-It-Yourselfers to build and diversify investment portfolios. While BBH, FDN, and FGJ aren’t for everyone, I’d see this trifecta as serving purpose as an aggressive, diversified core for many. With about 100 stocks spread across three different investment platforms, its diversity mitigates some risk. Still, given the general frothy valuations found in today’s markets, combined with the generally high beta (volatility) found in these spaces, this should not be considered a complete investment program. A dollar cost average approach may be well advised if you are considering a position today.

Adam Aloisi was long shares of BLK, FDN, and BBH at time of writing, but positions can change at any time.

Disclaimer: The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account