Gold hogs the limelight but Silver has delivered a much more impressive performance; hence, it is expedient that to consider silver ETFs. iShares Silver Trust , Global X Silver Miners ETF, and PureFunds Junior Silver Miners ETF should be in the portfolio of any investor that seeks to take advantage of the rally in precious metals this year.

Precious metal investors are usually fixated on gold because of centuries-long sentiments that consider gold a universal store of wealth. However, the value of the silvery metal is enmeshed in better fundamentals. Smart investors make decisions on fundamentals instead of sentiments. The silvery metal is more affordable for the average investor than gold, it has more industrial applications than gold, and it is less volatile than gold when faced with geopolitical uncertainties.

3 Silver ETFs outperforming gold ETFs

iShares Silver Trust is the largest ETF in the silvery markets and it also happens to be the most heavily traded fund. The ETF tracks the daily price movement of the shiny gray metal and the fact that the fund has more than $7B in total assets provides investors with a nice mix of volatility and liquidity. Interestingly, the ETF currently trades around $18.92.

Global X Silver Miners ETF is an ETF created to track the stocks of miners of the silvery metal. The trust that manages SIL has significant ownership in 22 silver mining firms globally. When the resplendent metal has a bullish streak in the market, one can expect mining companies in the sector to experience bullish tailwinds as well. The ETF currently trades around $48.99.

PureFunds Junior Silver Miners ETF is smaller than the other 2 ETFs mentioned above but it has delivered bigger returns than both of them combined. The trust that owns SILJ has an investment basket filled with the stock of 25 exploration and junior miners. SILJ currently trades around $16.98 but it is important to that that it is riskier than the aforementioned 2 ETFs.

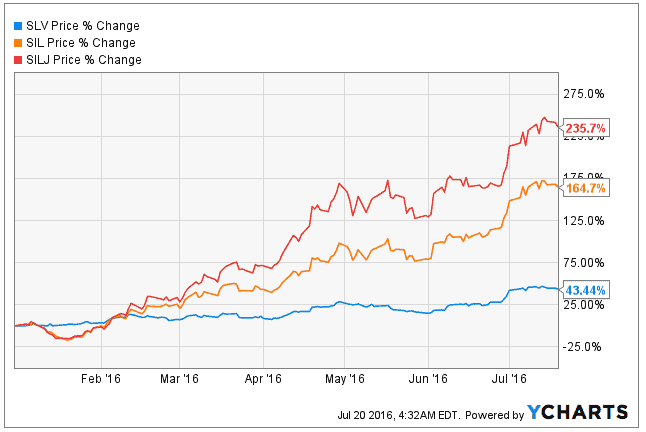

Year-to-date ETF Performance

The chart above shows the performance of 3 ETFs backed by the lustrous metal. You will observe that the first ETF profiled in this article (SLV) (Blue line) has gained 43.44% in the year-to-date period. The second ETF profiled (SIL) (Orange line) has gained an incredible 164.7%. The third ETF profiled in this piece (SIJL) has gained a breathtaking 235.7% in the year-to-date period. In essence, ETFs of the resplendent metal instead of putting all of your investment eggs in gold ETFs.

Citigroup advices caution

Silver has outperformed gold this year with 45% gains compared to 26% gains in the gold. However, analysts at Citibank have observed that the bullish drive in the shiny metal might not continue in the second half of the year. In a report released on Tuesday, Heath Jansen and David Wilson, analysts at Citigroup says “the year-to-date price rally already appears to be stalling… We caution against any further price optimism in the second half of 2016.”

The lustrous metal has recorded four straight sessions of losses to mark the longest decline in the last eight months. In response to the current weakness in the precious metal, the analysts noted that “performance anxiety and profit-taking ahead of the summer holiday season may deter money managers from adding fresh longs.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account