What is your definition of high yield in the current market? Anything above 7.5 percent? Maybe you consider it 10 percent. What if I said you could get around 20 percent? Yes, it’s possible.

Of course I’ll tell you upfront that you’ll have to take on tremendous risk to achieve that yield. And even for those that can shoulder the risk, the amount of exposure you should have to these vehicles is negligible.

So what am I talking about? I’m talking about 2X leveraged ETNs that track several different elevated-yield sectors.

First, let’s start with what an ETN is. ETN is an acronym for exchange traded note. Similar in many ways to the ETF (exchange traded fund), an ETN tracks, but does not actual own, a basket of securities typically related to an already assembled index.

Since the ETN does not own the securities – the tracking, and performance of the product is underwritten by a guarantor entity, usually a banking institution. Given this make-up, an ETN is technically a debt security with a defined maturity date and other features typically associated with bonds. It is also subject to default in the case of a banking catastrophe, no matter the health of the underlying tracked securities.

There are a variety of banks that issue ETNs: Citibank and UBS just to name two. The three I’m going to mention today are all issued by UBS.

UBS offers several dozen ETNs (see list here). Some are geared toward yield, some towards commodities, and others with more diversified end strategies. Many of them are “2x levered” which means that the performance of the basket is multiplied twice. If the basket yields 10%, the leverage makes that 20%. If the basket loses 15% of its valuation, the leverage creates a 30% loss.

The three we’re going to look at are:

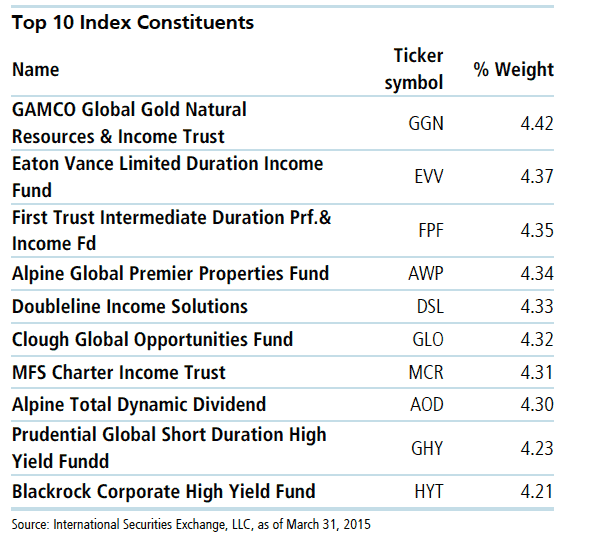

- CEFL: ETRACS Monthly Pay 2xLeveraged Closed-End Fund ETN (NYSEARCA:CEFL)

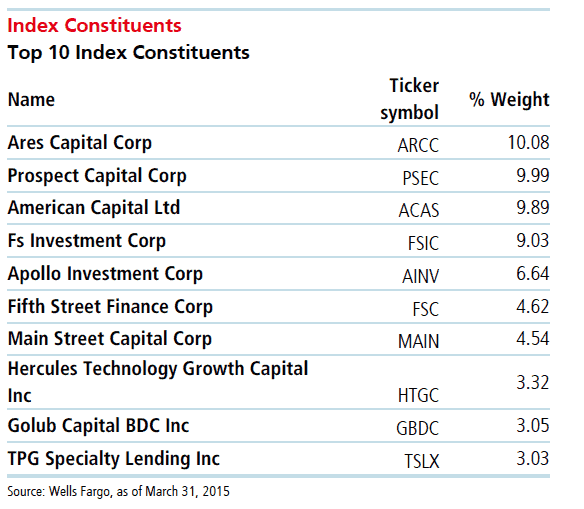

- BDCL: ETRACS 2xLeveraged Long Wells Fargo Business Development Company Index ETN (NYSEARCA:BDCL)

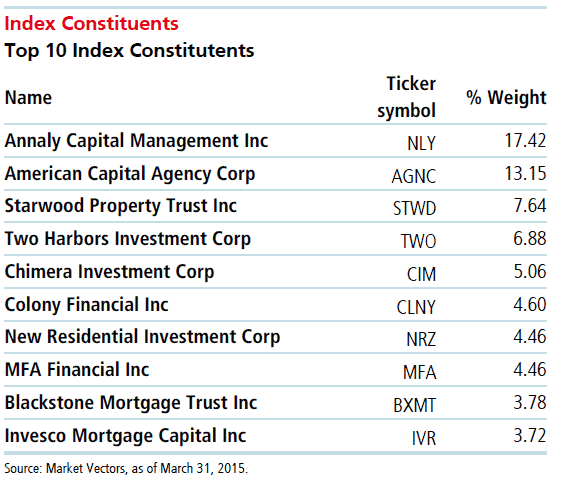

- MORL: ETRACS Monthly Pay 2xLeveraged Mortgage REIT ETN (NYSEARCA:MORL)

On a trailing 12 month basis, the funds yield:

- CEFL (NYSEARCA:CEFL): 19.61%

- BDCL (NYSEARCA:BDCL): 17.24%

- MORL (NYSEARCA:MORL): 21.87%

On a blended basis, if purchased in equal amounts, these three ETNs would have yielded you a whopping 19.5 percent. However, all three of them lost value over the past year, so total return would have been substantially less.

What I currently find somewhat attractive about the group is that the constituents of all three are being priced at a substantial discount to tangible value. Part of the reason for that is that closed-end funds, business development companies, as well as mortgage REITs are all considered somewhat interest rate sensitive. With the fear of a higher rate scenario factored in, investors are not expecting much out of these kinds of securities.

So what, exactly, do CEFL, BDCL, and MORL currently own? Here’s a rundown of holdings in all three ETNs.

CEFL: (NYSEARCA:CEFL)

MORL: (NYSEARCA:MORL):

I would agree that a rapidly rising rate scenario could pose negative repercussions for this group of securities. Further, with the 2x leverage added in, a sharp move lower could create disastrous results.

For that reason, even for more aggressive investors, a very small portion of one’s portfolio should be allocated to these kinds of securities.

The near-term has been somewhat tame, but any kind of market or interest rate hiccup could create a rapid and substantial downdraft that could prove surprisingly harsh.

There is a reason these securities yield almost 20 percent.

While 2x ETNs may represent an attractive way for investors to achieve “crazy-high” yields, one must understand the various layers of risk that are part of the equation. Caveat emptor.

Disclaimer: The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions.

Mr. Aloisi was long shares of BDCL, CEFL, and MORL at time of writing, but positions can change at any time.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account