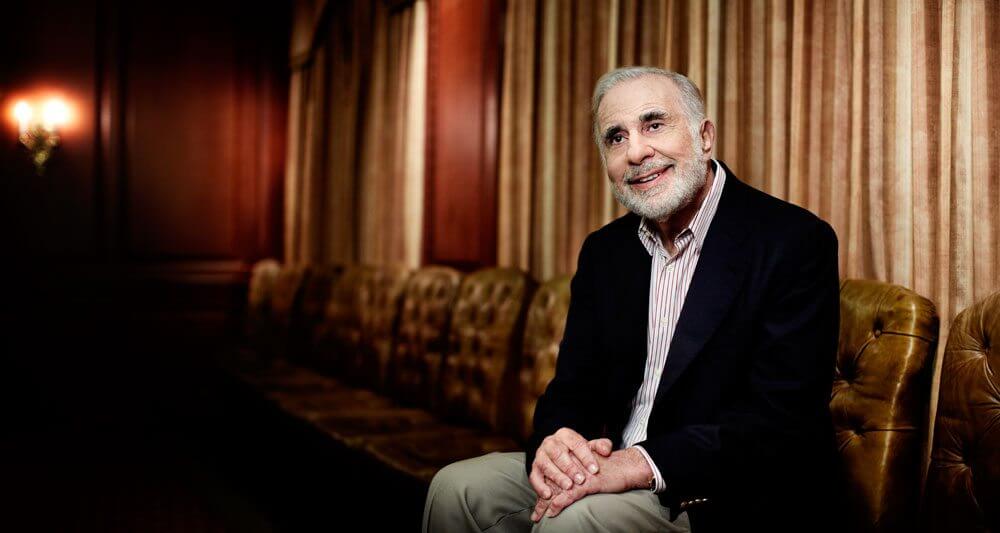

Icahn Capital, founded and managed by activist investor Carl Icahn, held an equity portfolio worth over $21 billion at the end of the first quarter of 2016. Icahn unloaded his entire stakes in six companies, including Apple Inc. (NASDAQ:AAPL), according to a 13F filing. Icahn sold Apple shares over China concerns. The Cupertino-based company reported its first-ever quarterly decline in iPhone sales and first revenue drop in 13 years in April. During the last quarter, Icahn also raised his positions in three companies during the last quarter. In this article, we’ll discuss Carl Icahn’s three favorite energy stocks including CVR Energy, Inc. , Cheniere Energy, Inc. and Chesapeake Energy Corporation .

CVR Energy

The 13F filing showed that Carl Icahn was holding 71.20 million shares of CVR Energy, Inc. (NYSE:CVI) at the end of March. The holding was valued at $1.86 billion at that time. CVR Energy is a holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in two limited partnerships, CVR Refining and CVR Partners. Financial performance of the company seems not good. For the first quarter of 2016, the firm swung to a loss of $16.2 million, or 19 cents per share, versus to income of $54.9 million, or 63 cents per share, a year ago. CVR Energy said that its income was negatively impacted by the downtime associated with the final phase of a major scheduled turnaround at CVR Refining’s Coffeyville refinery. The company’s stock hasn’t been performing well this year, declining over 56% year-to-date.

Cheniere Energy

In Cheniere Energy, Inc. (NYSEMKT:LNG), Carl Icahn owns 32.68 million shares, valued at about $1.11 billion. Cheniere Energy is a Houston-based energy company primarily engaged in LNG-related businesses. The company owns and operates the Sabine Pass LNG receiving terminal and Creole Trail Pipeline located in Louisiana through its general partner ownership interest and management agreements with Cheniere Energy Partners LP and its partial ownership interest in Cheniere Energy Partners Holdings LLC. Recently, Cheniere Energy Partners subsidiary Sabine Pass Liquefaction priced its offering of $1.5 billion senior secured notes due 2026. The notes will bear interest at a rate of 5.875% per annum and will mature on June 30, 2026. Cheniere Energy’s shares have dropped by 7.36% year-to-date.

Chesapeake Energy

Carl Icahn held 73.05 million shares of Chesapeake Energy Corporation (NYSE:CHK) at the end of March. The stake is valued at about $300.97 million. Chesapeake Energy is deemed to be the second-largest producer of natural gas and the 13th largest producer of oil and natural gas liquids in the United States. The company owns oil and natural gas marketing and natural gas gathering and compression businesses. For the first quarter of 2016, Chesapeake reported a net loss available to common stockholders of $964 million, mainly due to a noncash impairment of the carrying value of the company’s oil and natural gas properties of about $853 million. The company’s quarterly revenues declined by 39% year over year, primarily due to a decrease in the average realized commodity prices received for its production. During the past six months, shares of Chesapeake Energy’s stock have gained 11.36%.

Buffett’s Favorite Tech Stock

In its latest 13F, Warren Buffett’s Berkshire Hathaway disclosed holding an equity portfolio valued at $128.6 billion at the end of the first quarter of 2016. The filing showed that the investor started only one new position during January-March period, while reducing stakes in four companies. Technology stocks represent 12% of Berkshire’s total portfolio. In this article, we’ll discuss Buffett’s three favorite tech stocks including Apple, International Business Machines, and Wal-Mart Stores.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account