Kraft Heinz Co. (NASDAQ: KHC) began trading Monday for the very first time since the H.J. Heinz merger with Kraft Foods Group Inc. How did it perform? It started at $71 per share and jumped as much as $74.29 within the first hour of trading. The stock’s volume totaled about 950,000 shares after just the first 90 minutes of trading.

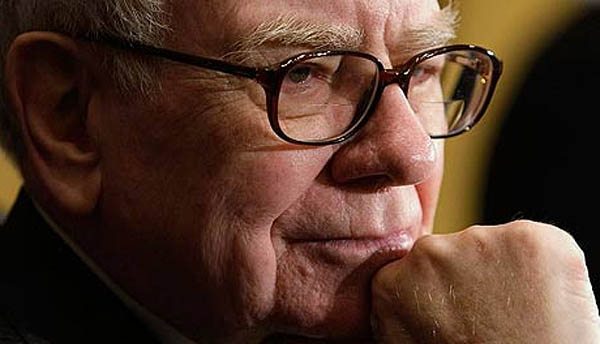

Warren Buffett Inc.’s (NYSE:BRK.A) Berkshire Hathaway owns roughly 325 million shares. The investment firm invested about $9.5 billion over the transactions to purchase common stock. With an impressive trading debut, the market realizes how important Buffett’s partnership has been with 3G Capital, an investment firm, in this deal.

Kraft Heinz is Buffett’s second largest stock investment; the first being Wells Fargo & Co. (NYSE:WFC) His other major investments consist of The Coca-Cola Co (NYSE:KO) and International Business Machines Corp. (NYSE:IBM).

Buffett presently owns $8 billion of preferred shares in Kraft Heinz. It pays a dividends of nine percent per year. Securities can be redeemed anytime next year.

The Emergence of Kraft Heinz Co.

This could be just the beginning of Kraft Heinz stock rising to epic heights.

Credit Suisse analyst Robert Moskow published a report Monday and in the coverage it gave the stock an Outperform rating and a price target of $85. One reason for the optimism regarding the stock is that maintains a dependable and astute management team with a proven track record. It’s known for cutting costs and reducing workforce numbers.

3G Capital is known for making tough decisions that are good for the long-term health of a business, which incumbent management teams are not often willing to make,” wrote Moskow.

Already, the company has established an objective of slashing annual costs by $1.5 billion by the end of 2017.

Other outlets are giving the thumbs up to Kraft Heinz.

Stifel rated the stock a Buy with an $80 price target. Fitch Ratings increased its long-term issuer default rating on Kraft Heinz last week from BB- to BBB-.

Indeed, it could take some time for the stock to reach its true value. But that hasn’t stopped the speculation that the brand could acquire grocery brands in the near future. According to the analyst coverage from Credit Suisse, Kraft Heinz may purchase various grocery brands owned by Mondelez International Inc. (NASDAQ:MDLZ).

Financial experts project Kraft Heinz share to go through a period of solid growth throughout the second half of 2015, particularly considering that six of the 11 board of directors seats belong to Berkshire and 3G Capital.

Kraft Heinz shares closed at $72.96 on Monday afternoon.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account