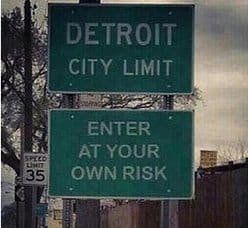

Last Friday, Detroit filed a proposal to reduce its $18 billion debt load and exit court supervision. The proposal offers municipal pension plans 50 cents on the dollar while G.O. bondholders could receive as little 20 cents on the dollar. This may come as a shock to G.O. holders as many believed that having a general obligation gave creditors more security. As most of our experience has been in the corporate credit markets, we viewed general obligations somewhat differently than municipal bond investors.

In Muni-land, general obligation bonds are usually backed by the full faith and taxing power of the issuing municipality. Many municipal bond investors were of the opinion (an opinion reinforced by municipal bond market salespeople) that a municipality would simply tax its way out of trouble. However, as Detroit is proving, you can’t tax people and businesses which aren’t there. Detroit has experienced a significant decline in both individual and business taxpayers. The city is now faced with trying to get blood from the proverbial stone. Unlike Puerto Rico, Detroit cannot (or cannot easily) claw back revenues to which revenue bonds appear to be legally entitled. If we were to draw a parallel between municipal bonds and corporate bonds, a senior general obligation municipal bond would be most similar to a senior unsecured corporate bond.

Both municipal G.O.s and senior unsecured corporate bonds are backed by the full faith of their issuers. However, both bonds can be less secure than bonds which are backed by specific revenues. In our opinion, a G.O. is simply an unsecured bond (meaning that it is not backed by specific revenues). It is for this reason that we have focused on municipal revenue bonds. The exception is general obligations of U.S. states. U.S. states cannot file for bankruptcy protection and are eligible for Federal assistance.

Will Detroit senior G.O. holders actually receive only 20 cents on the dollar? It is possible. This is not good news for municipal bond insurers as they would have to make up the difference. We believe that the insurance should be there, but we expect continued push-back from the insurers in court. The deal proposed by the City of Detroit is not a fait accompli, but we expect bondholder recovery to be fairly low in the case of uninsured Detroit G.O.s.

By Thomas Byrne – Director of Fixed Income – Investment Consultant

Employment

- November 2012 – Present, Wealth Strategies & Management LLC, Stroudsburg PA

- December 2011 – November 2012 – Bond Squad, Kunkletown, PA

- April 1988 – December 2011, Citigroup and predecessor firms, New York, NY

- June 1986 – March 1988 – E.F. Hutton, New York, NYThomas ByrneDirector of Fixed IncomeWealth Strategies & Management LLC570-424-1555 Office570-234-6350 CellE-mail: [email protected]Twitter: @Bond_SquadHigh yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

“Bond Squad is my favorite bond investing newsletter. It combines common sense with deep market knowledge.”

– Marc Prosser, Publisher of Learn Bonds

Bond Squad is more than just an investment newsletter! Paying subscribers can call-up bond market veteran trader and portfolio manager, Tom Byrne, for market advice and have him review their portfolio free of charge.

Get a free two-week, no commitment trial of Bond Squad by emailing Tom at [email protected]

Or learn more about Bond Squad’s clearly written, expert analysis, click here

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account