Apple Inc. share price has been battered since the new year began as it loses it’s spot in the triple-digit trading club. Much of the downtrend in the stock can be traced to weak iPhone sales and fears that that the firm has lost its innovative edge after the Apple Watch and Apple TV failed to live up to the hype. More so, the firm’s Apple Music and Apple News app offerings don’t seem to be gaining much traction and Apple Store sales are starting to drop.

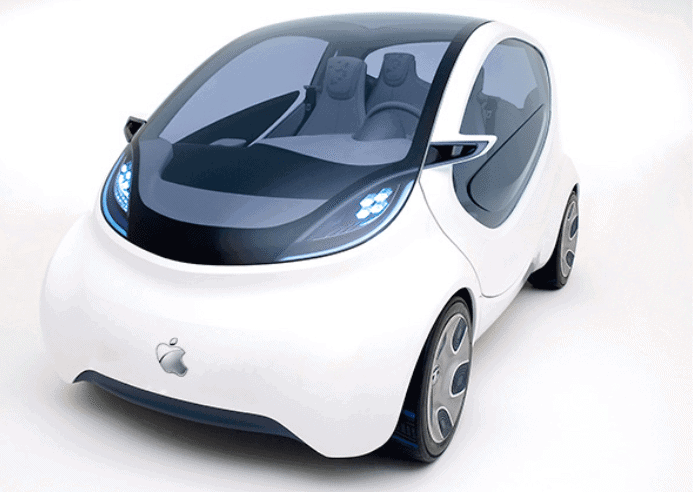

Nonetheless, the Cupertino tech giant might spring a surprise that will take the whole market by storm and make the stock a darling on Wall Street once more. Apple can spring a surprise if the rumors and hints about its purported Apple car turn out to be true. Apple has been rumored to be building a car codenamed “Project Titan” but the firm has not publicly confirmed or denied the rumors.

Tesla’s Elon Musk confirms Apple’s car project

In a chat with BBC, Tesla’s CEO Elon Musk has confirmed that Apple is indeed making a car somewhere on its facilities. He says Tim Cook can keep mute about his car project all he wants but “it’s pretty hard to hide something if you hire over a thousand engineers to do it”. Tesla Motors Inc has disrupted the auto sector, first with its electric cars and now, with Autopilot and Summon features that gives its cars self-driving abilities.

Musk sure knows what he is talking about because a large number of those thousand engineers were poached from Tesla. News once had it that the delays that Tesla Motors had with the Model X can be linked to the poaching of Tesla’s talents by Apple. The poaching however appears to be a two-way traffic has Tesla also seems to attract its fair share of Apple employees. Elon Musk is on record for saying that Apple is Tesla’s graveyard because workers who don’t make it at Tesla can always get a job from Tim Cook.

Questions that require answers

Apple is definitely working on a car project but no one outside the core project team at the firm knows the kind of involvement that the tech giant wants to have in the auto industry. A number of questions remain unanswered about Project Titan. Nobody knows if Apple is working on a “CarOS” that will control the electronics and infotainment systems in cars.

Another question that needs an answer is Apple’s plan for building its cars – will the firm create an assembly line, will the firm work with OEMs, or will it spin out its auto firm? Then, there’s the question of the design of the car. Will the firm change the status quo with the design to produce another iPhone on wheels? The market will also want to know if the firm would keep the car in its fleet to offer an Uber-like car-as-a-service package or if the firm will make direct sales to consumers.

Analyst says that Apple presents a buy opportunity

Apple is definitely making a car. Last week, news report shows that the firm has bought “apple.auto”, “apple.car”, and “apple.cars” domain names. CNBC reports that Abhey Lamba, senior technology analyst at Mizuho Securities has upgraded Apple to a “Buy”. The “Buy” upgrade is a contrarian move because Abhey’s firm has been “Neutral” on the firm for the last 12 months.

He says, “We were able to make a nonconsensus call last year by looking at the bigger picture and similar analysis this year makes us take a positive stance on the stock. We believe the firm continues to represent a very strong franchise that has potential to keep gaining share.”

He goes on to project a 40% upside on the firm. He says, “let’s check back and see what’s Apple really worth. What is their customer base really worth…? When we look at that, we get a value of about $140 per share, which we think is a fair value, and we think as these data points clear out, the stock will trend towards that.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account